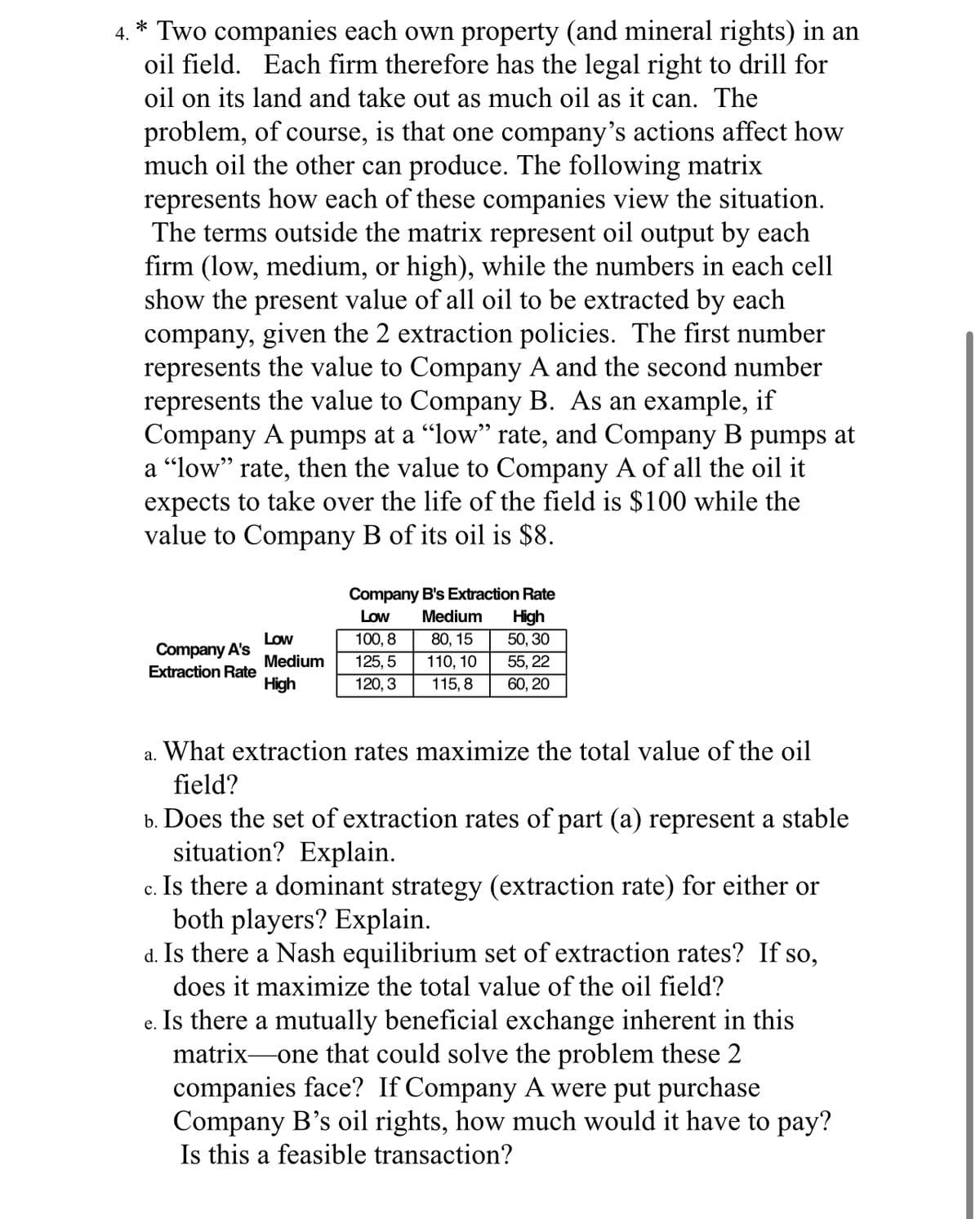

4. * Two companies each own property (and mineral rights) in an oil field. Each firm therefore has the legal right to drill for oil on its land and take out as much oil as it can. The problem, of course, is that one company's actions affect how much oil the other can produce. The following matrix represents how each of these companies view the situation. The terms outside the matrix represent oil output by each firm (low, medium, or high), while the numbers in each cell show the present value of all oil to be extracted by each company, given the 2 extraction policies. The first number represents the value to Company A and the second number represents the value to Company B. As an example, if Company A pumps at a "low” rate, and Company B pumps at a "low" rate, then the value to Company A of all the oil it expects to take over the life of the field is $100 while the value to Company B of its oil is $8. Company A's Extraction Rate Low Medium High Company B's Extraction Rate Low 100, 8 125,5 120, 3 Medium 80, 15 110, 10 115, 8 High 50, 30 55,22 60, 20 a. What extraction rates maximize the total value of the oil field? b. Does the set of extraction rates of part (a) represent a stable situation? Explain. C. Is there a dominant strategy (extraction rate) for either or both players? Explain. d. Is there a Nash equilibrium set of extraction rates? If so, does it maximize the total value of the oil field? e. Is there a mutually beneficial exchange inherent in this matrix-one that could solve the problem these 2 companies face? If Company A were put purchase Company B's oil rights, how much would it have to pay? Is this a feasible transaction?

4. * Two companies each own property (and mineral rights) in an oil field. Each firm therefore has the legal right to drill for oil on its land and take out as much oil as it can. The problem, of course, is that one company's actions affect how much oil the other can produce. The following matrix represents how each of these companies view the situation. The terms outside the matrix represent oil output by each firm (low, medium, or high), while the numbers in each cell show the present value of all oil to be extracted by each company, given the 2 extraction policies. The first number represents the value to Company A and the second number represents the value to Company B. As an example, if Company A pumps at a "low” rate, and Company B pumps at a "low" rate, then the value to Company A of all the oil it expects to take over the life of the field is $100 while the value to Company B of its oil is $8. Company A's Extraction Rate Low Medium High Company B's Extraction Rate Low 100, 8 125,5 120, 3 Medium 80, 15 110, 10 115, 8 High 50, 30 55,22 60, 20 a. What extraction rates maximize the total value of the oil field? b. Does the set of extraction rates of part (a) represent a stable situation? Explain. C. Is there a dominant strategy (extraction rate) for either or both players? Explain. d. Is there a Nash equilibrium set of extraction rates? If so, does it maximize the total value of the oil field? e. Is there a mutually beneficial exchange inherent in this matrix-one that could solve the problem these 2 companies face? If Company A were put purchase Company B's oil rights, how much would it have to pay? Is this a feasible transaction?

Chapter13: General Equilibrium And Welfare

Section: Chapter Questions

Problem 13.12P

Related questions

Question

Transcribed Image Text:4.

* Two companies each own property (and mineral rights) in an

oil field. Each firm therefore has the legal right to drill for

oil on its land and take out as much oil as it can. The

problem, of course, is that one company's actions affect how

much oil the other can produce. The following matrix

represents how each of these companies view the situation.

The terms outside the matrix represent oil output by each

firm (low, medium, or high), while the numbers in each cell

show the present value of all oil to be extracted by each

company, given the 2 extraction policies. The first number

represents the value to Company A and the second number

represents the value to Company B. As an example, if

Company A pumps at a "low" rate, and Company B pumps at

a “low” rate, then the value to Company A of all the oil it

expects to take over the life of the field is $100 while the

value to Company B of its oil is $8.

Company A's

Extraction Rate

Low

Medium

High

a.

Company B's Extraction Rate

Low

High

50, 30

55, 22

60, 20

100, 8

125, 5

120, 3

Medium

80, 15

110, 10

115, 8

What extraction rates maximize the total value of the oil

field?

b. Does the set of extraction rates of part (a) represent a stable

situation? Explain.

C.

Is there a dominant strategy (extraction rate) for either or

both players? Explain.

d. Is there a Nash equilibrium set of extraction rates? If so,

does it maximize the total value of the oil field?

e. Is there a mutually beneficial exchange inherent in this

matrix-one that could solve the problem these 2

companies face? If Company A were put purchase

Company B's oil rights, how much would it have to pay?

Is this a feasible transaction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you