4.) What has happened to the supply of Indian sugar this year? 5.) What has happened to the supply of Brazilian sugar as a result of the growing demand for ethanol to fuel cars?" 6.) What does the representative of Archer Consulting predict will happen to the supp of ethanol as a result of the Indian demand for sugar:

4.) What has happened to the supply of Indian sugar this year? 5.) What has happened to the supply of Brazilian sugar as a result of the growing demand for ethanol to fuel cars?" 6.) What does the representative of Archer Consulting predict will happen to the supp of ethanol as a result of the Indian demand for sugar:

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter25: The Keynesian Perspective

Section: Chapter Questions

Problem 17CTQ: In its recent report, The Conference Boards Global Economic Outlook 2015, updated November 2014...

Related questions

Question

Transcribed Image Text:1:57

ull 4G O

4.) What has happened to the supply of Indian sugar this year?

5.) What has happened to the supply of Brazilian sugar as a result of the growing

demand for ethanol to fuel cars?

6.) What does the representative of Archer Consulting predict will happen to the supply

of ethanol as a result of the Indian demand for sugar:

Add a caption.

Transcribed Image Text:12:52

Assessment- Sugar-rush-for-hy...

Sugar rush for hyperactive Brics

By Robert Plummer, Business reporter, BBC News, 2/9/09

The price of raw sugar is hitting highs not seen for nearly three decades - and the surge

is having a sweet-and-sour effect on two of the burgeoning Bric economies.

Sugar futures reached more than 24 cents a pound this week, the dearest they have been

since February 1981.

That makes it a valuable earner for the Centre-South region of Brazil, the largest sugar-cane

growing area in the world.

At the same time, Brazil's position is strengthened by a collapse in production in India, the

world's number two sugar producer.

The weakest monsoon rains in the Asian subcontinent for many years have led to

widespread drought, hitting crops hard.

However, India remains the top consumer of sugar and is relying on Brazilian imports to

make up the shortfall.

Up to one million tonnes of Brazilian sugar have been bought by India in recent weeks,

according to traders' estimates - and producers are betting that prices may climb as high as

30 cents a pound before the current run peaks.

"There's still room for a further increase in prices if Indian demand remains strong." says

Plinio Mario Nastari of Brazil's Datagro consultancy.

Food or fuel?

All splendid news for Brazilian sugar plantation owners, you might think. But whereas India

has had a shortage of rainfall, Brazil's cane crops have been waterlogged by heavier-than-

expected downpours.

Sugar-cane needs dry weather to ripen in order to maximise its sucrose content, but northern

Sao Paulo state, one of the key areas of cultivation, has had its heaviest August rainfall in 60

years.

That means more customers chasing less of the sweet stuff - and those customers include

not only people with a sweet tooth, but also the majority of Brazil's motorists.

In recent years, more and more Brazilian sucrose has been turned into ethanol rather than

sugar, as the country's roads have seen a huge increase in the number of "flex-fuel" vehicles

that run on a mixture of petrol and alcohol.

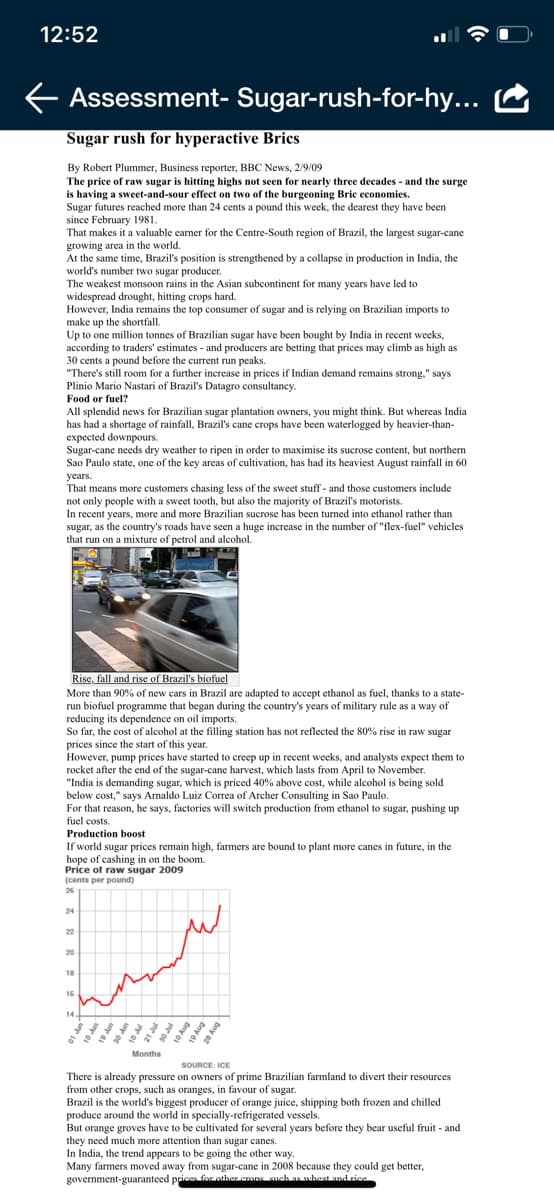

Rise, fall and rise of Brazil's biofuel

More than 90% of new cars in Brazil are adapted to accept ethanol as fuel, thanks to a state-

run biofuel programme that began during the country's years of military rule as a way of

reducing its dependence on oil imports.

So far, the cost of alcohol at the filling station has not reflected the 80% rise in raw sugar

prices since the start of this year.

However, pump prices have started to creep up in recent weeks, and analysts expect them to

rocket after the end of the sugar-cane harvest, which lasts from April to November.

"India is demanding sugar, which is priced 40% above cost, while alcohol is being sold

below cost," says Amaldo Luiz Correa of Archer Consulting in Sao Paulo.

For that reason, he says, factories will switch production from ethanol to sugar, pushing up

fuel costs.

Production boost

If world sugar prices remain high, farmers are bound to plant more canes in future, in the

hope of cashing in on the boom.

Price ot raw sugar 2009

(cents per pound)

26

24

22

20

18

16

14

Months

SOURCE: ICE

There is already pressure on owners of prime Brazilian farmland to divert their resources

from other crops, such as oranges, in favour of sugar.

Brazil is the world's biggest producer of orange juice, shipping both frozen and chilled

produce around the world in specially-refrigerated vessels.

But orange groves have to be cultivated for several years before they bear useful fruit - and

they need much more attention than sugar canes.

In India, the trend appears to be going the other way.

Many farmers moved away from sugar-cane in 2008 because they could get better,

government-guaranteed priees for other crons such as whont and rice

10 Aug

19 Aug

Aug

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax