4. You are the manager of a monopoly, and your demand and cost functions are given by P = 300 − 3Q and C(Q) = 1,500 + 2Q2, respectively. (LO3, LO4) a. What price–quantity combination maximizes your firm’s profits? b. Calculate the maximum profits. c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price–quantity combination?

4. You are the manager of a monopoly, and your demand and cost functions are given by P = 300 − 3Q and C(Q) = 1,500 + 2Q2, respectively. (LO3, LO4) a. What price–quantity combination maximizes your firm’s profits? b. Calculate the maximum profits. c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price–quantity combination?

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

4. You are the manager of a monopoly , and your demand and cost functions are given by P = 300 − 3Q and C(Q) = 1,500 + 2Q2, respectively. (LO3, LO4)

a. What price–quantity combination maximizes your firm’s profits?

b. Calculate the maximum profits.

c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price–quantity combination?

d. What price–quantity combination maximizes revenue?

e. Calculate the maximum revenues.

f. Is demand elastic, inelastic, or unit elastic at the revenue-maximizing price–quantity combination?

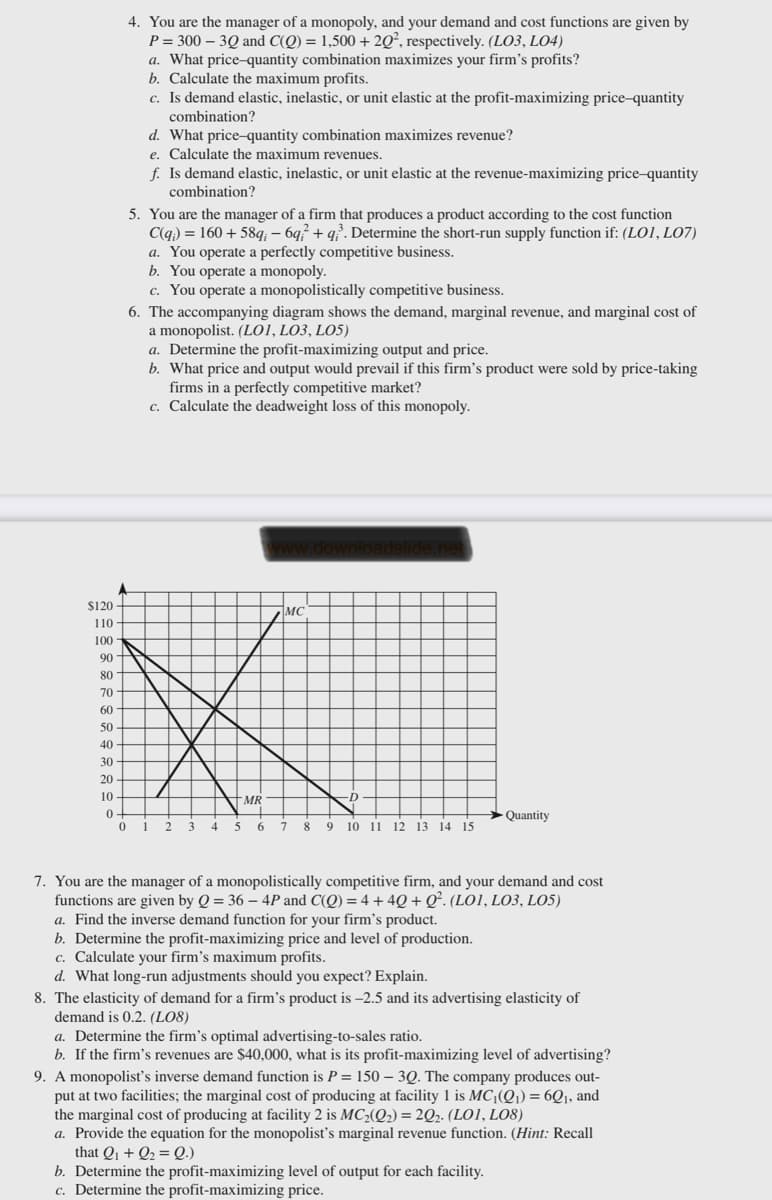

6. The accompanying diagram shows the demand, marginal revenue, and marginal cost of a monopolist. (LO1, LO3, LO5)

a. Determine the profit-maximizing output and price.

b. What price and output would prevail if this firm’s product were sold by price-taking

firms in a perfectly competitive market?

c. Calculate the deadweight loss of this monopoly.

8. The elasticity of demand for a firm’s product is –2.5 and its advertising elasticity of demand is 0.2. (LO8)

a. Determine the firm’s optimal advertising-to-sales ratio.

b. If the firm’s revenues are $40,000, what is its profit-maximizing level of advertising?

9. A monopolist’s inverse demand function is P = 150 − 3Q. The company produces out- put at two facilities; the marginal cost of producing at facility 1 is MC1(Q1) = 6Q1, and the marginal cost of producing at facility 2 is MC2(Q2) = 2Q2. (LO1, LO8)

a. Provide the equation for the monopolist’s marginal revenue function. (Hint: Recall

thatQ1 +Q2 =Q.)

b. Determine the profit-maximizing level of output for each facility.

c. Determine the profit-maximizing price.

Transcribed Image Text:4. You are the manager of a monopoly, and your demand and cost functions are given by

P = 300 – 3Q and C(Q) = 1,500 + 2Q², respectively. (LO3, LO4)

a. What price-quantity combination maximizes your firm's profits?

b. Calculate the maximum profits.

c. Is demand elastic, inelastic, or unit elastic at the profit-maximizing price-quantity

combination?

d. What price-quantity combination maximizes revenue?

e. Calculate the maximum revenues.

f. Is demand elastic, inelastic, or unit elastic at the revenue-maximizing price-quantity

combination?

5. You are the manager of a firm that produces a product according to the cost function

C(q) = 160 + 58q; – 6q² + q?. Determine the short-run supply function if: (LO1, LO7)

a. You operate a perfectly competitive business.

b. You operate a monopoly.

c. You operate a monopolistically competitive business.

6. The accompanying diagram shows the demand, marginal revenue, and marginal cost of

a monopolist. (LO1, LO3, LO5)

a. Determine the profit-maximizing output and price.

b. What price and output would prevail if this firm's product were sold by price-taking

firms in a perfectly competitive market?

c. Calculate the deadweight loss of this monopoly.

$120

MC

110

100

90

80

70

60

50

40

30

20

10

MR

>Quantity

1

2

3

7.

8.

9 10 11 12 13 14 15

7. You are the manager of a monopolistically competitive firm, and your demand and cost

functions are given by Q = 36 – 4P and C(Q) = 4 + 4Q+ Q². (LO1, LO3, LO5)

a. Find the inverse demand function for your firm's product.

b. Determine the profit-maximizing price and level of production.

c. Calculate your firm's maximum profits.

d. What long-run adjustments should you expect? Explain.

8. The elasticity of demand for a firm's product is -2.5 and its advertising elasticity of

demand is 0.2. (LO8)

a. Determine the firm's optimal advertising-to-sales ratio.

b. If the firm's revenues are $40,000, what is its profit-maximizing level of advertising?

9. A monopolist's inverse demand function is P = 150 – 3Q. The company produces out-

put at two facilities; the marginal cost of producing at facility 1 is MCQ1) = 6Q1, and

the marginal cost of producing at facility 2 is MC2(Q2) = 2Q2. (LO1, LO8)

a. Provide the equation for the monopolist's marginal revenue function. (Hint: Recall

that Q1 + Q2 = Q.)

b. Determine the profit-maximizing level of output for each facility.

c. Determine the profit-maximizing price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education