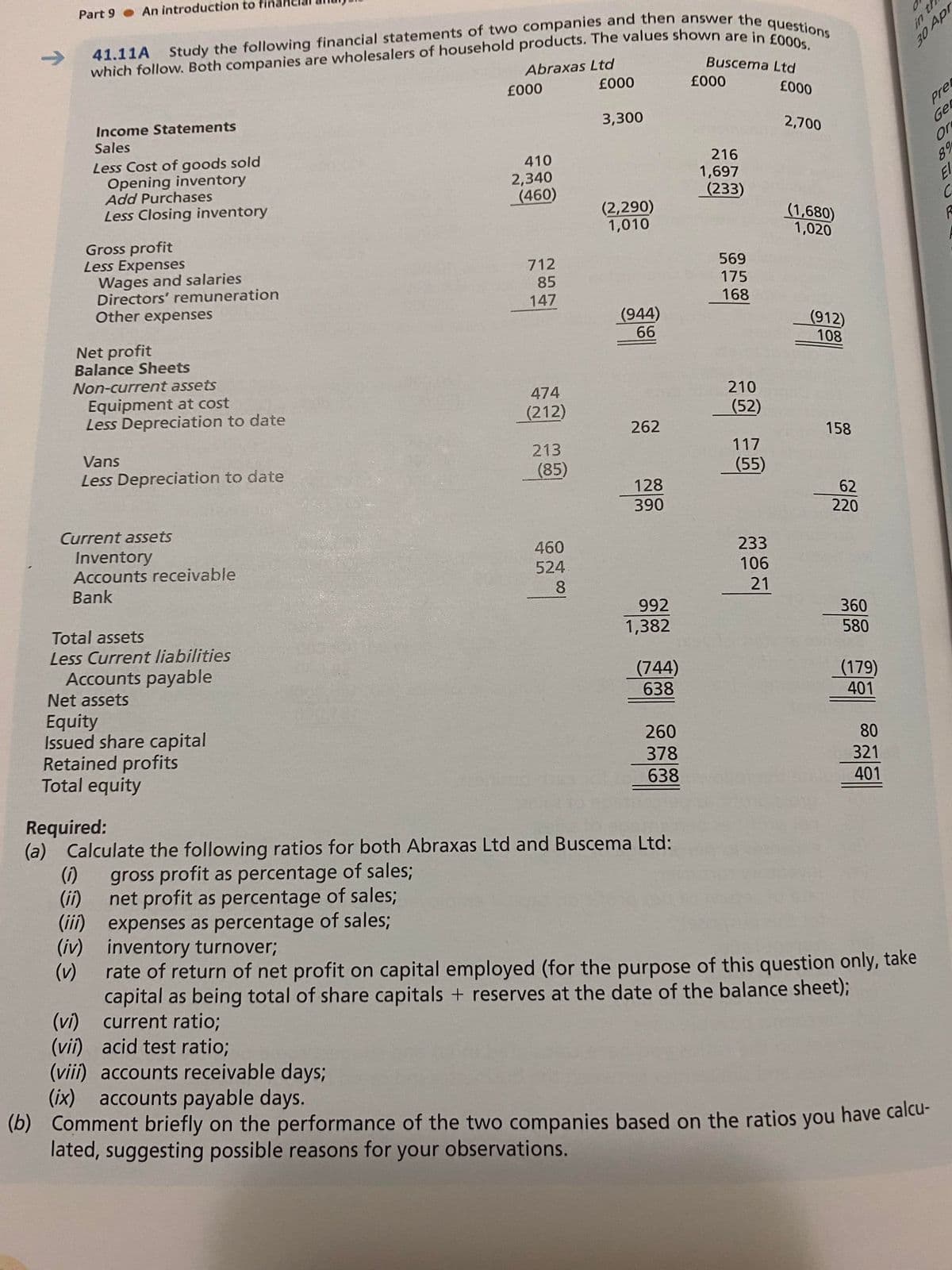

41.11A Study the following financial statements of two companies and then answer the questions -> which follow. Both companies are wholesalers of household products. The values shown are in £000s. Buscema Ltd Abraxas Ltd £000 £000 £000 £000 3,300 2,700 Income Statements Sales 216 Less Cost of goods sold Opening inventory Add Purchases Less Closing inventory 410 2,340 (460) 1,697 (233) (2,290) 1,010 (1,680) 1,020 Gross profit Less Expenses Wages and salaries Directors' remuneration Other expenses 712 85 569 175 168 147 (944) 66 (912) 108 Net profit Balance Sheets Non-current assets 474 210 Equipment at cost Less Depreciation to date (212) (52) 262 158 117 213 Vans (85) (55) Less Depreciation to date 128 62 390 220 Current assets 233 106 460 Inventory Accounts receivable Bank 524 8. 21 992 360 1,382 580 Total assets Less Current liabilities Accounts payable Net assets (744) 638 (179) 401 Equity Issued share capital Retained profits Total equity 260 378 80 321 638 401 equired: O Calculate the following ratios for both Abraxas Ltd and Buscema Ltd: () gross profit as percentage of sales; (ii) net profit as percentage of sales; (iii) expenses as percentage of sales; (iv) inventory turnover; (v) rate of return of net profit on capital employed (for the purpose of this question only, E capital as being total of share capitals + reserves at the date of the balance sheet); (vi) current ratio; (vii) acid test ratio; (vii) accounts receivable days; (ix) accounts payable days. Comment briefly on the performance of the two companies based on the ratios you have lated, suggesting possible reasons for your observations.

41.11A Study the following financial statements of two companies and then answer the questions -> which follow. Both companies are wholesalers of household products. The values shown are in £000s. Buscema Ltd Abraxas Ltd £000 £000 £000 £000 3,300 2,700 Income Statements Sales 216 Less Cost of goods sold Opening inventory Add Purchases Less Closing inventory 410 2,340 (460) 1,697 (233) (2,290) 1,010 (1,680) 1,020 Gross profit Less Expenses Wages and salaries Directors' remuneration Other expenses 712 85 569 175 168 147 (944) 66 (912) 108 Net profit Balance Sheets Non-current assets 474 210 Equipment at cost Less Depreciation to date (212) (52) 262 158 117 213 Vans (85) (55) Less Depreciation to date 128 62 390 220 Current assets 233 106 460 Inventory Accounts receivable Bank 524 8. 21 992 360 1,382 580 Total assets Less Current liabilities Accounts payable Net assets (744) 638 (179) 401 Equity Issued share capital Retained profits Total equity 260 378 80 321 638 401 equired: O Calculate the following ratios for both Abraxas Ltd and Buscema Ltd: () gross profit as percentage of sales; (ii) net profit as percentage of sales; (iii) expenses as percentage of sales; (iv) inventory turnover; (v) rate of return of net profit on capital employed (for the purpose of this question only, E capital as being total of share capitals + reserves at the date of the balance sheet); (vi) current ratio; (vii) acid test ratio; (vii) accounts receivable days; (ix) accounts payable days. Comment briefly on the performance of the two companies based on the ratios you have lated, suggesting possible reasons for your observations.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.12E: Inventory analysis Costco Wholesale Corporation (COST) and Wal-Mart Stores Inc. (WMT) compete...

Related questions

Topic Video

Question

Transcribed Image Text:Part 9

An introduction to

tr

which follow. Both companies are wholesalers of household products. The values shown are i questi

Buscema Ltd

->

Abraxas Ltd

£000

£000

£000

£000

Income Statements

Pre

3,300

2,700

Ger

Sales

or

Less Cost of goods sold

Opening inventory

Add Purchases

Less Closing inventory

410

216

89

2,340

1,697

(460)

(233)

El

(2,290)

1,010

(1,680)

1,020

Gross profit

Less Expenses

Wages and salaries

Directors' remuneration

712

569

85

175

Other expenses

147

168

(944)

Net profit

Balance Sheets

(912)

108

66

Non-current assets

Equipment at cost

Less Depreciation to date

474

210

(212)

(52)

262

158

Vans

213

117

Less Depreciation to date

(85)

(55)

128

62

390

220

Current assets

Inventory

Accounts receivable

460

233

524

106

Bank

8.

21

992

360

Total assets

1,382

580

Less Current liabilities

Accounts payable

Net assets

(744)

638

(179)

401

Equity

Issued share capital

Retained profits

Total equity

260

80

378

321

638

401

Required:

(a) Calculate the following ratios for both Abraxas Ltd and Buscema Ltd:

()

gross profit as percentage of sales;

(i)

net profit as percentage of sales;

(iii) expenses as percentage of sales;

(iv) inventory turnover;

(v)

rate of return of net profit on capital employed (for the purpose of this question only, take

capital as being total of share capitals + reserves at the date of the balance sheet);

(vi) current ratio%;

(vii) acid test ratio%;

(viii) accounts receivable days;

(ix) accounts payable days.

(b) Comment briefly on the performance of the two companies based on the ratios you have calcu-

lated, suggesting possible reasons for your observations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning