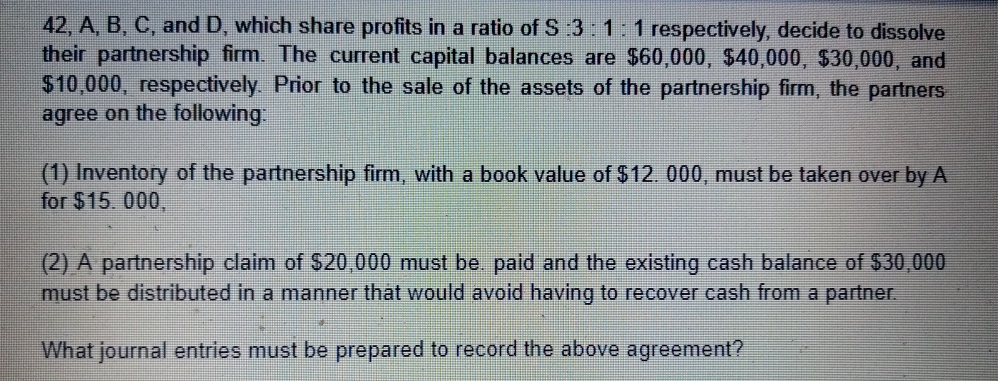

42, A, B, C, and D, which share profits in a ratio of S :3:1: 1 respectively, decide to dissolve their partnership firm. The current capital balances are $60,000, $40,000, $30,000, and $10,000, respectively. Prior to the sale of the assets of the partnership firm, the partners agree on the following: (1) Inventory of the partnership firm, with a book value of $12. 000, must be taken over by A for $15. 000, (2) A partnership claim of $20,000 must be. paid and the existing cash balance of $30,000 must be distributed in a manner that would avoid having to recover cash from a partner. What journal entries must be prepared to record the above agreement?

42, A, B, C, and D, which share profits in a ratio of S :3:1: 1 respectively, decide to dissolve their partnership firm. The current capital balances are $60,000, $40,000, $30,000, and $10,000, respectively. Prior to the sale of the assets of the partnership firm, the partners agree on the following: (1) Inventory of the partnership firm, with a book value of $12. 000, must be taken over by A for $15. 000, (2) A partnership claim of $20,000 must be. paid and the existing cash balance of $30,000 must be distributed in a manner that would avoid having to recover cash from a partner. What journal entries must be prepared to record the above agreement?

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:42, A, B, C, and D, which share profits in a ratio of S 3: 1:1 respectively, decide to dissolve

their partnership firm. The current capital balances are $60,000, $40,000, $30,000, and

$10,000, respectively. Prior to the sale of the assets of the partnership firm, the partners

agree on the following

(1) Inventory of the partnership firm, with a book value of $12. 000, must be taken over by A

for $15. 000,

(2) A partnership claim of $20,000 must be. paid and the existing cash balance of $30,000

must be distributed in a manner that would avoid having to recover cash from a partner.

What journal entries must be prepared to record the above agreement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College