5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average cost amounts places.) Answer is complete but not entirely correct. Specific Identification Weighted- average cost FIFO LIFO Sales revenue $ 3,395 O $ 3,395 O $ 3,395 2$ 3,395.00 Cost of goods sold 3,080 3,140 O 3,070 X 3,124.00 Gross profit 315 $ 255 $ 325 X $ 271.00 X

5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average cost amounts places.) Answer is complete but not entirely correct. Specific Identification Weighted- average cost FIFO LIFO Sales revenue $ 3,395 O $ 3,395 O $ 3,395 2$ 3,395.00 Cost of goods sold 3,080 3,140 O 3,070 X 3,124.00 Gross profit 315 $ 255 $ 325 X $ 271.00 X

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 1PB: FIFO perpetual inventory The beginning inventory at Dunne Co. and data on purchases and sales for a...

Related questions

Question

Transcribed Image Text:cm6n ר 7ם

Purchase

aכLC

TT

1,100

$

4,720

August 29

10

110

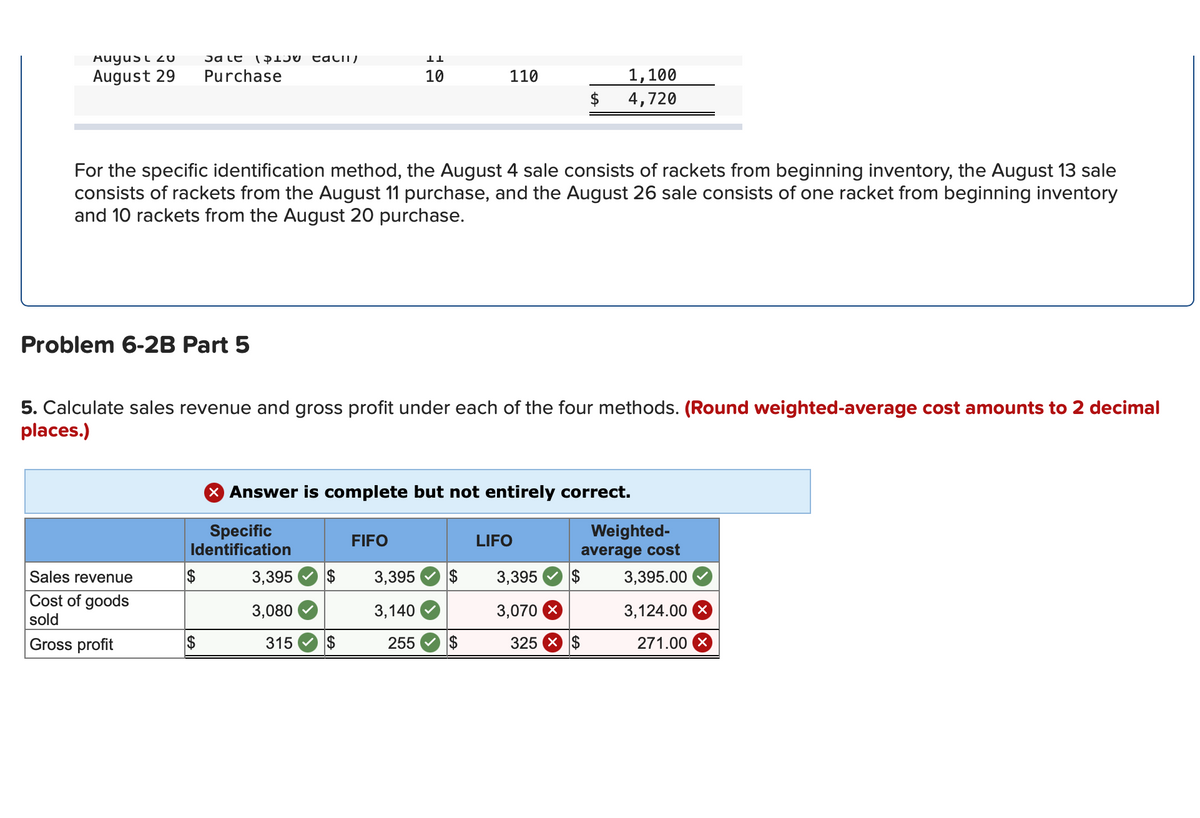

For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale

consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory

and 10 rackets from the August 20 purchase.

Problem 6-2B Part 5

5. Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average cost amounts to 2 decimal

places.)

X Answer is complete but not entirely correct.

Specific

Identification

Weighted-

average cost

FIFO

LIFO

Sales revenue

$

3,395

$

3,395

3,395

$

3,395.00

Cost of goods

3,080

3,140

3,070 X

3,124.00 X

sold

Gross profit

$

315

$

255

325 X $

271.00 X

%24

![!

Required information

Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four

inventory methods (LO6-3, 6-4, 6-5)

[The following information applies to the questions displayed below.]

Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August.

Pete's Tennis Shop uses a periodic inventory system.

Date

Transactions

Units

Unit Cost

Total Cost

Beginning

inventory

Sale ($125 each)

Purchase

Sale ($140 each)

Purchase

August 1

8.

$140

$

1,120

August 4

August 11

August 13

August 20

August 26

August 29

130

1,300

120

1,200

Sale ($150 each)

10

11

1,100

$

4,720

Purchase

10

110

For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale

consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory

and 10 rackets from the August 20 purchase.

Problem 6-2B Part 5

LO O 00 HO](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcc35bfef-1e1d-4e62-a745-481127990680%2F80ed8682-4dc6-4c07-842b-aecbd8829caf%2Fd1twl6w_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four

inventory methods (LO6-3, 6-4, 6-5)

[The following information applies to the questions displayed below.]

Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August.

Pete's Tennis Shop uses a periodic inventory system.

Date

Transactions

Units

Unit Cost

Total Cost

Beginning

inventory

Sale ($125 each)

Purchase

Sale ($140 each)

Purchase

August 1

8.

$140

$

1,120

August 4

August 11

August 13

August 20

August 26

August 29

130

1,300

120

1,200

Sale ($150 each)

10

11

1,100

$

4,720

Purchase

10

110

For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale

consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory

and 10 rackets from the August 20 purchase.

Problem 6-2B Part 5

LO O 00 HO

Expert Solution

Step 1 Introduction

The FIFO stands for First in First out and LIFO stands for Last in first out.

Using average method, cost per unit ia calculated as total cost of goods available for sale divided by number of units available for sale.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College