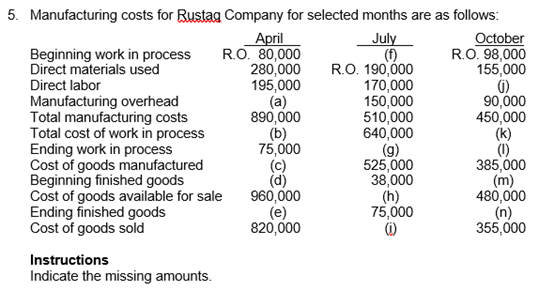

5. Manufacturing costs for Rustag Company for selected months are as follows: April RO. 80,000 280,000 195,000 (a) 890,000 (b) 75,000 (c) (d) 960,000 (e) 820,000 July () R.O. 190,000 170,000 150,000 510,000 640,000 (g) 525,000 38,000 (h) 75,000 Beginning work in process Direct materials used October RO. 98,000 155,000 Direct labor Manufacturing overhead Total manufacturing costs Total cost of work in process Ending work in process Cost of goods manufactured Beginning finished goods Cost of goods available for sale Ending finished goods Cost of goods sold 90,000 450,000 (k) (1) 385,000 (m) 480,000 (n) 355,000 Instructions Indicate the missing amounts.

5. Manufacturing costs for Rustag Company for selected months are as follows: April RO. 80,000 280,000 195,000 (a) 890,000 (b) 75,000 (c) (d) 960,000 (e) 820,000 July () R.O. 190,000 170,000 150,000 510,000 640,000 (g) 525,000 38,000 (h) 75,000 Beginning work in process Direct materials used October RO. 98,000 155,000 Direct labor Manufacturing overhead Total manufacturing costs Total cost of work in process Ending work in process Cost of goods manufactured Beginning finished goods Cost of goods available for sale Ending finished goods Cost of goods sold 90,000 450,000 (k) (1) 385,000 (m) 480,000 (n) 355,000 Instructions Indicate the missing amounts.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 2CMA

Related questions

Question

Transcribed Image Text:5. Manufacturing costs for Rustag Company for selected months are as follows:

April

RO. 80,000

280,000

195,000

(a)

890,000

(b)

75,000

(c)

(d)

960,000

(e)

820,000

July

()

R.O. 190,000

170,000

150,000

510,000

640,000

(g)

525,000

38,000

(h)

75,000

Beginning work in process

Direct materials used

October

RO. 98,000

155,000

Direct labor

Manufacturing overhead

Total manufacturing costs

Total cost of work in process

Ending work in process

Cost of goods manufactured

Beginning finished goods

Cost of goods available for sale

Ending finished goods

Cost of goods sold

90,000

450,000

(k)

(1)

385,000

(m)

480,000

(n)

355,000

Instructions

Indicate the missing amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College