Masay Company provided the following information for the Problem 9-2 (IAA) current year: Sales Inyentories - January 1: Raw materials Goods in process Finished goods 7,500,000 200,000 240,000 360,000 ntories. December 31.

Masay Company provided the following information for the Problem 9-2 (IAA) current year: Sales Inyentories - January 1: Raw materials Goods in process Finished goods 7,500,000 200,000 240,000 360,000 ntories. December 31.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 12E: a. Based on the data in Exercise 17-11, determine the following: 1. Cost of beginning work in...

Related questions

Question

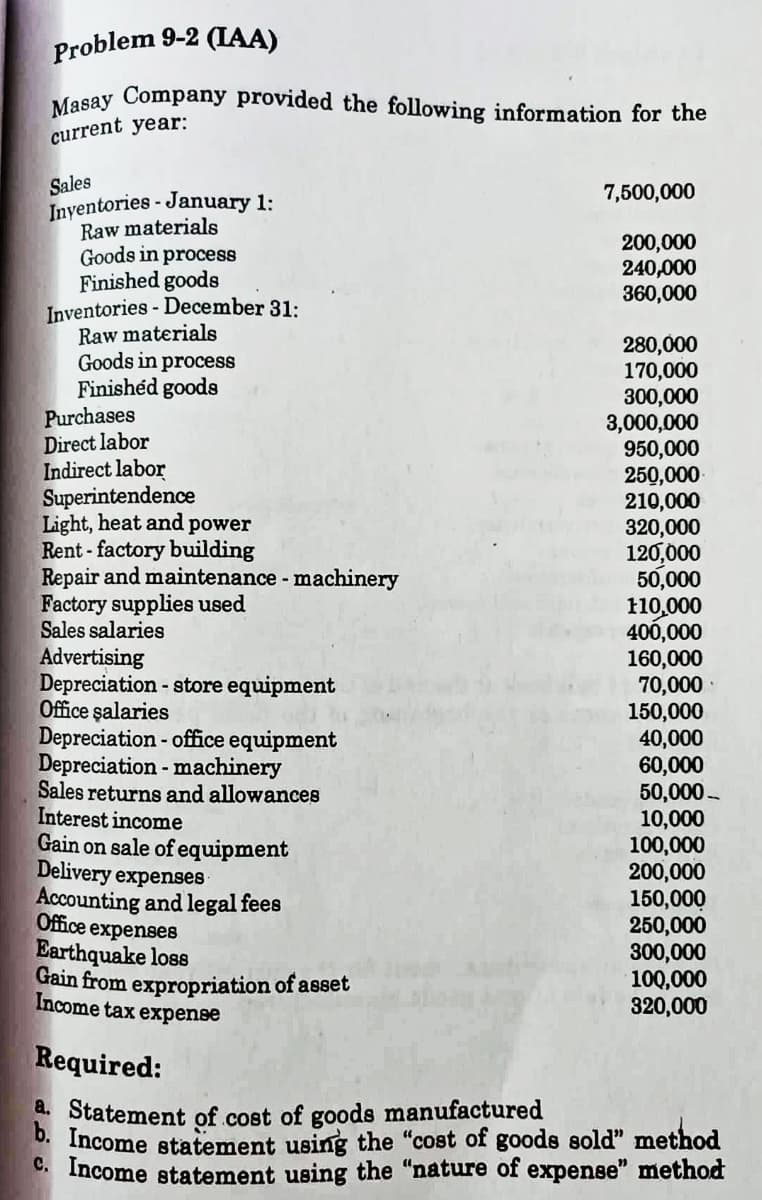

Provide the following requirement (a,b and c) of the problem:

Transcribed Image Text:Problem 9-2 (IAA)

Masay Company provided the following information for the

current year:

Sales

Inyentories - January 1:

Raw materials

Goods in process

Finished goods

Inventories - December 31:

Raw materials

Goods in process

Finishéd goods

Purchases

Direct labor

Indirect labor

Superintendence

Light, heat and power

Rent - factory building

Repair and maintenance - machinery

Factory supplies used

Sales salaries

Advertising

Depreciation - store equipment

Office şalaries

Depreciation - office equipment

Depreciation - machinery

Sales returns and allowances

Interest income

Gain on sale of equipment

Delivery expenses

Accounting and legal fees

Office expenses

Earthquake loss

Gain from expropriation of asset

Income tax expense

7,500,000

200,000

240,000

360,000

280,000

170,000

300,000

3,000,000

950,000

250,000

210,000

320,000

120,000

50,000

10,000

400,000

160,000

70,000

150,000

40,000

60,000

50,000 -

10,000

100,000

200,000

150,000

250,000

300,000

100,000

320,000

Required:

a. Statement of cost of goods manufactured

* Income statement using the "cost of goods sold" method

C. Income statement using the "nature of expense" method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning