Q: a demand 8=400 アニー and équilil

A: The forces of demand (dd) and supply (ss) collectively determine the equilibrium price (Pe) and…

Q: Price $25.00 20.00 15.00 10.00 200 400 500 600 700 800 Quantity Refer to figure above. If the price…

A:

Q: 1 and 2 examine the market for Rmags. The demand for Rmags is given by Q = 12,500–500P and the…

A: equilibrium price means the only price where the consumers and the producers plan agree that means…

Q: Price per Ice-cream (Rs.) Demand for Ice cream (Qd) Supply for Ice cream (Qs) 140…

A: The market is a place where the buyers and sellers interact with each other and the exchange of…

Q: Demand: Supply: 3 Q Price ceiling = 11 4 Q 11 P = 60 - P = 4 + 12 Demand: P = 20 40 Price floor = 8

A: Since you have specifically asked for Q# 11, we are providing the solution only for that subpart.…

Q: ssume a demand equation: Q, = 9 - 0.1p - Pc + 0.01ps + 0.0001Y and a supply equation: Q = 0.1p -…

A: If the price is $55, there will be an excess supply of 1 thousand units.

Q: čubic per 100 During a three month period the price of natural gas decreased from $4.81 per cu ft.…

A: Given Information: a) initial price (P1)= $4.81 (per 1,000 cu ft) b) initial quantity (Q1)=62.21…

Q: The following diagram shows supply and demand in the market for smartphones. Use the black point…

A: Total surplus is the aggregate of Consumer surplus and the producer surplus , Consumer surplus is…

Q: 180 150 120 110 Supply 90 60 30 Demand 5 10 15 20 25 30 QUANTITY At the equilibrium price, producer…

A: Producer surplus is the area below the market price line and above the supply curve.

Q: In the long-run equilibrium, what is the price? what is the output? what is the total profit?

A: Monopolistic competition is a market structure where large number of sellers exist to produce…

Q: 6. The following is part of the demand schedule for commodity X. Price (Ngwee) per Unit Units of X…

A: demand refers to the consumer wishes to purchase at a given price in a given period of time The…

Q: At a price of $3, Nam demands how many units? Quantity Demanded Fon Nam Market Demand Price 10 9…

A: Given,

Q: Using the table below answer the following question Price Quantity demanded Quantity supplied…

A: * ANSWER :- Given that ,

Q: Price per apple (S) Quantity demanded Quantity demanded (Income = $10,000) (Income = $12,000) 1 10…

A: Quantity demanded is inversely related to price, keeping other factors of demand constant. When the…

Q: starting pointerre Haute St. Louis Evansville Bloomington demand 8.₁ 5.₁ 3. 150 Indianapolis.. Ft.…

A: Transportation problem can be solved by simplex method and transportation method. A feasible…

Q: The Ministry of Misallocation has decreed that the production of widgets must be 2000 each month and…

A: In the free market, the equilibrium price and quantity is determined through the forces of demand…

Q: TT Price per Ice-cream (Rs.) Demand for Ice cream (Qd) Supply for Ice cream (Qs) 140 500 1500 120…

A: Given,

Q: 80 40 L00 60 20 80 40 S1 D1. 100 200 300 400 500 600 7õ0 800 Quantity of hamburgers (per week) e:…

A: At P=$2 required quantity sold is 300 units.

Q: If the market is in equilibrium, price is $12 and quantity is 900. What is the consumer surplus,…

A: At equilibrium, price is $12, and quantity is 900. The difference between the price consumers have…

Q: Quantity Quantity supplied (cups per hour) 30 40 Price (dollars per cup) 1.50 demanded 90 70 50 1.75…

A: The price and quantity demanded of a good are decided by the market forces, demand, and supply.…

Q: A. Here is some information about the market for onions in Vancouver: 3 S7911 etc PRICE PER UNIT…

A: Here, demand schedule for onion in Vancouver is given using which one can derive the demand equation…

Q: Price $25.00 20.00 15.00 10.00 200 400 500 600 700 800 Quantity Refer to Figure 3-4. If the price is…

A: At Equilibrium Price, quantity demanded is equal to quantity supplied. Shortage occurs when quantity…

Q: A) Use the following data to construct the graph for the market for milk. Price ($) 10 12 14 16 18…

A: Price Demand Supply 10 400 200 12 375 300 14 350 400 16 325 500 18 300 600 20 275 700…

Q: The equilibrium price of a good is $25 and the equilibrium quantity demanded is 35. What is total…

A: Equilibrium quantity is when there is no shortage or surplus of an item. the equilibrium price is…

Q: Question 8

A: The producer surplus is defined as the difference between actual market price and the minimum amount…

Q: We are given the market information of Supply pizza as below: a) Define the market demand equation…

A: Given the graph we construct the demand and supply in the following table. Quantity demanded (in…

Q: 60 54 Supply 48 42 36 30 24 18 Demand 200 300 40t 500 800 TO0 3od eco 1e00 QUANTITY Tespots ch PRICE…

A: At equilibrium both the demand and supply will meet.

Q: a. Calculate market demand. Instructions: Enter your responses in the table below. Alex DMarket 16…

A: Market demand is the aggregate of the individual demands of all consumers participating in the…

Q: Points Price Qd Ed TR (Sales) = Qs Es Price x Quantity Demanded A 50 150 350 45 200 490 C 40 250 700…

A: Elasticity of Demand = (Percentage change in quantity demanded)/(Percentage change in price)…

Q: Price 38 Supply 34 28 22 16 Demand 10 6 4 5 10 20 30 50 60 70 80 90 Quantity 40 2.

A: When the world price is less than the equilibrium price, then the domestic demand will be higher…

Q: 180 150 120 110 Supply 90 70 60 Demand 10 15 20 25 30 QUANTITY At the equilibrium price, producer…

A: Producer surplus is the area below Market price line and above supply curve.

Q: uppose that Edison and Hilary are the only consumers of shoes in a particular market. The following…

A: As per the law of demand, the price has an inverse relationship with the quantity demanded.

Q: Problem 5 Refer to problem 4. A new minimum wage of $20 has been enforced. What is the surplus?

A: Surplus: When supply exceeds demand Labour supplied at the new wage $20 is: Qs=1000+20*(20) Qs=1400…

Q: $17.00 $16.00 $15.00 $14 00 $13.00 $12.00 $11.00 $10.00 $9.00 $8.00 Demand 57 00 S6.00 $5.00 5400…

A: d. Price floor or binding price floor. The equilibrium is at demand equal supply where P=11 The…

Q: sume a demand equation: Qd = 9 - 0.1p – Pc + 0.01ps + 0.0001Y %3D nd a supply equation: Qs = 0.1p -…

A: We know the equilibrium price is attained at a point where the quantity demanded equals to the…

Q: 110 100 90 8 8 8 70 60+ 50 45 40 30 Price Supply Demand

A: Marginal benefits are the most extreme sum a purchaser will pay for an extra good or service.

Q: Determine the size of the market surplus or shortage that would es a price of $40. There will be a…

A: - Diagram

Q: TPrice Supply 4+ 3- Price ceiling Denand 120 180 Quantity

A: The price ceiling, will result in quantity demanded increasing, whereas, the quantity supplied will…

Q: 9. Fewer COVID restrictions lead to more vacation and work travel by car a. Shift only one curve on…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: What is the total surplus : Price 110 - Supply 100 a) 800 b) 1000 c) 1500 d) 2000 e) 2500 f) 3500 g)…

A: The total surplus in a market is a measure of the total wellbeing of all participants in a market.…

Q: Price $10 $8 $6 $4 $2 nded and supply for a given market Quantity Supplied 60 45 30 15 Quantity…

A: The given data shows the inverse relationship between the price and the quantity demanded. As it can…

Q: 17. Which of the following is NOT a likely reason for supply sl (A) COVID-19 lockdowns and…

A: The pandemic has noncontinuous nearly each side of the world provide chain — that’s the typically…

Q: Note: Plot your points in the order in which you would like them connected. Line segments will…

A: Price Quantity demanded Quantity Supplied 4 2000 200 8 1600 600 12 1200 800 16 800 1200 20…

Q: Question 10

A: The impact of increase in supply can be depict as follows:

Q: S 10 - 12 15 Refer to the figure 3.9. A surplus will exist when the price equals $10. the price…

A: Demand is the willingness and ability of consumers for consuming and buying goods and services at…

Q: The diagram shows the market for a good with an initial equilibrium price of $10. The demand fo the…

A:

Q: $12 8.15 Supply 365 2 Demand 220 400 Quantity 9. Refer to the above figure, at price=9 Price

A: Refer to the above figure , at price = $8.15,

Q: 60- Q, = 40- 1.00p and for other town residents is 50- Q2 = 10 - 0.25p. 으 40- The town's total…

A: Total demand curve is the summation of all individuals demand curve.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

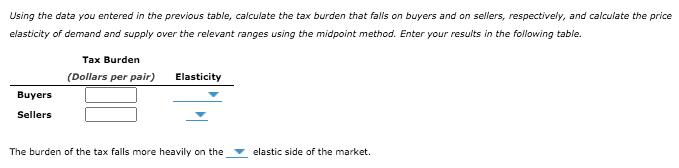

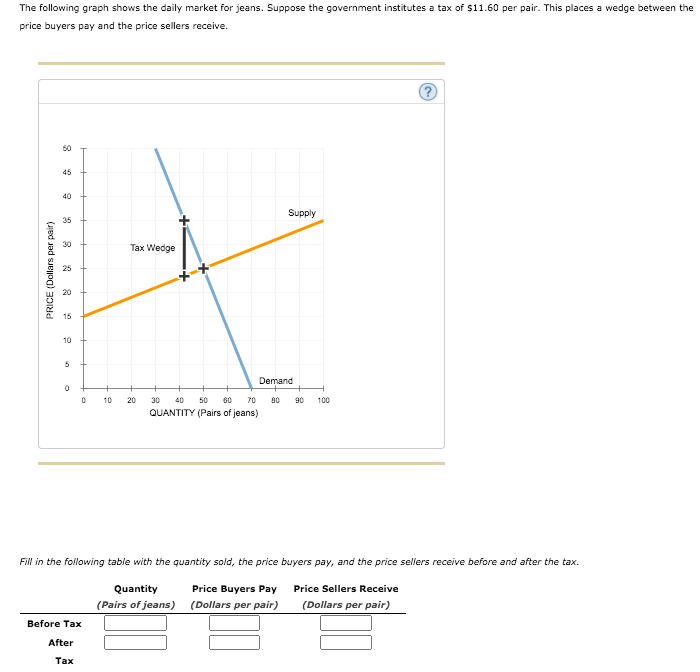

- Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Suppose the government institutes a tax of $10.15 per pair. This places a wedge between the price buyers pay and the price sellers receive. 0100200300400500600700800900100050454035302520151050PRICE (Dollars per pair)QUANTITY (Pairs of jeans)Tax WedgeDemandSupply Fill in the following table with the quantity sold, the price buyers pay, and the price sellers receive before and after the tax. Quantity Price Buyers Pay Price Sellers Receive (Pairs of jeans) (Dollars per pair) (Dollars per pair) Before Tax After Tax Using the data you entered in the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table. Tax Burden Elasticity…The following graph shows the daily market for jeans. Suppose the government institutes a tax of $40.60 per pair. This places a wedge between the price buyers pay and the price sellers receive.Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Suppose the government institutes a tax of $23.20 per pair. This places a wedge between the price buyers pay and the price sellers receive.

- The following graph shows the daily market for wine. Suppose the government institutes a tax of $11.60 per bottle. This places a wedge between the price buyers pay and the price sellers receive.Congress and the president decide that the United States should reduce air pollution by reducing its use of gasoline. They impose a $0.50 tax on each gallon of gasoline sold. Suppose they decided to impose the tax on consumers. In the following graph, shows the effect of a $0.50 tax on each gallon of gasoline sold imposed on consumers by shifting the demand or supply curve. DemandSupply01234563.02.52.01.51.00.50Price of Gasoline (Dollars per gallon)Quantity of Gasoline (Thousands of gallons)Demand Supply True or False: The effect of the tax will be the same regardless of whom the tax is imposed on. True False This tax would be more effective in reducing the quantity of gasoline consumed if the demand for gasoline were elastic. True or False: Consumers of gasoline are helped by this tax. True False Workers in the oil industry are by this tax.Economists in Champaign have been studying the local market for pizza. The market is described in the graph below: Some research by the local university shows that eating pizza improves health in several ways. The local government decides to subsidize pizza consumption paying for $2 of every pizza sold(essentially a negative tax of $2). How much will the government spend with this subsidy?

- Look at the figure above. If the government assesses a tax of $0.75 on each latte, the price the consumer pays for a latte after the tax will: (explain please) increase from $2 to $2.75. increase from $2 to $2.50. increase from $2 to $2.25. change, but we cannot determine by how much.Economists in Champaign have been studying the local market for pizza. The market is described in the graph below: Some research by the local university shows that eating pizza improves health in several ways. The local government decides to subsidize pizza consumption paying for $2 of every pizza sold(essentially a negative tax of $2). How many pizzas will be sold in the market?The following graph shows the market for the long-distance bus rides. In the absence of taxes, the equilibrium price of a ride is $5 and the equilibrium quantity is 10 million rides. Suppose that regulator levies an excise tax on bus service providers. The amount of excise tax equals $2 per ride. Calculate the amount of dead-weight loss resulting from this tax. $4 million $0.5 million $1 million $2 million

- This question analyze the market for cellular service. QD = 50 – 0.25P QS = 2P – 76 a. Suppose the government imposes a $60 price ceiling. Calculate the new quantity sold in the market. Q = a. Suppose the government instead imposes a $50 price ceiling. Calculate the new quantity sold in the market. Q = b. Briefly explain whether the $50 price ceiling creates a shortage or surplus in the market, and calculate the size of that shortage/surplus. What is The amount of the surplus or shortage is units? c. Calculate the amount of deadweight loss associated with the $50 price ceiling. DWL =Graph the following In the market for smartphones, the price elasticity of supply is +0.8, and the price elasticity of demand is -1.2. At equilibrium, price is $800 and quantity is 400000. (1a) Assuming supply and demand are linear, reconstruct and draw the supply and demand curves. Label the intercepts. (1b) To help consumers and phone-makers, the government proposes to subsidize smartphones by $80 each. What are PB and PS after the subsidy? What is the new equilibrium quantity? Illustrate them on the same graph. (c) Calculate the change in consumer surplus, producer surplus, government expenditure, and deadweight loss and identify them on the graph.The current market price of bananas is $1 per pound. Use a graph and words to show the effect of a ten cent tax on each pound of bananas. Insert your own numbers into your graph. Be sure to indicate the new price paid by consumers, the new price received by sellers, and the new quantity sold.