6. 300- Real estate is typically reassessed annually for property tax purposes. This assessed value, however, is not necessarily the same as the fair market value of the property. An SRS of 30 properties recently sold in a midwestern city was taken. The scatter plot below show the actual sales prices and the assessed values of the 30 properties. Both variables are measured in 250- 200- thousands of dollars. 150- Let y; and x; be respectively the sales price and the assessed value of the ith property. We use R to fit the regression model 100– Yi = Bo + B1Xi + Ei, Ei ~ i.i.d. N(0, ơ). 100 150 200 250 300 and yield the output below. Assessed Value ($1000) Call: Mean SD 1m(formula = Sales.Price ~ Assessed.Value) Assessed Value 184.13 45.43 Sales Price 195.84 47.18 Coefficients: Estimate Std. Error t value Pr(>|t]) (Intercept) 21.49923 15.27936 1.407 0.17 Assessed. Value 0.94682 0.08064 11.741 2.49e-12 *** --- Residual standard error: 19.73 on 28 degrees of freedom Multiple R-squared: 0.8312, F-statistic: 137.9 on 1 and 28 DF, Adjusted R-squared: 0.8251 p-value: 2.488e-12 What is the value of the slope of the regression line predicting the actual sales price from the assessed value? Interpret the slope of the regression line in the context of the data. Sales Price ($1000)

6. 300- Real estate is typically reassessed annually for property tax purposes. This assessed value, however, is not necessarily the same as the fair market value of the property. An SRS of 30 properties recently sold in a midwestern city was taken. The scatter plot below show the actual sales prices and the assessed values of the 30 properties. Both variables are measured in 250- 200- thousands of dollars. 150- Let y; and x; be respectively the sales price and the assessed value of the ith property. We use R to fit the regression model 100– Yi = Bo + B1Xi + Ei, Ei ~ i.i.d. N(0, ơ). 100 150 200 250 300 and yield the output below. Assessed Value ($1000) Call: Mean SD 1m(formula = Sales.Price ~ Assessed.Value) Assessed Value 184.13 45.43 Sales Price 195.84 47.18 Coefficients: Estimate Std. Error t value Pr(>|t]) (Intercept) 21.49923 15.27936 1.407 0.17 Assessed. Value 0.94682 0.08064 11.741 2.49e-12 *** --- Residual standard error: 19.73 on 28 degrees of freedom Multiple R-squared: 0.8312, F-statistic: 137.9 on 1 and 28 DF, Adjusted R-squared: 0.8251 p-value: 2.488e-12 What is the value of the slope of the regression line predicting the actual sales price from the assessed value? Interpret the slope of the regression line in the context of the data. Sales Price ($1000)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 23PPS

Related questions

Question

Transcribed Image Text:Before making further inference, one should check whether the assumptions for the linear

regression model appear reasonable for the data. Name one plot for checking (some of) the assumptions

and explain (or sketch) what we expect the plot to look like if the assumptions are met.

Test the hypotheses Ho: B1

1 versus Ha: B1 # 1. Together with an insignificant intercept

in this model, this would imply that the selling price (y) is equal to the assessed value (x) on average.

Give the test statistic, degrees of freedom, and give a range for the P-value. At the 5% significance level,

would we reject the null hypothesis?

Transcribed Image Text:6.

300-

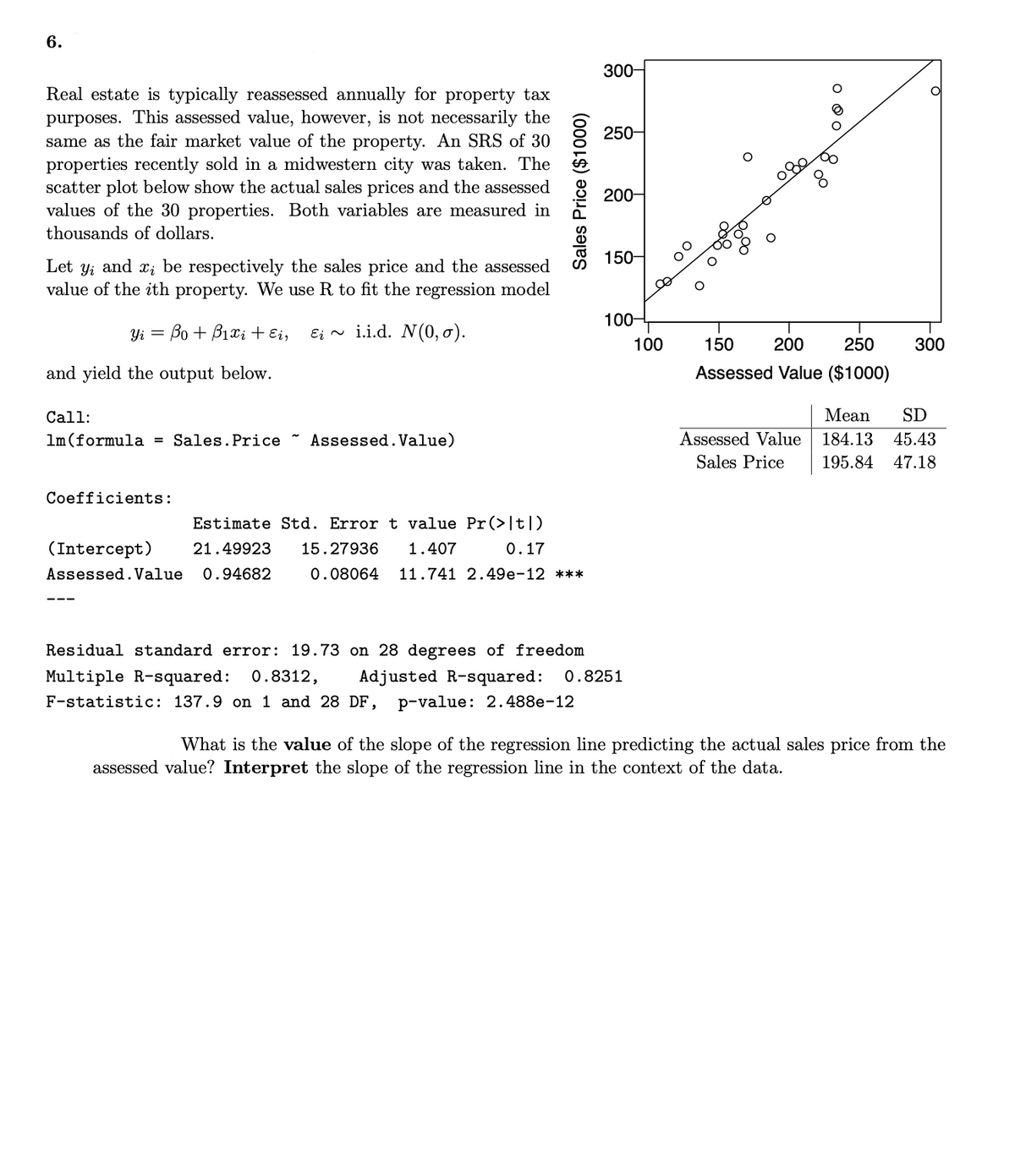

Real estate is typically reassessed annually for property tax

purposes. This assessed value, however, is not necessarily the

same as the fair market value of the property. An SRS of 30

properties recently sold in a midwestern city was taken. The

scatter plot below show the actual sales prices and the assessed

values of the 30 properties. Both variables are measured in

8 250-

200-

thousands of dollars.

150-

Let y; and x; be respectively the sales price and the assessed

value of the ith property. We use R to fit the regression model

100-

Yi =

Bo + B1xi + Ei,

Ei ~ i.i.d. N(0, o).

100

150

200

250

300

and yield the output below.

Assessed Value ($1000)

Call:

Mean

SD

1m (formula = Sales.Price *

Assessed. Value)

Assessed Value

184.13 45.43

Sales Price

195.84

47.18

Coefficients:

Estimate Std. Error t value Pr(>It|)

(Intercept)

Assessed. Value

21.49923

15.27936

1.407

0.17

0.94682

0.08064

11.741 2.49e-12 ***

Residual standard error: 19.73 on 28 degrees of freedom

Multiple R-squared: 0.8312,

Adjusted R-squared:

0.8251

F-statistic: 137.9 on 1 and 28 DF,

p-value: 2.488e-12

What is the value of the slope of the regression line predicting the actual sales price from the

assessed value? Interpret the slope of the regression line in the context of the data.

Sales Price ($1000)

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt