6. Imagine inflation is 10%, and the central bank wants to have inflation equal to 2%. When announcing information about future monetary policy, the central bank brings inflation expectations to 4%. The slope of the Phillips Curve is 1/3. Cost push shocks are zero. How much must short-run output fall to achieve the goal of 2% inflation? 7. Repeat the last exercise assuming that the announcement of future monetary policy is less effective, bringing inflation expectations to 8%.

6. Imagine inflation is 10%, and the central bank wants to have inflation equal to 2%. When announcing information about future monetary policy, the central bank brings inflation expectations to 4%. The slope of the Phillips Curve is 1/3. Cost push shocks are zero. How much must short-run output fall to achieve the goal of 2% inflation? 7. Repeat the last exercise assuming that the announcement of future monetary policy is less effective, bringing inflation expectations to 8%.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter17: The Short-run Trade-off Between Inflation And Unemployment

Section: Chapter Questions

Problem 4PA

Related questions

Question

3

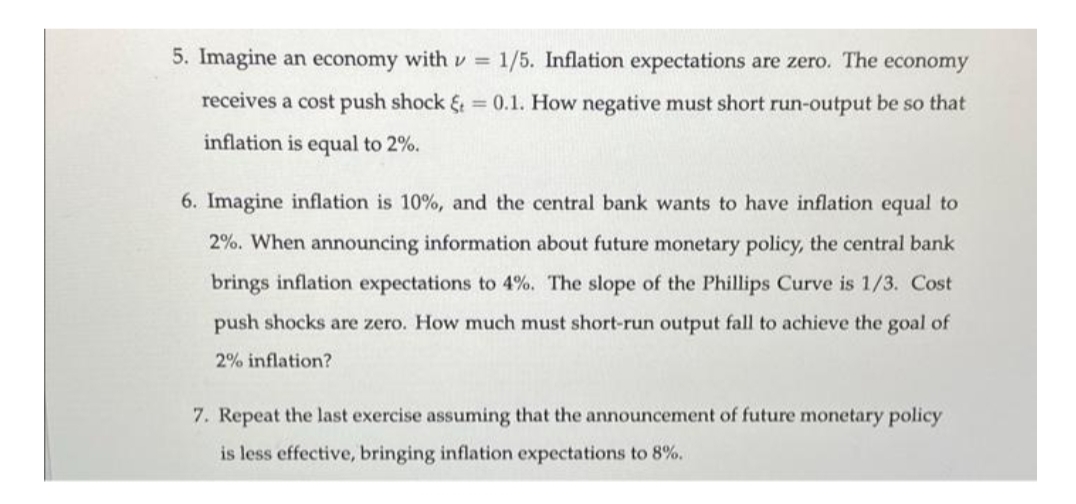

Transcribed Image Text:5. Imagine an economy withv = 1/5. Inflation expectations are zero. The

economy

receives a cost push shock & = 0.1. How negative must short run-output be so that

inflation is equal to 2%.

6. Imagine inflation is 10%, and the central bank wants to have inflation equal to

2%. When announcing information about future monetary policy, the central bank

brings inflation expectations to 4%. The slope of the Phillips Curve is 1/3. Cost

push shocks are zero. How much must short-run output fall to achieve the goal of

2% inflation?

7. Repeat the last exercise assuming that the announcement of future monetary policy

is less effective, bringing inflation expectations to 8%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning