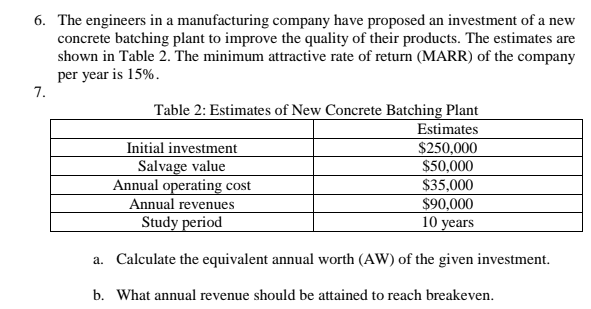

6. The engineers in a manufacturing company have proposed an investment of a new concrete batching plant to improve the quality of their products. The estimates are shown in Table 2. The minimum attractive rate of return (MARR) of the company per year is 15%. 7. Table 2: Estimates of New Concrete Batching Plant Estimates $250,000 $50,000 $35,000 $90,000 10 years Initial investment Salvage value Annual operating cost Annual revenues Study period a. Calculate the equivalent annual worth (AW) of the given investment. b. What annual revenue should be attained to reach breakeven.

6. The engineers in a manufacturing company have proposed an investment of a new concrete batching plant to improve the quality of their products. The estimates are shown in Table 2. The minimum attractive rate of return (MARR) of the company per year is 15%. 7. Table 2: Estimates of New Concrete Batching Plant Estimates $250,000 $50,000 $35,000 $90,000 10 years Initial investment Salvage value Annual operating cost Annual revenues Study period a. Calculate the equivalent annual worth (AW) of the given investment. b. What annual revenue should be attained to reach breakeven.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 5P

Related questions

Question

The engineers in a manufacturing company have proposed an investment of a new

concrete batching plant to improve the quality of their products. The estimates are

shown in Table 2. The minimum attractive

per year is 15%.

Table 2: Estimates of New Concrete Batching Plant

Estimates

Initial investment $250,000

Salvage value $50,000

Annual operating cost $35,000

Annual revenues $90,000

Study period 10 years

a. Calculate the equivalent annual worth (AW) of the given investment.

b. What annual revenue should be attained to reach breakeven.

Transcribed Image Text:6. The engineers in a manufacturing company have proposed an investment of a new

concrete batching plant to improve the quality of their products. The estimates are

shown in Table 2. The minimum attractive rate of return (MARR) of the company

per year is 15%.

7.

Table 2: Estimates of New Concrete Batching Plant

Estimates

Initial investment

Salvage value

Annual operating cost

$250,000

$50,000

$35,000

$90,000

10 years

Annual revenues

Study period

a. Calculate the equivalent annual worth (AW) of the given investment.

b. What annual revenue should be attained to reach breakeven.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning