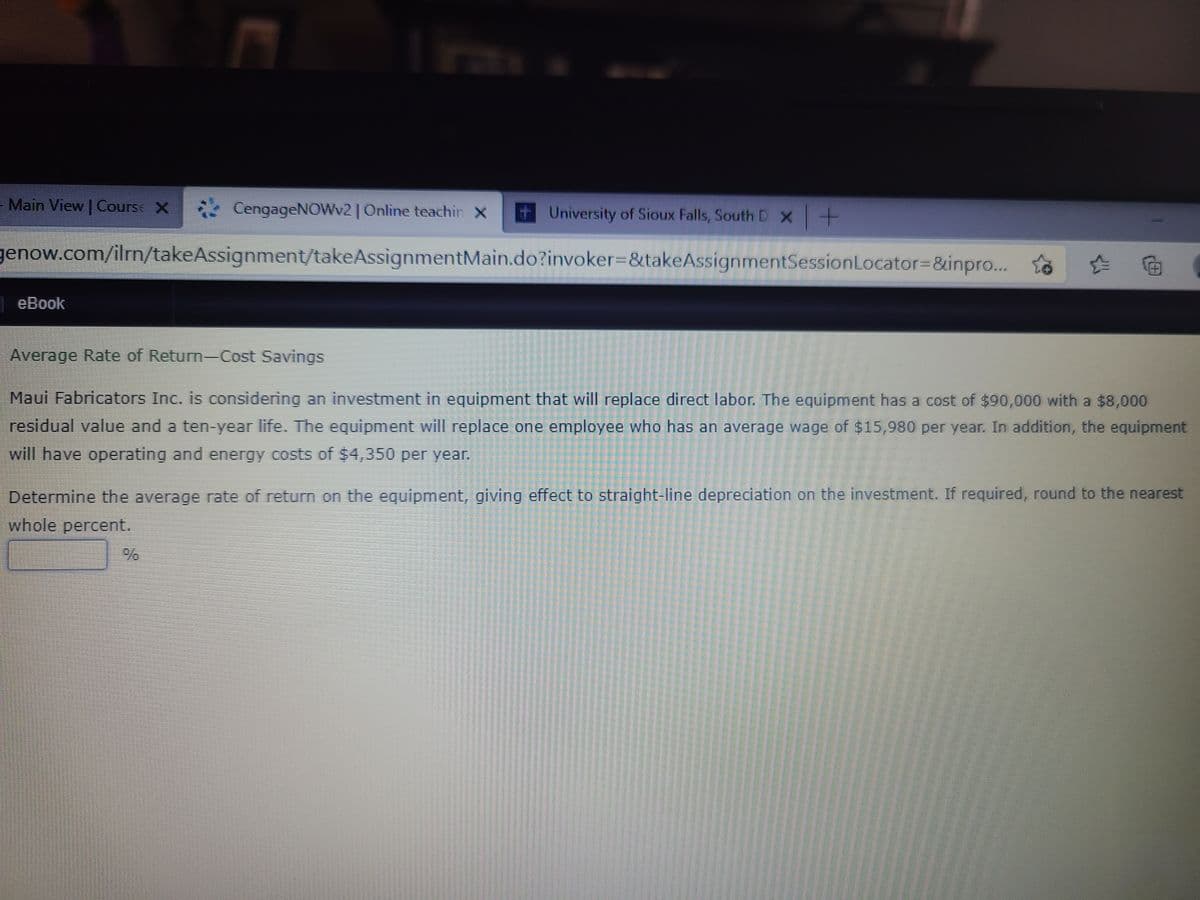

Average Rate of Return-Cost Savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $90,000 with a $8,000 residual value and a ten-year life. The equipment will replace one employee who has an average wage of $15,980 per year. In addition, the equipment will have operating and energy costs of $4,350 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. %

Average Rate of Return-Cost Savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $90,000 with a $8,000 residual value and a ten-year life. The equipment will replace one employee who has an average wage of $15,980 per year. In addition, the equipment will have operating and energy costs of $4,350 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. %

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 35SP

Related questions

Question

Transcribed Image Text:- Main View | Course X

* CengageNOWV2| Online teachin X

University of Sioux Falls, South D x -

genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%3D&inpro...

eBook

Average Rate of Return-Cost Savings

Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $90,000 with a $8,000

residual value and a ten-year life. The equipment will replace one employee who has an average wage of $15,980 per year. In addition, the equipment

will have operating and energy costs of $4,350 per year.

Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest

whole percent.

IC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you