On March 1, 2012, Westfield Corporation received an order for parts from a foreign customer at a price of 500,000 foreign currencies with a delivery date of April 30, 2012. On March 1, when the peso-foreign currency spot rate is P0.115, Westfields Corp. entered into a two month forward contract to sell 500,000 foreign currencies at a forward rate of P0.12 per foreign currency. It designates the forward contract as a fair value hedge of the firm commitment to receive foreign currencies, and the fair value of the firm commitment is measured by referring to changes in the peso forward rate. Westfields delivers the parts and receives payment on April 30, 2012, when the foreign currency rate is P0.118. On March 31, 2012, the foreign currency spot rate is PO.123, and the forward contract has a fair value of P1,250. What is the net impact on Westfields net income for the quarter ended March 31, 2012, as a result of the forward contract hedge of a firm commitment? A. PO B. P1,250 increase in net income C. P1,500 decrease in net income D. P1,500 increase in net income What is the net impact on Westfields net income for the quarter ended June 30, 2012, as a result of the forward contract hedge of a firm commitment? A. PO B. P59,000increase in net income C. P60,000 increase in net income D. P61,500 increase in net income

On March 1, 2012, Westfield Corporation received an order for parts from a foreign customer at a price of 500,000 foreign currencies with a delivery date of April 30, 2012. On March 1, when the peso-foreign currency spot rate is P0.115, Westfields Corp. entered into a two month forward contract to sell 500,000 foreign currencies at a forward rate of P0.12 per foreign currency. It designates the forward contract as a fair value hedge of the firm commitment to receive foreign currencies, and the fair value of the firm commitment is measured by referring to changes in the peso forward rate. Westfields delivers the parts and receives payment on April 30, 2012, when the foreign currency rate is P0.118. On March 31, 2012, the foreign currency spot rate is PO.123, and the forward contract has a fair value of P1,250. What is the net impact on Westfields net income for the quarter ended March 31, 2012, as a result of the forward contract hedge of a firm commitment? A. PO B. P1,250 increase in net income C. P1,500 decrease in net income D. P1,500 increase in net income What is the net impact on Westfields net income for the quarter ended June 30, 2012, as a result of the forward contract hedge of a firm commitment? A. PO B. P59,000increase in net income C. P60,000 increase in net income D. P61,500 increase in net income

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter27: Multinational Financial Management

Section: Chapter Questions

Problem 11P: Boisjoly Watch Imports has agreed to purchase 15,000 Swiss watches for 1 million francs at today’s...

Related questions

Question

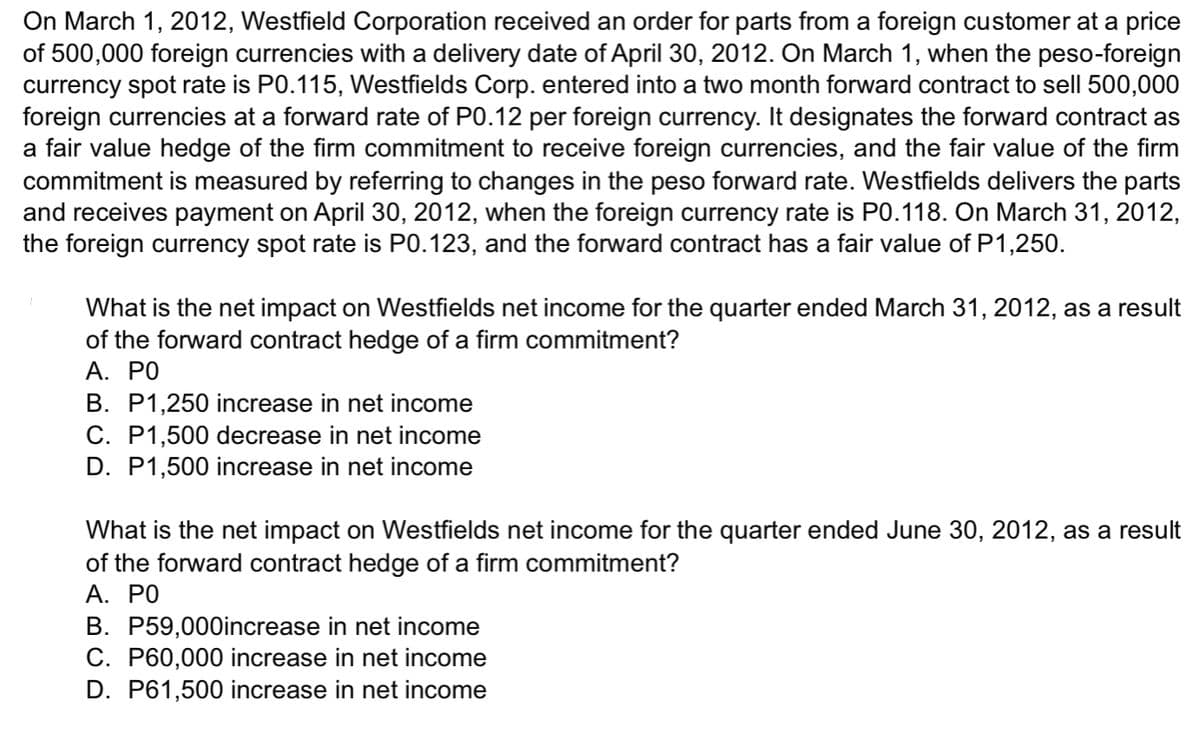

Transcribed Image Text:On March 1, 2012, Westfield Corporation received an order for parts from a foreign customer at a price

of 500,000 foreign currencies with a delivery date of April 30, 2012. On March 1, when the peso-foreign

currency spot rate is P0.115, Westfields Corp. entered into a two month forward contract to sell 500,000

foreign currencies at a forward rate of P0.12 per foreign currency. It designates the forward contract as

a fair value hedge of the firm commitment to receive foreign currencies, and the fair value of the firm

commitment is measured by referring to changes in the peso forward rate. Westfields delivers the parts

and receives payment on April 30, 2012, when the foreign currency rate is P0.118. On March 31, 2012,

the foreign currency spot rate is P0.123, and the forward contract has a fair value of P1,250.

What is the net impact on Westfields net income for the quarter ended March 31, 2012, as a result

of the forward contract hedge of a firm commitment?

A. PO

B. P1,250 increase in net income

C. P1,500 decrease in net income

D. P1,500 increase in net income

What is the net impact on Westfields net income for the quarter ended June 30, 2012, as a result

of the forward contract hedge of a firm commitment?

A. PO

B. P59,000increase in net income

C. P60,000 increase in net income

D. P61,500 increase in net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning