6. Using a payoff matrix to determine the equilibrium outcome Suppose there are only two firms that sell tablets: Padmania and Capturesque. The following payoff matrix shows the profit (in millions of dollars) each company will earn, depending on whether it sets a high or low price for its tablets. Capturesque Pricing High Low High 11, 11 2, 18 Padmania Pricing Low 18, 2 10, 10 For example, the lower-left cell shows that if Padmania prices low and Capturesque prices high, Padmania will earn a profit of $18 million, and Capturesque will earn a profit of $2 million. Assume this is a simultaneous game and that Padmania and Capturesque are both profit-maximizing firms. If Padmania prices high, Capturesque will make more profit if it chooses a price, and if Padmania prices low, Capturesque will make more profit if it chooses a v price. If Capturesque prices high, Padmania will make more profit if it chooses a price, and if Capturesque prices low, Padmania will make more profit if it chooses a v price. Considering all of the information given, pricing high a dominant strategy for both Padmania and Capturesque. If the firms do not collude, what strategies will they end up choosing? O Padmania will choose a low price, and Capturesque will choose a high price. O Both Padmania and Capturesque will choose a high price. O Padmania will choose a high price, and Capturesque will choose a low price. O Both Padmania and Capturesque will choose a low price. True or False: The game between Padmania and Capturesque is an example of the prisoners' dilemma. O True O False

6. Using a payoff matrix to determine the equilibrium outcome Suppose there are only two firms that sell tablets: Padmania and Capturesque. The following payoff matrix shows the profit (in millions of dollars) each company will earn, depending on whether it sets a high or low price for its tablets. Capturesque Pricing High Low High 11, 11 2, 18 Padmania Pricing Low 18, 2 10, 10 For example, the lower-left cell shows that if Padmania prices low and Capturesque prices high, Padmania will earn a profit of $18 million, and Capturesque will earn a profit of $2 million. Assume this is a simultaneous game and that Padmania and Capturesque are both profit-maximizing firms. If Padmania prices high, Capturesque will make more profit if it chooses a price, and if Padmania prices low, Capturesque will make more profit if it chooses a v price. If Capturesque prices high, Padmania will make more profit if it chooses a price, and if Capturesque prices low, Padmania will make more profit if it chooses a v price. Considering all of the information given, pricing high a dominant strategy for both Padmania and Capturesque. If the firms do not collude, what strategies will they end up choosing? O Padmania will choose a low price, and Capturesque will choose a high price. O Both Padmania and Capturesque will choose a high price. O Padmania will choose a high price, and Capturesque will choose a low price. O Both Padmania and Capturesque will choose a low price. True or False: The game between Padmania and Capturesque is an example of the prisoners' dilemma. O True O False

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter17: Oligopoly

Section: Chapter Questions

Problem 9PA

Related questions

Question

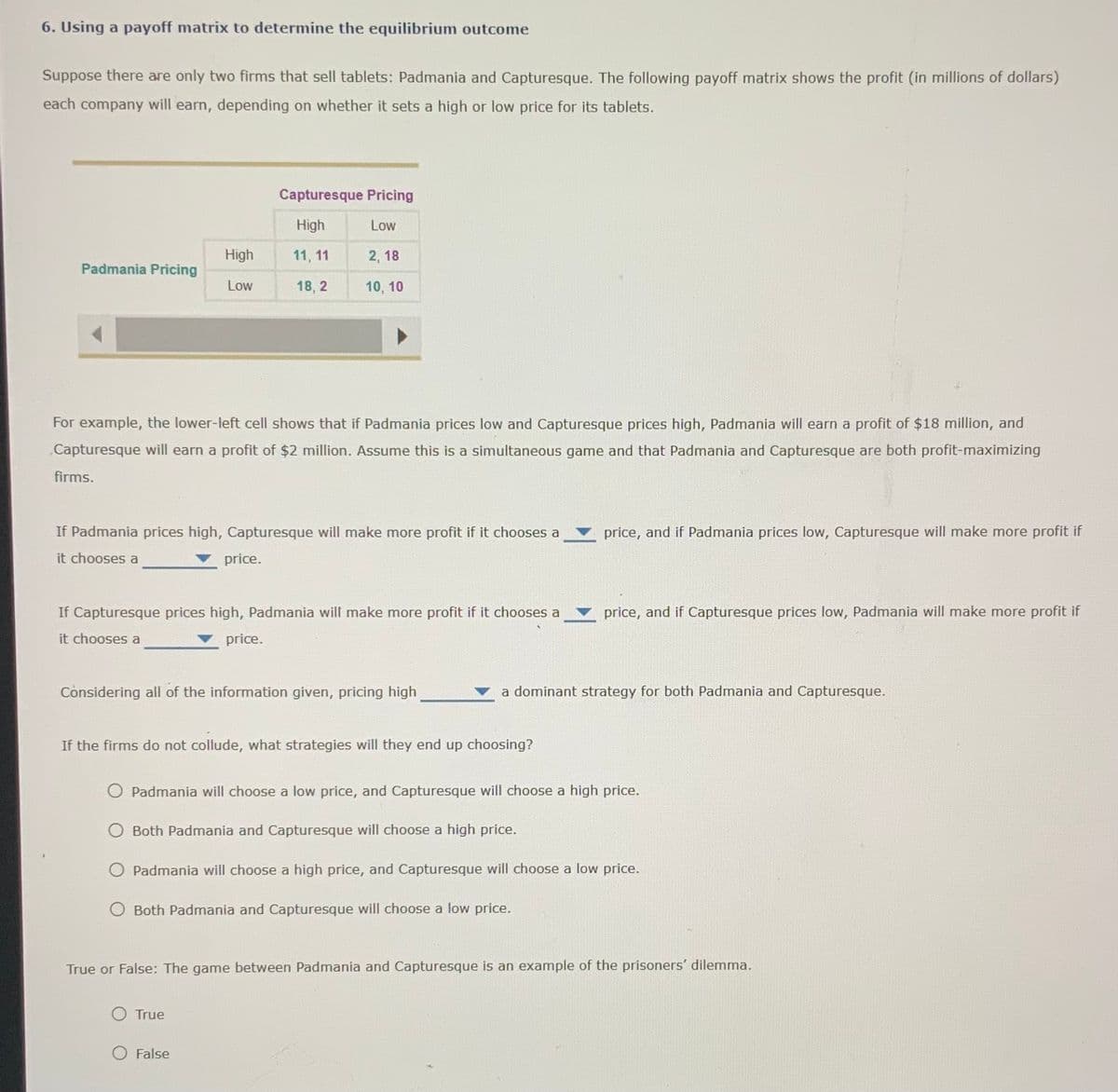

Transcribed Image Text:6. Using a payoff matrix to determine the equilibrium outcome

Suppose there are only two firms that sell tablets: Padmania and Capturesque. The following payoff matrix shows the profit (in millions of dollars)

each company will earn, depending on whether it sets a high or low price for its tablets.

Capturesque Pricing

High

Low

High

11, 11

2, 18

Padmania Pricing

Low

18, 2

10, 10

For example, the lower-left cell shows that if Padmania prices low and Capturesque prices high, Padmania will earn a profit of $18 million, and

„Capturesque will earn a profit of $2 million. Assume this is a simultaneous game and that Padmania and Capturesque are both profit-maximizing

firms.

If Padmania prices high, Capturesque will make more profit if it chooses a

price, and if Padmania prices low, Capturesque will make more profit if

it chooses a

price.

If Capturesque prices high, Padmania will make more profit if it chooses a

price, and if Capturesque prices low, Padmania will make more profit if

it chooses a

price.

Considering all of the information given, pricing high

a dominant strategy for both Padmania and Capturesque.

If the firms do not collude, what strategies will they end up choosing?

O Padmania will choose a low price, and Capturesque will choose a high price.

O Both Padmania and Capturesque will choose a high price.

O Padmania will choose a high price, and Capturesque will choose a low price.

O Both Padmania and Capturesque will choose a low price.

True or False: The game between Padmania and Capturesque is an example of the prisoners' dilemma.

O True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning