Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 10, Problem 3SCQ

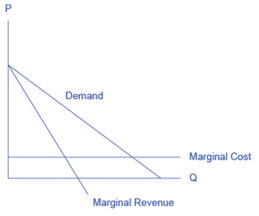

Consider the curve in the figure below, which shows the market demand. marginal cost, and marginal revenue curve for firms in an oligopolistic industry. In this example, we assume firms have zero fixed costs.

- Suppose the firms collude to form a cartel. What

price will the cartel charge? What quantity will the cartel supply? How much profit will the cartel earn? - Suppose now that the cane] breaks up and the oligopolistic firms compete as vigorously as possible by cutting the price and increasing sales. What will be the industry quantity and price? What will be the collective profits of all firms in the industry?

- Compare the

equilibrium price, quantity , and profit for the cartel and cutthroat competition outcomes.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The attached diagram illustrate an industry under oligopoly consisting of 10 equal-sized firms, and a particular firm in that industry. Each of the firms produces an identical product.

Assuming the firms form a cartel, what price will the cartel choose if it wishes to maximize overall profits for the cartel?

What total output must the cartel produce in order to maintain this price?

To what output will an individual firm be restricted if the price is to be maintained?Assume that all firms are permitted to produce the same level of output.

If the other firms stick to this output, how much would an individual firm be tempted to produce if it wished to maximize its own profit at the agreed price?

If it undercut the cartel price, what and output would maximize its profit 9assuming the other members did not retaliate)?

Consider the curve in Figure, which shows the market demand, marginal cost, and marginal revenue curve for firms in an oligopolistic industry. In this example, we assume firms have zero fixed costs. a. Suppose the firms collude to form a cartel. What price will the cartel charge? What quantity will the carte supply? How much profit will the cartel earn? b. Suppose now that the cartel breaks up and the oligopolistic firms compete as vigorously as possible by cutting the price and increasing sales. What will be the industry quantity and price? What will be the collective profits of all firms in the industry? c. Compare the equilibrium price, quantity, and profit for the cartel and cutthroat competition outcomes.

The following diagrams illustrate an industry under oligopoly consisting of 10 equal-sized firms, and a particular firm in that industry. Each of the firms produces an identical product.

(a) Assuming the firms form a cartel, what price will the cartel choose if it wishes to maximise overall profits for the cartel?

(b) What total output must the cartel produce in order to maintain this price?

(c) To what output will an individual firm be restricted if this price is to be maintained? Assume that all firms are permitted to produce the same level of output.

(d) If the other firms stick to this output, how much would an individual firm be tempted to produce if it wished to maximise its own profit at the agreed price?

(e) If it undercut the cartel price, what price and output would maximise its profit (assuming the other members did not retaliate)?

Chapter 10 Solutions

Principles of Economics 2e

Ch. 10 - Suppose that, due to a successful advertising...Ch. 10 - Continuing with the scenario in question 1, in the...Ch. 10 - Consider the curve in the figure below, which...Ch. 10 - Sometimes oligopolies in the same industry are...Ch. 10 - What is the relationship between product...Ch. 10 - How is the perceived demand curve for a...Ch. 10 - How does a monopolistic competitor choose its...Ch. 10 - How can a monopolistic competitor tell whether the...Ch. 10 - If the firms in a monopolistically competitive...Ch. 10 - Is a monopolistically competitive firm...

Ch. 10 - Will the firms in an oligopoly act more like a...Ch. 10 - Does each individual in a prisoners dilemma...Ch. 10 - What stops oligopolists from acting together as a...Ch. 10 - Aside from advertising, how can monopolistically...Ch. 10 - Make a case for why monopolistically competitive...Ch. 10 - Would you rather have efficiency or variety? That...Ch. 10 - Would you expect the kinked demand curve to be...Ch. 10 - When OPEC raised the price of oil dramatically in...Ch. 10 - Andreas Day Spa began to offer a relaxing...Ch. 10 - May and Raj me the only two growers who provide...Ch. 10 - Jane and Bill are apprehended for a bank robbery....

Additional Business Textbook Solutions

Find more solutions based on key concepts

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (11th Edition)

Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted tr...

Principles of Accounting Volume 1

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

What are the major roles that managers play in communicating with employees?

Principles of Management

Corolla Manufacturing has a standard cost for steel of $20 per pound for a product that uses 4 pounds of steel....

Principles of Accounting Volume 2

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Knowledge Booster

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning