7-5: Massey Electronics Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the devices consist of many small fins cut in the metal to increase its surface area and hence its ability to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy the processor and other components on the circuit board without a heat sink to disperse the heat. Massey has two production facilities, one in Texas and the other in Mexico. Both produce a wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, serv- ers, and telecommunications. The three lines of business are profit centers, whereas the two plants are cost centers. Products produced by each plant are charged to the lines of business selling the heat sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to each line of business. The Texas plant produces more complicated heat sinks that require tighter engineering toler- ances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger and employs more people. Both facilities utilize a set of shared manufacturing resources: a common manufacturing IT system that schedules and controls the manufacturing process, inventory control, and cost accounting, industrial engineers, payroll processing, and quality control. These shared man- ufacturing overhead resources cost Massey $9.5 million annually. Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool: direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants. The following table summarizes the operations of the two plants: Direct labor hours Direct labor dollars Direct material dollars Square footage Texas 3,000,000 $60,000,000 $180,000,000 200,000 Mexico 4,000,000 $40,000,000 $200,000,000 300,000 Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax liability in any tax jurisdiction where it operates for the next five years. Required: a. Prepare a table showing how the $9.5 million would be allocated using each of the four proposed allocation schemes (direct labor hours, direct labor dollars, direct material dol- lars, and square footage of the two plants). b. Discuss the advantages and disadvantages of each of the four proposed allocation methods (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

7-5: Massey Electronics Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the devices consist of many small fins cut in the metal to increase its surface area and hence its ability to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy the processor and other components on the circuit board without a heat sink to disperse the heat. Massey has two production facilities, one in Texas and the other in Mexico. Both produce a wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, serv- ers, and telecommunications. The three lines of business are profit centers, whereas the two plants are cost centers. Products produced by each plant are charged to the lines of business selling the heat sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to each line of business. The Texas plant produces more complicated heat sinks that require tighter engineering toler- ances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger and employs more people. Both facilities utilize a set of shared manufacturing resources: a common manufacturing IT system that schedules and controls the manufacturing process, inventory control, and cost accounting, industrial engineers, payroll processing, and quality control. These shared man- ufacturing overhead resources cost Massey $9.5 million annually. Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool: direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants. The following table summarizes the operations of the two plants: Direct labor hours Direct labor dollars Direct material dollars Square footage Texas 3,000,000 $60,000,000 $180,000,000 200,000 Mexico 4,000,000 $40,000,000 $200,000,000 300,000 Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax liability in any tax jurisdiction where it operates for the next five years. Required: a. Prepare a table showing how the $9.5 million would be allocated using each of the four proposed allocation schemes (direct labor hours, direct labor dollars, direct material dol- lars, and square footage of the two plants). b. Discuss the advantages and disadvantages of each of the four proposed allocation methods (direct labor hours, direct labor dollars, direct material dollars, and square footage of the two plants).

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter13: Lean Manufacturing And Activity Analysis

Section: Chapter Questions

Problem 2PA

Related questions

Question

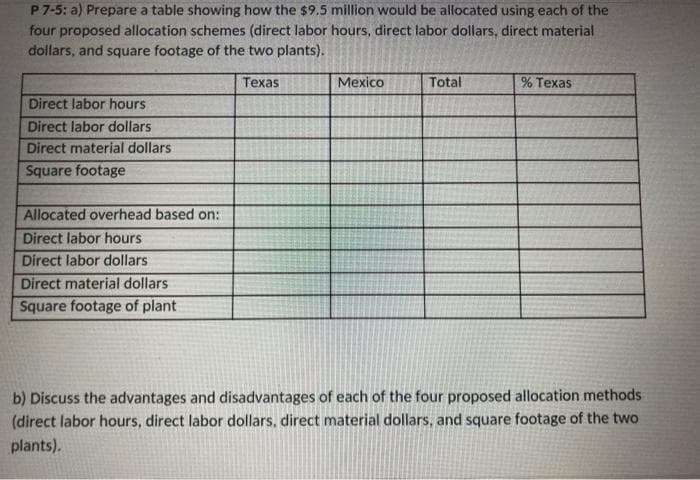

Transcribed Image Text:P 7-5: a) Prepare a table showing how the $9.5 million would be allocated using each of the

four proposed allocation schemes (direct labor hours, direct labor dollars, direct material

dollars, and square footage of the two plants).

Texas

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage

Allocated overhead based on:

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage of plant

Mexico

Total

% Texas

b) Discuss the advantages and disadvantages of each of the four proposed allocation methods

(direct labor hours, direct labor dollars, direct material dollars, and square footage of the two

plants).

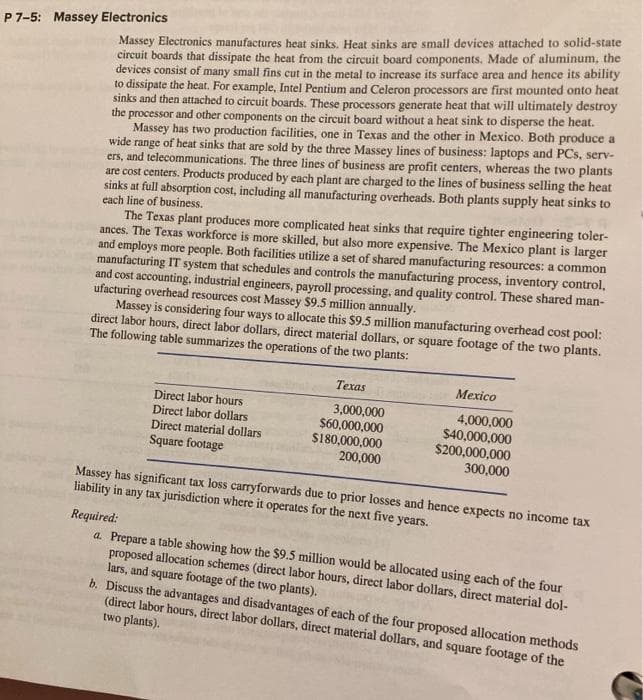

Transcribed Image Text:P 7-5: Massey Electronics

Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state

circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the

devices consist of many small fins cut in the metal to increase its surface area and hence its ability

to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat

sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy

the processor and other components on the circuit board without a heat sink to disperse the heat.

Massey has two production facilities, one in Texas and the other in Mexico. Both produce a

wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, serv-

ers, and telecommunications. The three lines of business are profit centers, whereas the two plants

are cost centers. Products produced by each plant are charged to the lines of business selling the heat

sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to

each line of business.

The Texas plant produces more complicated heat sinks that require tighter engineering toler-

ances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger

and employs more people. Both facilities utilize a set of shared manufacturing resources: a common

manufacturing IT system that schedules and controls the manufacturing process, inventory control,

and cost accounting, industrial engineers, payroll processing, and quality control. These shared man-

ufacturing overhead resources cost Massey $9.5 million annually.

Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool:

direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants.

The following table summarizes the operations of the two plants:

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage

Texas

3,000,000

$60,000,000

$180,000,000

200,000

Mexico

4,000,000

$40,000,000

$200,000,000

300,000

Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax

liability in any tax jurisdiction where it operates for the next five years.

Required:

a. Prepare a table showing how the $9.5 million would be allocated using each of the four

proposed allocation schemes (direct labor hours, direct labor dollars, direct material dol-

lars, and square footage of the two plants).

b. Discuss the advantages and disadvantages of each of the four proposed allocation methods

(direct labor hours, direct labor dollars, direct material dollars, and square footage of the

two plants).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning