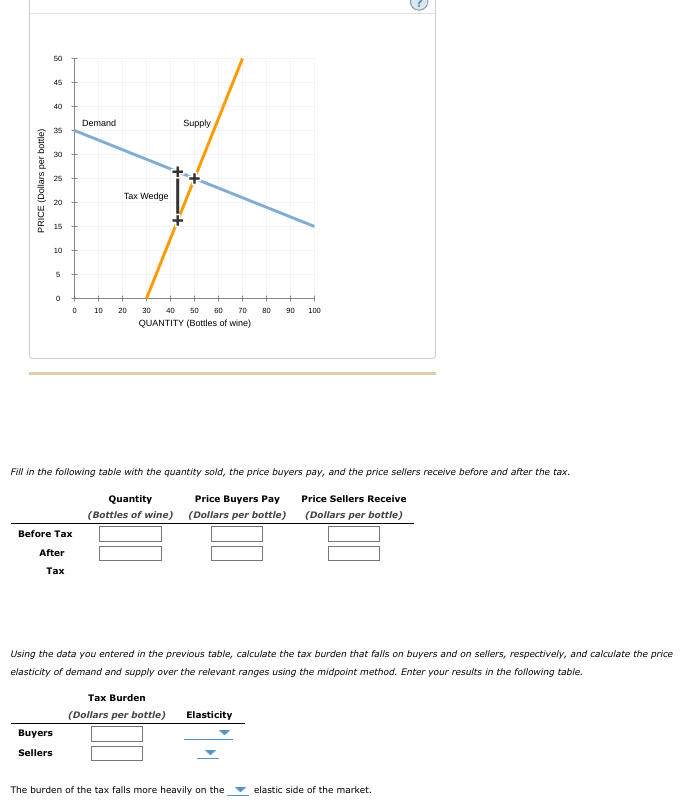

7. Effect of a tax on buyers and sellers Part 2 The following graph shows the daily market for wine. Suppose the government institutes a tax of $10.15 per bottle. This places a wedge between the price buyers pay and the price sellers receive.

7. Effect of a tax on buyers and sellers Part 2

The dynamics of demand and supply determine the equilibrium price and quantity in a free market, but the government can intervene in a free market by levying taxes that divert the market from the equilibrium position. When a tax is assessed on an item or service, the burden is divided between the consumer and seller based on the elasticity of demand and elasticity of supply, regardless of who first levied the tax.

The elasticity of demand is a measurement of the change in the amount requested of a commodity as a result of price changes or other variables other than the commodity's price. It's worth noting that a change in pricing leads to a significant change in the amount requested. If the commodity is a typical good, income has a positive connection with the amount requested of the commodity. This indicates that as the consumer's income grows, the quantity required of the commodity tends to climb as well.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images