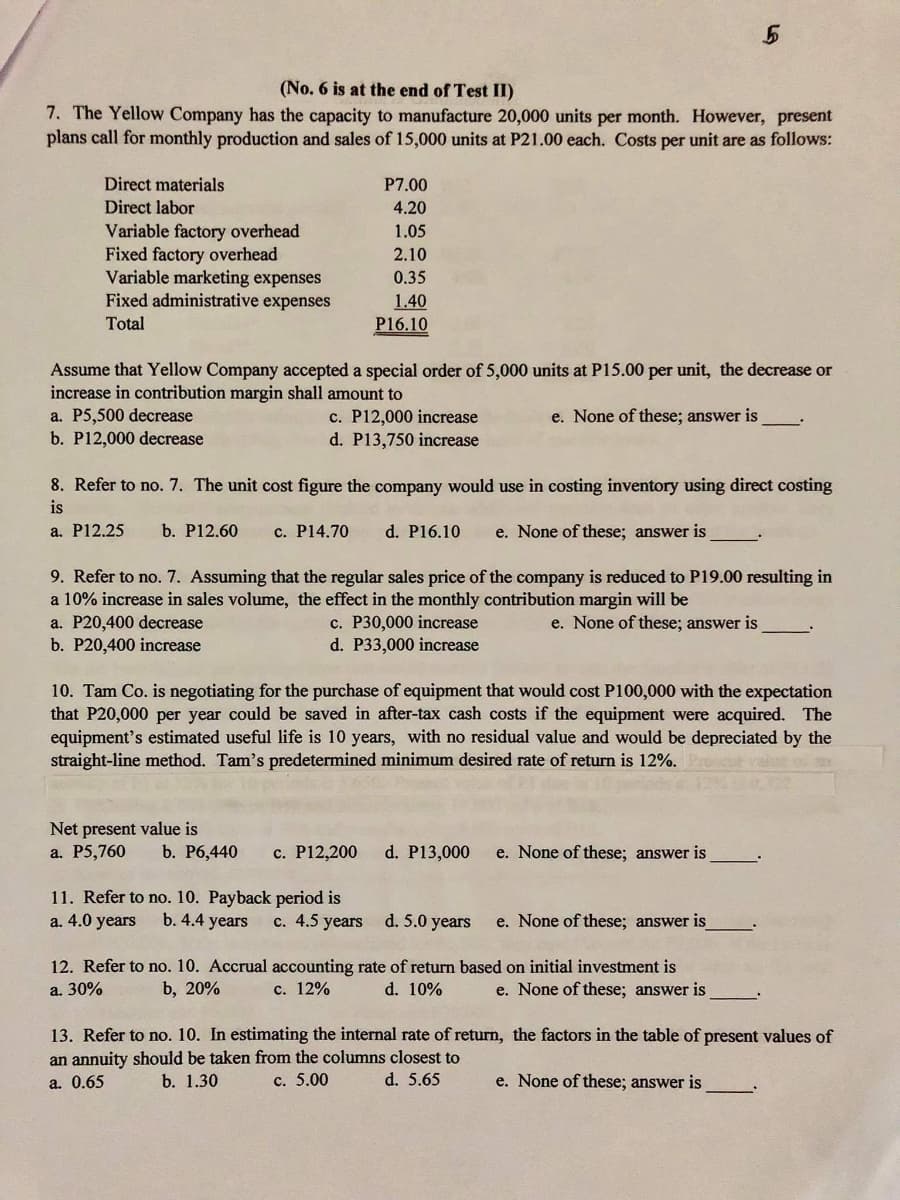

7. The Yellow Company has the capacity to manufacture 20,000 units per month. However, present plans call for monthly production and sales of 15,000 units at P21.00 each. Costs per unit are as follows: Direct materials P7.00 Direct labor 4.20 Variable factory overhead Fixed factory overhead Variable marketing expenses Fixed administrative expenses 1.05 2.10 0.35 1.40 P16.10 Total Assume that Yellow Company accepted a special order of 5,000 units at P15.00 per unit, the decrease or increase in contribution margin shall amount to a. P5,500 decrease b. P12,000 decrease c. P12,000 increase d. P13,750 increase e. None of these; answer is 8. Refer to no. 7. The unit cost figure the company would use in costing inventory using direct costing is a. P12.25 b. P12.60 c. P14.70 d. P16.10 e. None of these; answer is 9. Refer to no. 7. Assuming that the regular sales price of the company is reduced to P19.00 resulting in a 10% increase in sales volume, the effect in the monthly contribution margin will be a. P20,400 decrease b. P20,400 increase c. P30,000 increase d. P33,000 increase e. None of these; answer is

7. The Yellow Company has the capacity to manufacture 20,000 units per month. However, present plans call for monthly production and sales of 15,000 units at P21.00 each. Costs per unit are as follows: Direct materials P7.00 Direct labor 4.20 Variable factory overhead Fixed factory overhead Variable marketing expenses Fixed administrative expenses 1.05 2.10 0.35 1.40 P16.10 Total Assume that Yellow Company accepted a special order of 5,000 units at P15.00 per unit, the decrease or increase in contribution margin shall amount to a. P5,500 decrease b. P12,000 decrease c. P12,000 increase d. P13,750 increase e. None of these; answer is 8. Refer to no. 7. The unit cost figure the company would use in costing inventory using direct costing is a. P12.25 b. P12.60 c. P14.70 d. P16.10 e. None of these; answer is 9. Refer to no. 7. Assuming that the regular sales price of the company is reduced to P19.00 resulting in a 10% increase in sales volume, the effect in the monthly contribution margin will be a. P20,400 decrease b. P20,400 increase c. P30,000 increase d. P33,000 increase e. None of these; answer is

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter8: Tactical Decision-making And Relevant Analysis

Section: Chapter Questions

Problem 39E

Related questions

Question

Transcribed Image Text:(No. 6 is at the end of Test II)

7. The Yellow Company has the capacity to manufacture 20,000 units per month. However, present

plans call for monthly production and sales of 15,000 units at P21.00 each. Costs per unit are as follows:

Direct materials

P7.00

Direct labor

4.20

Variable factory overhead

Fixed factory overhead

Variable marketing expenses

Fixed administrative expenses

1.05

2.10

0.35

1.40

P16.10

Total

Assume that Yellow Company accepted a special order of 5,000 units at P15.00 per unit, the decrease or

increase in contribution margin shall amount to

a. P5,500 decrease

b. P12,000 decrease

c. P12,000 increase

d. P13,750 increase

e. None of these; answer is

8. Refer to no. 7. The unit cost figure the company would use in costing inventory using direct costing

is

a. P12.25

b. P12.60

c. P14.70

d. P16.10

e. None of these; answer is

9. Refer to no. 7. Assuming that the regular sales price of the company is reduced to P19.00 resulting in

a 10% increase in sales volume, the effect in the monthly contribution margin will be

a. P20,400 decrease

b. P20,400 increase

c. P30,000 increase

d. P33,000 increase

e. None of these; answer is

10. Tam Co. is negotiating for the purchase of equipment that would cost P100,000 with the expectation

that P20,000 per year could be saved in after-tax cash costs if the equipment were acquired. The

equipment's estimated useful life is 10 years, with no residual value and would be depreciated by the

straight-line method. Tam's predetermined minimum desired rate of return is 12%.

Net present value is

a. P5,760

b. P6,440

с. Р12,200

d. P13,000

e. None of these; answer is

11. Refer to no. 10. Payback period is

a. 4.0 years

b. 4.4 years

c. 4.5 years d. 5.0 years

e. None of these; answer is

12. Refer to no. 10. Accrual accounting rate of return based on initial investment is

d. 10%

a. 30%

b, 20%

c. 12%

e. None of these; answer is

13. Refer to no. 10. In estimating the internal rate of return, the factors in the table of present values of

an annuity should be taken from the columns closest to

с. 5.00

a. 0.65

b. 1.30

d. 5.65

e. None of these; answer is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub