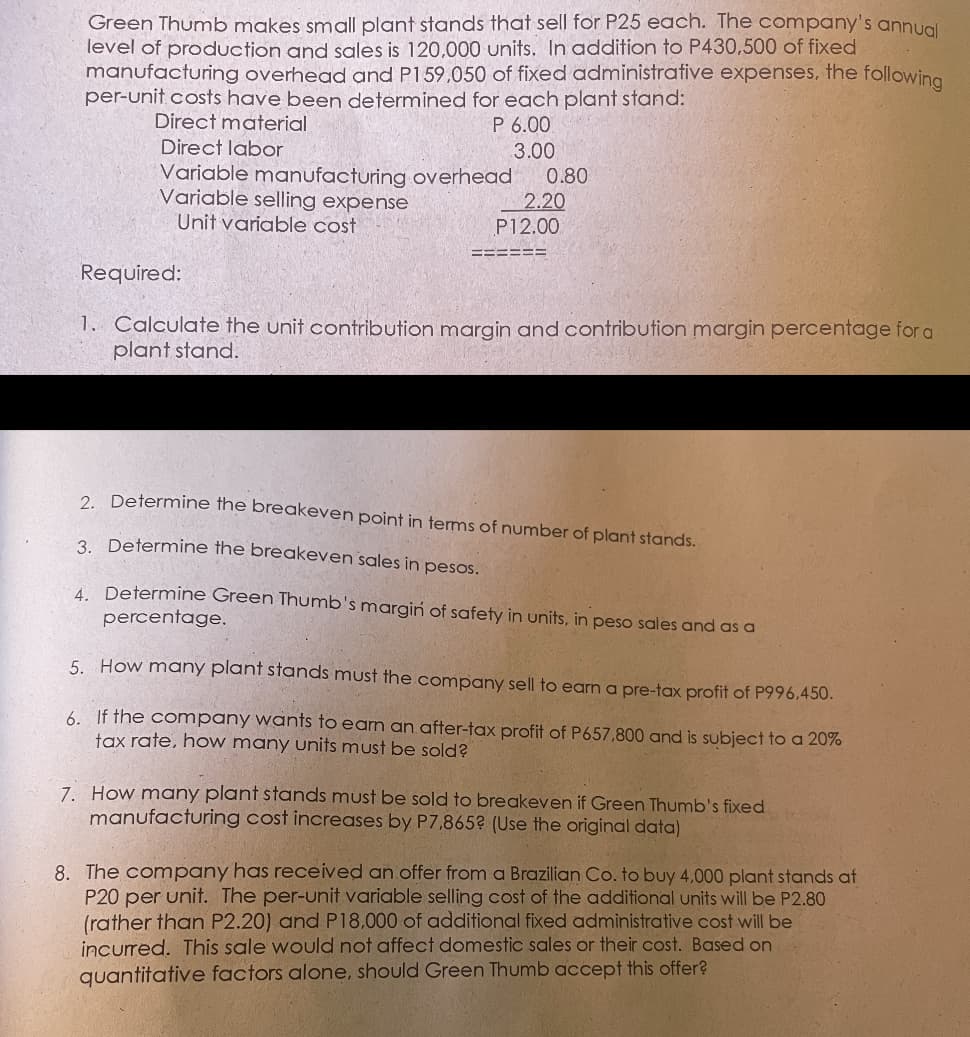

Green Thumb makes small plant stands that sell for P25 each. The company's annual level of production and sales is 120,000 units. In addition to P430,500 of fixed manufacturing overhead and P159,050 of fixed administraftive expenses, the following per-unit costs have been determined for each plant stand: Direct material P 6.00 Direct labor 3.00 Variable manufacturing overhead 2.20 P12.00 0.80 Variable selling expense Unit variable cost ==== Required: 1. Calculate the unit contribution margin and contribution margin percentage fora plant stand. 2 Determine the breakeven point in tems of number of plant stands. 3 Determine the breakeven sales in pesos. A Determine Green Thumb's margin of safety in units, in peso sales and as a percentage. 5. How many plant stands must the company sell to earn a pre-tax profit of P996.450. 6. If the company wants to eam an after-tax profit of P657,800 and is subject to a 20% tax rate, how many units must be sold? 7. How many plant stands must be sold to breakeven if Green Thumb's fixed manufacturing cost increases by P7,865? (Use the original data) 8. The company has received an offer from a Brazilian Co. to buy 4,000 plant stands at P20 per unit. The per-unit variable selling cost of the additional units will be P2.80 (rather than P2.20) and P18.000 of additional fixed administrative cost will be incurred. This sale would not affect domestic sales or their cost. Based on quantitative factors alone, should Green Thumb accepf this offer?

Green Thumb makes small plant stands that sell for P25 each. The company's annual level of production and sales is 120,000 units. In addition to P430,500 of fixed manufacturing overhead and P159,050 of fixed administraftive expenses, the following per-unit costs have been determined for each plant stand: Direct material P 6.00 Direct labor 3.00 Variable manufacturing overhead 2.20 P12.00 0.80 Variable selling expense Unit variable cost ==== Required: 1. Calculate the unit contribution margin and contribution margin percentage fora plant stand. 2 Determine the breakeven point in tems of number of plant stands. 3 Determine the breakeven sales in pesos. A Determine Green Thumb's margin of safety in units, in peso sales and as a percentage. 5. How many plant stands must the company sell to earn a pre-tax profit of P996.450. 6. If the company wants to eam an after-tax profit of P657,800 and is subject to a 20% tax rate, how many units must be sold? 7. How many plant stands must be sold to breakeven if Green Thumb's fixed manufacturing cost increases by P7,865? (Use the original data) 8. The company has received an offer from a Brazilian Co. to buy 4,000 plant stands at P20 per unit. The per-unit variable selling cost of the additional units will be P2.80 (rather than P2.20) and P18.000 of additional fixed administrative cost will be incurred. This sale would not affect domestic sales or their cost. Based on quantitative factors alone, should Green Thumb accepf this offer?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7PB: Remarkable Enterprises requires four units of part A for every unit of Al that it produces....

Related questions

Question

Transcribed Image Text:Green Thumb makes small plant stands that sell for P25 each. The company's annul

level of production and sales is 120,000 units. In addition to P430,500 of fixed

manufacturing overhead and P159,050 of fixed administrafive expenses, the following

per-unit costs have been determined for each plant stand:

Direct material

P 6.00

Direct labor

3.00

Variable manufacturing overhead

2.20

P12.00

0.80

Variable selling expense

Unit variable cost

Required:

1. Calculate the unit contribution margin and contribution margin percentage for a

plant stand.

2 Determine the breakeven point in terms of number of plant stands.

3 Determine the breakeven sales in pesos.

A Determine Green Thumb's margin of safety in units, in peso sales and as a

percentage.

5. How many plant stands must the company sell to earn a pre-tax profit of P996,450.

6. If the company wants to eam an after-tax profit of P657,800 and is subject to a 20%

tax rate, how many units must be sold?

7. How many plant stands must be sold to breakeven if Green Thumb's fixed

manufacturing cost increases by P7,865? (Use the original data)

8. The company has received an offer from a Brazilian Co. to buy 4,000 plant stands at

P20 per unit. The per-unit variable selling cost of the additional units will be P2.80

(rather than P2.20) and P18.000 of additional fixed administrative cost will be

incurred. This sale would not affect domestic sales or their cost. Based on

quantitative factors alone, should Green Thumb accept this offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning