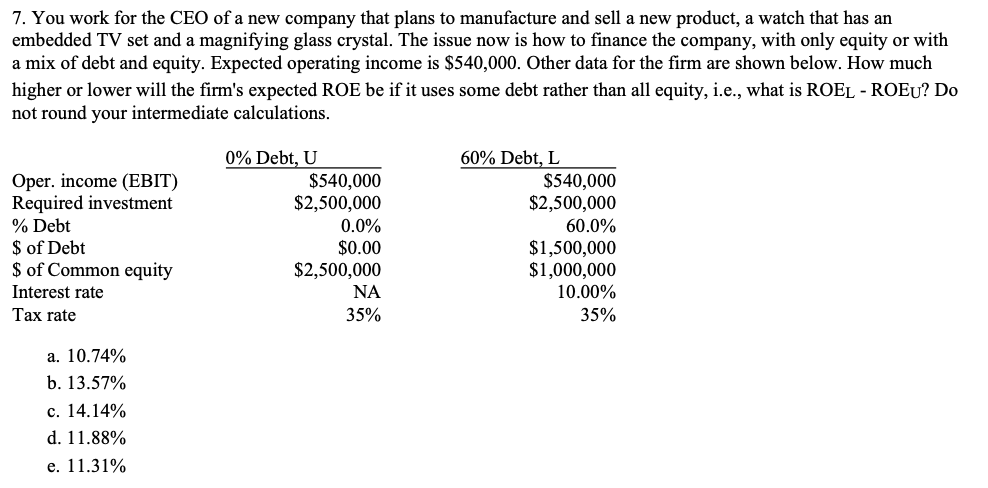

7. You work for the CEO of a new company that plans to manufacture and sell a new product, a watch that has an embedded TV set and a magnifying glass crystal. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $540,000. Other data for the firm are shown below. How much higher or lower will the firm's expected ROE be if it uses some debt rather than all equity, i.e., what is ROEL - ROEU? Do not round your intermediate calculations. 0% Debt, U 60% Debt, L Oper. income (EBIT) Required investment % Debt $ of Debt $ of Common equity $540,000 $2,500,000 $540,000 $2,500,000 0.0% $0.00 $2,500,000 60.0% $1,500,000 $1,000,000 10.00% Interest rate NA Tax rate 35% 35% a. 10.74% b. 13.57% с. 14.14% d. 11.88% e. 11.31%

7. You work for the CEO of a new company that plans to manufacture and sell a new product, a watch that has an embedded TV set and a magnifying glass crystal. The issue now is how to finance the company, with only equity or with a mix of debt and equity. Expected operating income is $540,000. Other data for the firm are shown below. How much higher or lower will the firm's expected ROE be if it uses some debt rather than all equity, i.e., what is ROEL - ROEU? Do not round your intermediate calculations. 0% Debt, U 60% Debt, L Oper. income (EBIT) Required investment % Debt $ of Debt $ of Common equity $540,000 $2,500,000 $540,000 $2,500,000 0.0% $0.00 $2,500,000 60.0% $1,500,000 $1,000,000 10.00% Interest rate NA Tax rate 35% 35% a. 10.74% b. 13.57% с. 14.14% d. 11.88% e. 11.31%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 4MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

Transcribed Image Text:7. You work for the CEO of a new company that plans to manufacture and sell a new product, a watch that has an

embedded TV set and a magnifying glass crystal. The issue now is how to finance the company, with only equity or with

a mix of debt and equity. Expected operating income is $540,000. Other data for the firm are shown below. How much

higher or lower will the firm's expected ROE be if it uses some debt rather than all equity, i.e., what is ROEL - ROEU? Do

not round your intermediate calculations.

0% Debt, U

60% Debt, L

Oper. income (EBIT)

Required investment

$540,000

$2,500,000

$540,000

$2,500,000

% Debt

$ of Debt

$ of Common equity

0.0%

60.0%

$1,500,000

$1,000,000

$0.00

$2,500,000

Interest rate

NA

10.00%

Tax rate

35%

35%

а. 10.74%

b. 13.57%

с. 14.14%

d. 11.88%

е. 11.31%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning