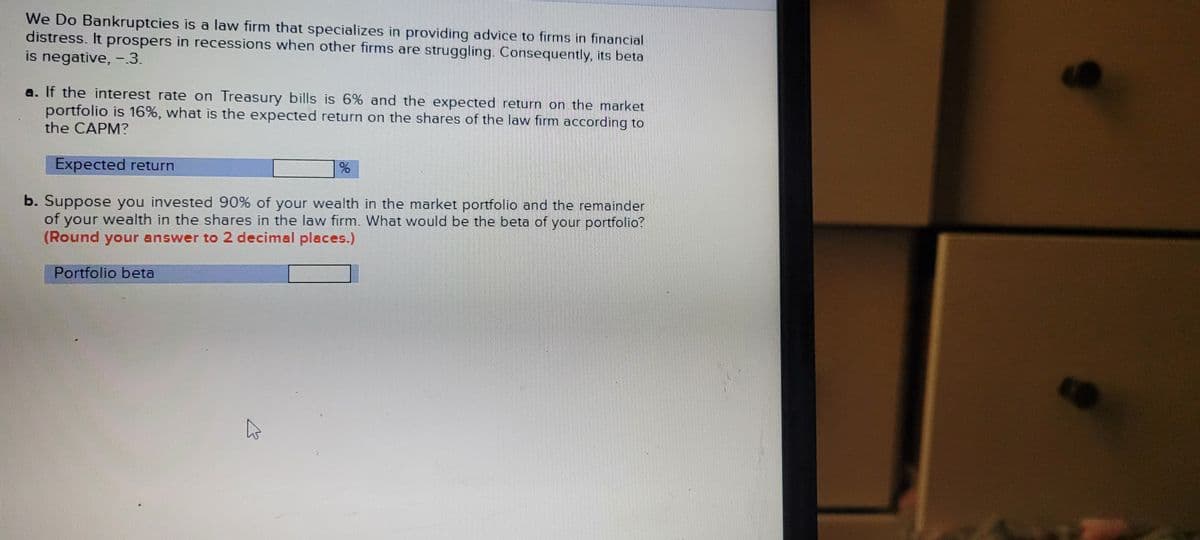

We Do Bankruptcies is a law firm that specializes in providing advice to firms in financial distress. It prospers in recessions when other firms are struggling. Consequently, its beta is negative, -3. a. If the interest rate on Treasury bills is 6% and the expected return on the market portfolio is 16%, what is the expected return on the shares of the law firm according to the CAPM? Expected return b. Suppose you invested 90% of your wealth in the market portfolio and the remainder of your wealth in the shares in the law firm. What would be the beta of your portfolio? (Round your answer to 2 decimal places.) Portfolio beta

We Do Bankruptcies is a law firm that specializes in providing advice to firms in financial distress. It prospers in recessions when other firms are struggling. Consequently, its beta is negative, -3. a. If the interest rate on Treasury bills is 6% and the expected return on the market portfolio is 16%, what is the expected return on the shares of the law firm according to the CAPM? Expected return b. Suppose you invested 90% of your wealth in the market portfolio and the remainder of your wealth in the shares in the law firm. What would be the beta of your portfolio? (Round your answer to 2 decimal places.) Portfolio beta

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 13QTD

Related questions

Question

Transcribed Image Text:We Do Bankruptcies is a law firm that specializes in providing advice to firms in financial

distress. It prospers in recessions when other firms are struggling. Consequently, its beta

is negative, -3.

a. If the interest rate on Treasury bills is 6% and the expected return on the market

portfolio is 16%, what is the expected return on the shares of the law firm according to

the CAPM?

Expected return

b. Suppose you invested 90% of your wealth in the market portfolio and the remainder

of your wealth in the shares in the law firm. What would be the beta of your portfolio?

(Round your answer to 2 decimal places.)

Portfolio beta

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning