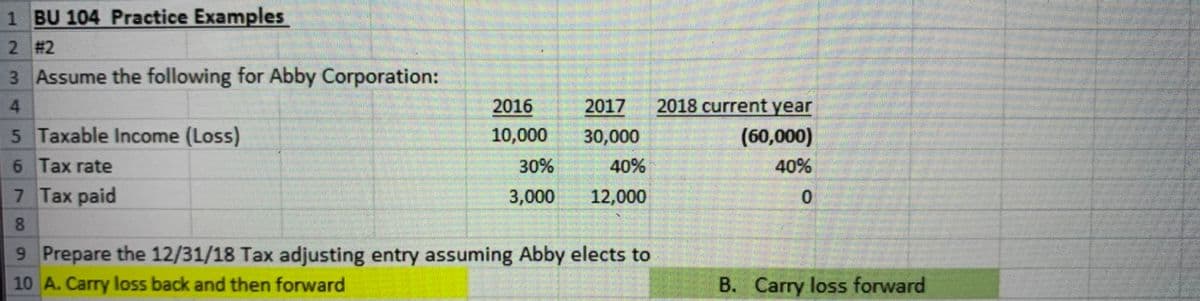

8 9 Prepare the 12/31/18 Tax adjusting entry assuming Abby elects to 10 A. Carry loss back and then forward B. Carry loss forward

Q: Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a…

A: Federal Tax Bracket While calculating federal tax which are used for the method of progressive tax…

Q: The Request for Taxpayer Identification Number and Certification is also known as Form _____.…

A: Since the questions asked are different,As per our guidelines ,we are allowed to answer only first…

Q: Question 6: Total taxes owed, against which total deposits are compared, are reported on which line…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Hello I’m using Cengage chapter 11 What is the social tax deduction on a gross pay of 720 dolars.…

A: The social security tax consists of 2 components i.e. Social Security Program and Medicare. The…

Q: 13. How much is the current tax income tax expense for 2003? (b) P22,400 (a) P23,030 (c) P19,460 (d)…

A: As per our protocol we provide solution to the one question only and you have asked to answer two…

Q: 1.2.11 Use the 2012 marginal tax rates to compute the tax owed by the following person. Round…

A: Given information is: A married couple jointly filing return with a taxable income of $296,000 and…

Q: PSc 3-5 Calculate Federal Income Tax Withholding Using Two Methods (Pre-2020 Form W-4) For each…

A: Solution Tax is the means by which a government or taxing authority imposes or levies a tax on its…

Q: 12. Manny's adjusted gross income on his federal tax return was $45,231. He claimed a standard…

A: In the given question, Manny's gross income on his federal tax return = $45,231 Standard Deduction…

Q: Table 7.13. 2014 single taxpayer tax calculation [R180] Taxable income more than less than Тах $0…

A: An individual's or a corporation's effective tax rate is the percentage of their income that they…

Q: A taxpayer made available the following financial information: Gross sales - Php 10,000,000…

A: OSD is now applied at forty percent (40%) of net sales without deducting cost of sales or service…

Q: Q8) The table below shows the 1991 federal tax rates for persons who submit as "Marxied filing…

A:

Q: Question 7: FUTA tax must be remitted if the total FUTA tax owed exceeds $300 as of the end of the…

A: FUTA Tax refers to tax charged under Federal Unemployment Tax Act. The rate of tax for the year 2022…

Q: Question 20: Identify the incorrect statement regarding EFTPS. Answer: А. It's a free, online…

A: Answer 20:- Option C is incorrect. Explanation:- When the payment is done using this system must be…

Q: E19.5 (LO 1, 2) (Two Temporary Differences, One Rate, Beginning Deferred Taxes) The following facts…

A: given (Two Temporary Differences, One Rate, Beginning Deferred Taxes) The following facts relate…

Q: Question 14: The original Social Security tax rate was of taxable earnings. Answer: A. 10% O 1% с.…

A: Retirement Planning: Retirement planning alludes to monetary techniques of saving, ventures, and, at…

Q: What is Thad's qualified business income deduction?

A: Compute the applicable percentage.

Q: hich of the following disclosures is required for a change from LIFO to FIFO? Question 52 options:…

A: Solution: The disclosure required for a change from LIFO to FIFO are "The cumulative effect on prior…

Q: 34. PENALTY ON UNPAID INCOME TAX On January 5, Helen Terry made an income tax pay- ment that was due…

A: Total delays in days=112 (September 15 to January 15)Interest rate=11%Unpaid amount=$2100

Q: Schedule Z-If your filing status is Head of household If your taxable income is: The tax is: of the…

A: Here, y = mx + b means Where y = Total tax payable m = income taxable x = percentge of tax b = fixed…

Q: 15Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1,…

A: The tax rate for domestic corporation under CREATE law is 25%, if income of the corporation is more…

Q: QUESTION 14 If you are in the highest tax bracket. your tax rate on long-term capital gains is O a.…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 14,650 $ 14,650 $ 55,900…

A: In question it is not specified that in which capacity reba is filling the return. The expert use…

Q: The class is Income Tax Accounting. I can't seem to figure out the solution to the following: Chuck,…

A:

Q: Question 6 of 40 The first section of Form 1120 requests O A. income by category O B. the tax…

A: The first section of Form 1120 requests the name of the corporation and the income generated from…

Q: PSb 5-4 Calculate SUTA Tax For each of the following independent circumstances calculate the SUTA…

A: Given, The rate of SUTA tax is 3.4% and taxable earning threshold is $ 8,500 2. Two employees…

Q: 4:34 PMJ-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in…

A: Calculate the amount of tax payable.

Q: Schedule Z-If your filing status is Head of household The tax is: If your taxable income is: of the…

A: Head of households is one of the types of filing status for the persons in the USA. For filing the…

Q: Question no. 01: A. According to the Turkish tax legislation, there are two main types of tax…

A: Mathematical model is representation of mathematical figures, language and concepts. It uses…

Q: Statement 1: the income of the estate distributed to the beneficiary during the year is subject to…

A: Statement I is False: The rate applicable is 6% in Philippines Statement II is also False: Since…

Q: Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a…

A: Federal Taxation Federal taxation which was followed by the progressive taxation system which…

Q: 1. What amount of permanent difference between book income and taxable income existed at year end?…

A: As per our protocol we provide solution to one question only but you have asked multiple questions…

Q: Question 14 What is your average tax rate if you pay taxes of $7134 on taxable income of $57920?…

A: Taxes = $ 7134 Taxable income = $ 57920

Q: Problem 14-65 (b) (LO. 5) For 2020, Lanzo has properly determined that his taxable income is…

A: Tax liability is the obligation for the individual who earns income in a country. Income includes…

Q: 10. A taxpayer filed his income tax return on October 28, 2020. The deadline for the return was…

A: Penalties in the form interest : Effective from January 1, 2018 the interest penalty is 12 % per…

Q: Problem 14-08 (Static) [LO 14-5] Mr. Olaf earned an $89.000 salary, and Mrs. Olaf earned a $40,330…

A: Tax is the amount of expenses that is charged by the government to individuals and organizations on…

Q: 42. REVISED WITHHOLDING TAX TABLE FOR COMPENSATION DAILY 1 2 3 4 5…

A:

Q: Q.1.1 The government announced a change to the tax law which will have a significanteffect on the…

A: As per IAS 10: Adjusting events are events which occurs after the reporting date but before the…

Q: problem 12-3 Joan filed her Individual Inceme tax reteun 4 Months aftr it was due she did not…

A: Failure to pay penalty=Tax amount×0.5%×Number of months=$750×0.5%×5=$18.75

Q: tion above, us Figure 12.4 on page corresponding tax page 397 to determ owe the governmer 1. Who…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Schedule Z-lIf your filing status is Head of household The tax is: If your taxable income is: of the…

A: 5th Row says that if the income is more than $160700 but not more than $204100, the tax payable will…

Q: a. Identify FIVE deduction not allowable for the purpose of ascertaining the income of an individual…

A:

Q: Question No. 2: Ali and Ali enterprise filed the return on June 30th 2019. The entity applies for…

A: Ali and Ali enterprise filed a return on 30.06.2019 Entity applies for special tax year i.e., from…

please help solve

Given information is:

Taxable income:

2016 = $10,000

2017 = $30,000

2018 = (-$60,000)

In the first option, company can carry back the losses and claim the refund of already paid taxes $15,000 (3000 + 12000).

Journal entry is:

| Date | Particulars | Debit ($) | Credit ($) |

| Income tax refund receivable | 15,000 | ||

|

Income tax expense (To record income tax refund receivable) |

15,000 | ||

Step by step

Solved in 3 steps

- LO.2 Oak Corporation has the following general business credit carryovers. If the general business credit generated by activities during 2019 equals 36,000 and the total credit allowed during the current year is 60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige generated taxable income of 1,200,000. What is Beige Corporations tax liability for this period?LO.3, 4, 5 Using the legend provided below, classify each statement under 2019 tax law. a. A foreign tax credit is available. b. The deduction of charitable contributions is subject to percentage limitation(s). c. Excess charitable contributions can be carried forward for five years. d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction. e. Excess capital losses can be carried forward indefinitely. f. Excess capital losses cannot be carried back. g. A net short-term capital gain is subject to the same tax rate as ordinary income. h. The deduction for qualified business income may be available. i. A dividends received deduction is available. j. The like-kind exchange provisions of 1031 are available. k. A taxpayer with a fiscal year of May 1April 30 has a due date for filing a Federal income tax return of July 15. l. Estimated Federal income tax payments may be required.

- Ma3. All final answers, unless otherwise indicated, have been rounded to the nearest $10. Also, assume that each question is independent of any other question. please answer questions using tax rules in effect for the year 2021, but ignoring temporary Covid-10 related changes. 8. During the year, Dan Davis, a single taxpayer, pays $2,200 of interest on a qualified student loan. Assume that Dan has adjusted gross income of $65,000. What student loan interest deduction may Dan claim on his Form 1040 for the year? A. $2,500 B. 2,200 C. 1,100 D. 0 E. None of the above 9. A contribution made to which of the listed entities is not deductible? A. Boy Scouts of America B. Oxford University, England C. Virginia Commonwealth University D. Society for the Prevention of Cruelty to Animals E. All of the above are deductible57. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…59. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…

- Intermediate Accounting ll ch. 16 4. Alvis Corporation reports pretax accounting income of $400,000, but due to a single temporary difference, taxable income is only $250,000. At the beginning of the year, no temporary differences existed. Required: Assuming a tax rate of 25%, what will be Alvis’s net income? What will Alvis report in the balance sheet pertaining to income taxes?[8:50 PM, 2/23/2022] Veron Walker Uwi: Grace Corporation's pretax financial income is $600,000 and taxable income is $550,000 for year 2020.Its beginning deferred tax liability account has a balance of $75,000. Its cumulative temporarydifferences for year-end 2020 is equal to $300,000 and will reverse and result in taxable amounts as follows: Year Taxable Amount2021 $100,0002022 $ 75,0002023 $125,000The tax rate is 30% for all years.[8:50 PM, 2/23/2022] Veron Walker Uwi: Required:(i) Calculate the taxes payable for the year 2020(ii) Calculate the deferred tax liability for the year 2020(iii) Calculate the total tax expense for 2020(iv) Prepare the journal entry to record the tax expense for 2020(v) Prepare the income statement presentation of the tax amounBE19.2 (LO 1) Oxford Corporation began operations in 2020 and reported pretax financial income of $225,000 for the year. Oxford's tax depreciation exceeded its book depreciation by $40,000. Oxford's tax rate for 2020 and years thereafter is 30%. In its December 31, 2020, balance sheet, what amount of deferred tax liability should be reported? BE19.3 (LO 1, 2) Using the information from BE19.2, assume this is the only difference between Oxford's pretax financial income and taxable income. Prepare the journal entry to record the income tax expense, deferred income taxes, and income taxes payable, and show how the deferred tax liability will be classified on the December 31, 2020, balance sheet.

- 4... 4 Sunland Company has the following two temporary differences between its income tax expense and income taxes payable. 2020 2021 2022 Pretax financial income $842,000 $956,000 $914,000 Excess depreciation expense on tax return (28,800 ) (39,300 ) (9,900 ) Excess warranty expense in financial income 20,400 9,500 7,600 Taxable income $833,600 $926,200 $911,700 The income tax rate for all years is 20%. (a) Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 2020…16. Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer made available the following financial information: Gross receipts - Php 10,000,000 Cost of service – Php 6,000,000 Expenses: Depreciation expense – Php 200,000 Miscellaneous expenses – Php 10,000 Office supplies…Intermediate Accounting ll ch 16 7. At the end of 2023, Payne Industries had a deferred tax asset account with a balance of $25 million attributable to a temporary book-tax difference of $100 million in a liability for estimated expenses. At the end of 2024, the temporary difference is $64 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2024 is $180 million and the tax rate is 25%. Required: Prepare the journal entry(s) to record Payne’s income taxes for 2024, assuming it is more likely than not that the deferred tax asset will be realized in full. Prepare the journal entry(s) to record Payne’s income taxes for 2024, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. Required 1 Record 2024 income taxes Transaction General Journal Debit Credit 1 Record…