Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a complete history of income tax brackets and rates from the inception of the income tax in 1913 through 2013, in both dollars current in each year and adjusted for inflation (2012 dollars) a) compute the tax due in 2003 for a single taxpayer with a net taxable income of $30k. what is her effective tax rate? b) suppose the taxpayer received raises each year that kept up with inflation. use an inflation calculator to calculate her net taxable income in 2013.

Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a complete history of income tax brackets and rates from the inception of the income tax in 1913 through 2013, in both dollars current in each year and adjusted for inflation (2012 dollars) a) compute the tax due in 2003 for a single taxpayer with a net taxable income of $30k. what is her effective tax rate? b) suppose the taxpayer received raises each year that kept up with inflation. use an inflation calculator to calculate her net taxable income in 2013.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter17: Other Services Provided By Audit Firms

Section: Chapter Questions

Problem 27MCQ

Related questions

Question

7.8.26 a),b)

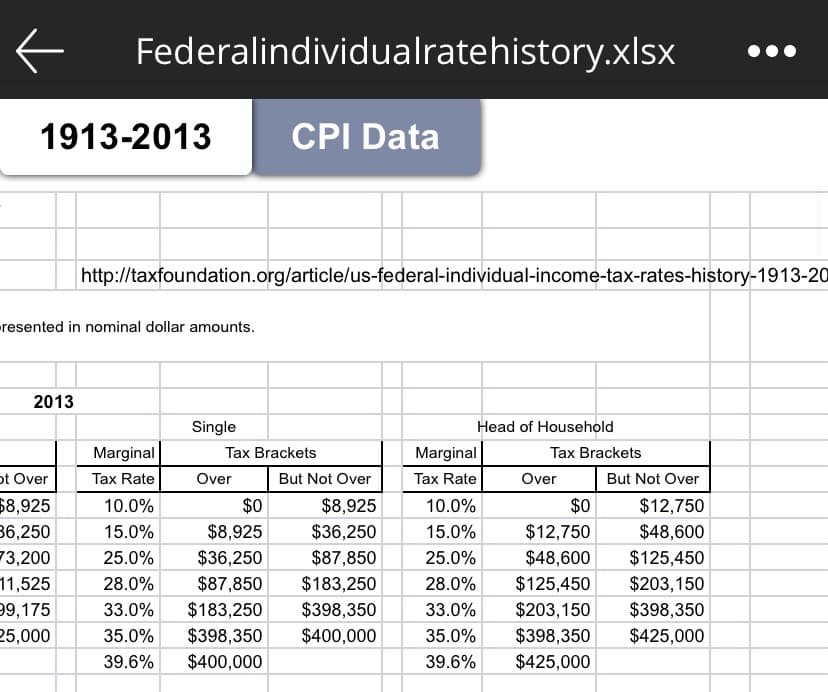

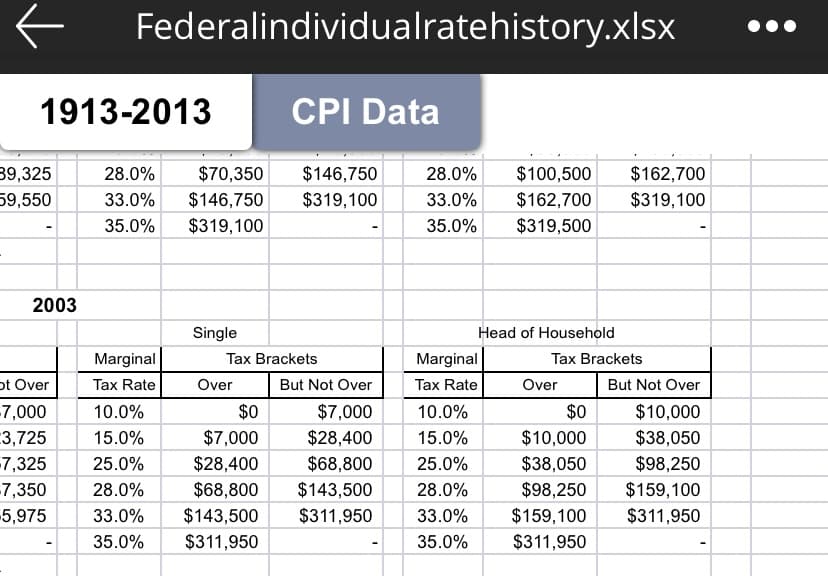

Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a complete history of income tax brackets and rates from the inception of the income tax in 1913 through 2013, in both dollars current in each year and adjusted for inflation (2012 dollars)

a) compute the tax due in 2003 for a single taxpayer with a net taxable income of $30k. what is her effective tax rate?

b) suppose the taxpayer received raises each year that kept up with inflation. use an inflation calculator to calculate her net taxable income in 2013.

Transcribed Image Text:Federalindividualratehistory.xlsx

1913-2013

CPI

CPI Data

http://taxfoundation.org/article/us-federal-individual-income-tax-rates-history-1913-20

resented in nominal dollar amounts.

2013

Single

Head of Household

Marginal

Tax Brackets

Marginal

Tax Brackets

ot Over

Tax Rate

Over

But Not Over

Tax Rate

Over

But Not Over

$8,925

10.0%

$0

$8,925

10.0%

$0

$12,750

36,250

15.0%

$8,925

$36,250

15.0%

$12,750

$48,600

73,200

11,525

99,175

25.0%

$36,250

$87,850

25.0%

$48,600

$125,450

28.0%

$87,850

$183,250

28.0%

$125,450

$203,150

33.0%

$183,250

$398,350

33.0%

$203,150

$398,350

25,000

35.0%

$398,350

$400,000

35.0%

$398,350

$425,000

39.6%

$400,000

39.6%

$425,000

Transcribed Image Text:Federalindividualratehistory.xlsx

1913-2013

CPI Data

39,325

28.0%

$70,350

$146,750

28.0%

$100,500

$162,700

59,550

33.0%

$146,750

$319,100

33.0%

$162,700

$319,100

35.0%

$319,100

35.0%

$319,500

2003

Single

Head of Household

Marginal

Tax Brackets

Marginal

Tax Brackets

ot Over

Tax Rate

Over

But Not Over

Tax Rate

Over

But Not Over

-7,000

3,725

-7,325

-7,350

-5,975

10.0%

$0

$7,000

10.0%

$0

$10,000

15.0%

$7,000

$28,400

15.0%

$10,000

$38,050

25.0%

$28,400

$68,800

25.0%

$38,050

$98,250

28.0%

$68,800

$143,500

28.0%

$98,250

$159,100

33.0%

$143,500

$311,950

33.0%

$159,100

$311,950

35.0%

$311,950

35.0%

$311,950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning