8) Show a monopoly graph and show the area of consumer surplus, producer surplus and deadweight loss. If a lump sum tax was used on the monopoly would the area of consumer surplus, producer surplus or deadweight loss change?

8) Show a monopoly graph and show the area of consumer surplus, producer surplus and deadweight loss. If a lump sum tax was used on the monopoly would the area of consumer surplus, producer surplus or deadweight loss change?

Principles of Economics (MindTap Course List)

8th Edition

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter15: Monopoly

Section: Chapter Questions

Problem 12PA

Related questions

Question

Question 8

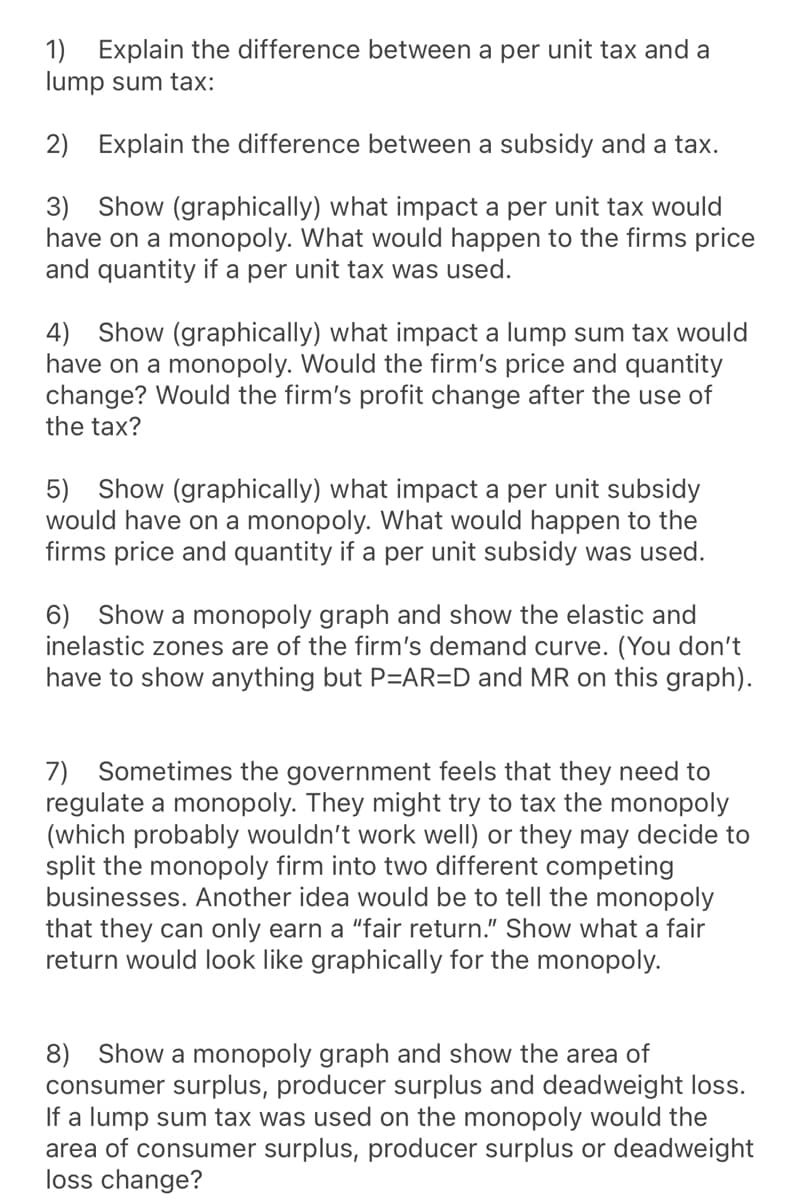

Transcribed Image Text:1) Explain the difference between a per unit tax and a

lump sum tax:

2) Explain the difference between a subsidy and a tax.

3) Show (graphically) what impact a per unit tax would

have on a monopoly. What would happen to the firms price

and quantity if a per unit tax was used.

4) Show (graphically) what impact a lump sum tax would

have on a monopoly. Would the firm's price and quantity

change? Would the firm's profit change after the use of

the tax?

5) Show (graphically) what impact a per unit subsidy

would have on a monopoly. What would happen to the

firms price and quantity if a per unit subsidy was used.

6) Show a monopoly graph and show the elastic and

inelastic zones are of the firm's demand curve. (You don't

have to show anything but P=AR=D and MR on this graph).

7) Sometimes the government feels that they need to

regulate a monopoly. They might try to tax the monopoly

(which probably wouldn't work well) or they may decide to

split the monopoly firm into two different competing

businesses. Another idea would be to tell the monopoly

that they can only earn a "fair return." Show what a fair

return would look like graphically for the monopoly.

8) Show a monopoly graph and show the area of

consumer surplus, producer surplus and deadweight loss.

If a lump sum tax was used on the monopoly would the

area of consumer surplus, producer surplus or deadweight

loss change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc