After preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $30,000. The entry to close the income summary account will be: Multiple Choice Credit Retained earnings $30,000; debit Dividends $30,000. Debit Income Summary $30,000; credit Dividends $30,000. Debit Retained earnings $30,000, credit Income Summary $30,000. Dohit Dvirlande an000 credin Income Summan 30000 < Prev 28 of 30 Next >

After preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $30,000. The entry to close the income summary account will be: Multiple Choice Credit Retained earnings $30,000; debit Dividends $30,000. Debit Income Summary $30,000; credit Dividends $30,000. Debit Retained earnings $30,000, credit Income Summary $30,000. Dohit Dvirlande an000 credin Income Summan 30000 < Prev 28 of 30 Next >

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 7DQ: Write the third closing entry to transfer the net income or net loss to the P. Hernandez, Capital...

Related questions

Question

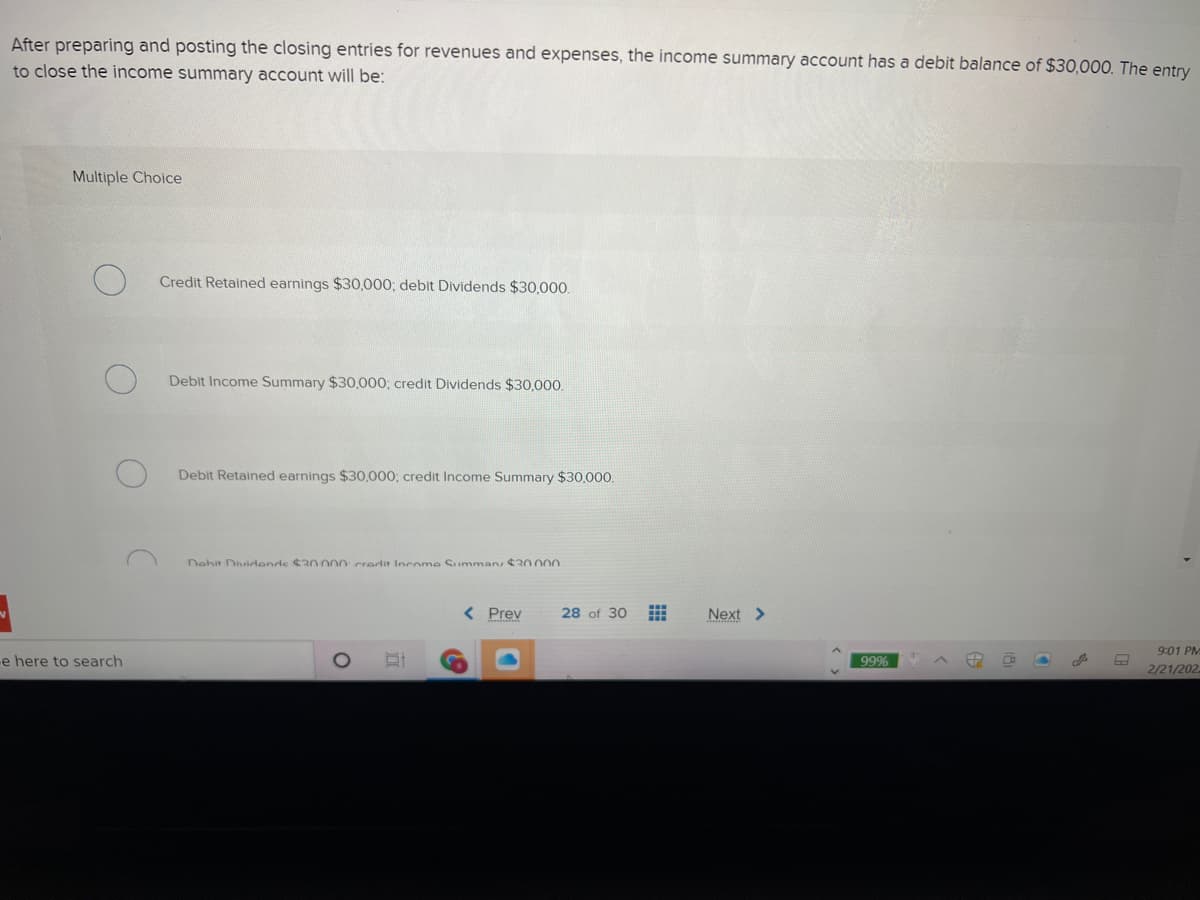

Transcribed Image Text:After preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $30,000. The entry

to close the income summary account will be:

Multiple Choice

Credit Retained earnings $30,000; debit Dividends $30,000.

Debit Income Summary $30,000; credit Dividends $30,000.

Debit Retained earnings $30,000; credit Income Summary $30,000.

Nohit Dividonde €20000 credit Income Summan 3000n

< Prev

28 of 30

Next >

9:01 PM

e here to search

99%

2/21/202

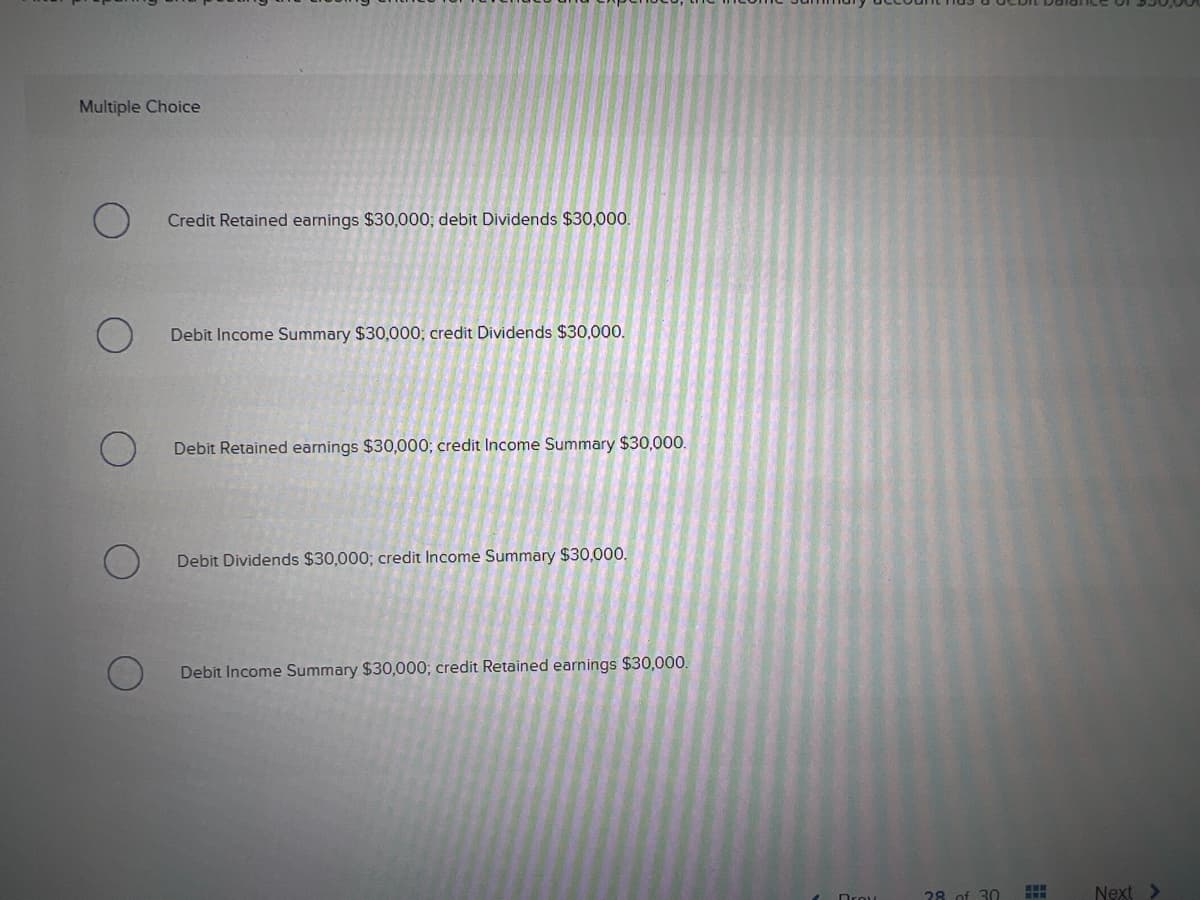

Transcribed Image Text:Multiple Choice

Credit Retained earnings $30,000; debit Dividends $30,000.

Debit Income Summary $30,000; credit Dividends $30,000.

Debit Retained earnings $30,000; credit Income Summary $30,000.

Debit Dividends $30,000; credit Income Summary $30,000.

Debit Income Summary $30,000; credit Retained earnings $30,000.

28. of 30

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage