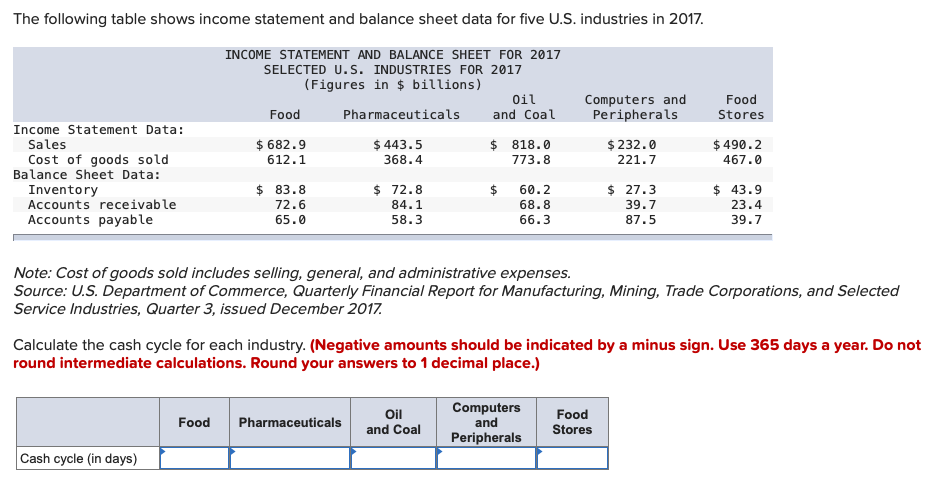

The following table shows income statement and balance sheet data for five U.S. industries in 2017. INCOME STATEMENT AND BALANCE SHEET FOR 2017 SELECTED U.S. INDUSTRIES FOR 2017 (Figures in $ billions) Oil and Coal Computers and Peripherals Food Food Pharmaceuticals Stores Income Statement Data: $ 682.9 $ 443.5 $ 232.0 221.7 $ 490.2 467.0 Sales $ 818.0 Cost of goods sold Balance Sheet Data: 612.1 368.4 773.8 Inventory Accounts receivable Accounts payable $ 83.8 72.6 $ 72.8 84.1 $ 27.3 39.7 $ 43.9 23.4 60.2 68.8 65.0 58.3 66.3 87.5 39.7 Note: Cost of goods sold includes selling, general, and administrative expenses. Source: U.S. Department of Commerce, Quarterly Financial Report for Manufacturing, Mining, Trade Corporations, and Selected Service Industries, Quarter 3, issued December 2017. Calculate the cash cycle for each industry. (Negative amounts should be indicated by a minus sign. Use 365 days a year. Do not round intermediate calculations. Round your answers to 1 decimal place.) Computers and Peripherals Food Stores Oil Food Pharmaceuticals and Coal Cash cycle (in days)

The following table shows income statement and balance sheet data for five U.S. industries in 2017. INCOME STATEMENT AND BALANCE SHEET FOR 2017 SELECTED U.S. INDUSTRIES FOR 2017 (Figures in $ billions) Oil and Coal Computers and Peripherals Food Food Pharmaceuticals Stores Income Statement Data: $ 682.9 $ 443.5 $ 232.0 221.7 $ 490.2 467.0 Sales $ 818.0 Cost of goods sold Balance Sheet Data: 612.1 368.4 773.8 Inventory Accounts receivable Accounts payable $ 83.8 72.6 $ 72.8 84.1 $ 27.3 39.7 $ 43.9 23.4 60.2 68.8 65.0 58.3 66.3 87.5 39.7 Note: Cost of goods sold includes selling, general, and administrative expenses. Source: U.S. Department of Commerce, Quarterly Financial Report for Manufacturing, Mining, Trade Corporations, and Selected Service Industries, Quarter 3, issued December 2017. Calculate the cash cycle for each industry. (Negative amounts should be indicated by a minus sign. Use 365 days a year. Do not round intermediate calculations. Round your answers to 1 decimal place.) Computers and Peripherals Food Stores Oil Food Pharmaceuticals and Coal Cash cycle (in days)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

Transcribed Image Text:The following table shows income statement and balance sheet data for five U.S. industries in 2017.

INCOME STATEMENT AND BALANCE SHEET FOR 2017

SELECTED U.S. INDUSTRIES FOR 2017

(Figures in $ billions)

Oil

and Coal

Computers and

Peripherals

Food

Food

Pharmaceuticals

Stores

Income Statement Data:

$ 682.9

$ 443.5

$ 232.0

221.7

$ 490.2

467.0

Sales

$ 818.0

Cost of goods sold

Balance Sheet Data:

612.1

368.4

773.8

Inventory

Accounts receivable

Accounts payable

$ 83.8

72.6

$ 72.8

84.1

$ 27.3

39.7

87.5

$ 43.9

23.4

39.7

60.2

68.8

65.0

58.3

66.3

Note: Cost of goods sold includes selling, general, and administrative expenses.

Source: U.S. Department of Commerce, Quarterly Financial Report for Manufacturing, Mining, Trade Corporations, and Selected

Service Industries, Quarter 3, issued December 2017.

Calculate the cash cycle for each industry. (Negative amounts should be indicated by a minus sign. Use 365 days a year. Do not

round intermediate calculations. Round your answers to 1 decimal place.)

Computers

and

Oil

Food

Food

Pharmaceuticals

and Coal

Stores

Peripherals

Cash cycle (in days)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT