8. Suppose that: r= required reserve ratio = 0.10 c= (C/D} = currency ratio = 0.25 e = {ER/D} = excess reserve ratio = 0.05 MB = the monetary base = $1,000 billion Given that the formula for the money multiplier is 1+e find the value for M, the money supply. r+.+e The money supply is $. billion. Use the money multiplier to find the new value for the money supply if open market operations increase the monetary base by $200 billion. The money supply is now $ billion. 9a. Lare intended to change the level of reserves and the monetary ba. A. Open market purchases B. Dynamic open market operations c. Open marketsales D. Defensive open market operations 9b. monetary base. are intended to offset movements in other factors that affect reserves and the A. Open market purchases B. Defensive open market operations c. Open marketsales D. Dynamic open market operations 9c. Because most open market operations are typically repurchase agreements, it is likely that the volume of defensive open market operations is (1)_ the volume of dynamic open market operations. (1) less than greater than

8. Suppose that: r= required reserve ratio = 0.10 c= (C/D} = currency ratio = 0.25 e = {ER/D} = excess reserve ratio = 0.05 MB = the monetary base = $1,000 billion Given that the formula for the money multiplier is 1+e find the value for M, the money supply. r+.+e The money supply is $. billion. Use the money multiplier to find the new value for the money supply if open market operations increase the monetary base by $200 billion. The money supply is now $ billion. 9a. Lare intended to change the level of reserves and the monetary ba. A. Open market purchases B. Dynamic open market operations c. Open marketsales D. Defensive open market operations 9b. monetary base. are intended to offset movements in other factors that affect reserves and the A. Open market purchases B. Defensive open market operations c. Open marketsales D. Dynamic open market operations 9c. Because most open market operations are typically repurchase agreements, it is likely that the volume of defensive open market operations is (1)_ the volume of dynamic open market operations. (1) less than greater than

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 18CQ

Related questions

Question

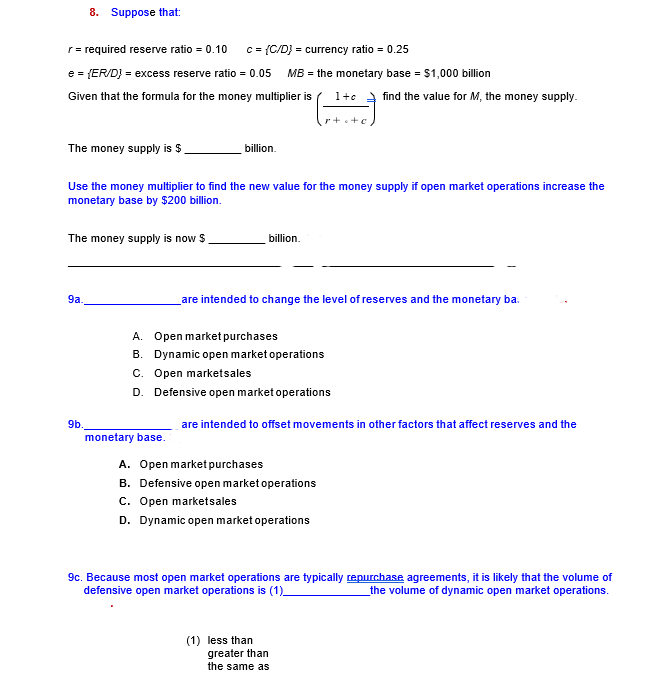

Transcribed Image Text:8. Suppose that:

r= required reserve ratio = 0.10

c = {C/D} = currency ratio = 0.25

e = (ER/D} = excess reserve ratio = 0.05

MB = the monetary base = $1,000 billion

Given that the formula for the money multiplier is

1+c

find the value for M, the money supply.

r+.+c

The money supply is $.

billion.

Use the money multiplier to find the new value for the money supply if open market operations increase the

monetary base by $200 billion.

The money supply is now $

billion.

9a.

are intended to change the level of reserves and the monetary ba.

A. Open market purchases

B. Dynamic open market operations

C. Open marketsales

D. Defensive open market operations

9b.

are intended to offset movements in other factors that affect reserves and the

monetary base.

A. Open market purchases

B. Defensive open market operations

c. Open marketsales

D. Dynamic open market operations

9c. Because most open market operations are typically repurchase agreements, it is likely that the volume of

defensive open market operations is (1)_

_the volume of dynamic open market operations.

(1) less than

greater than

the same as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning