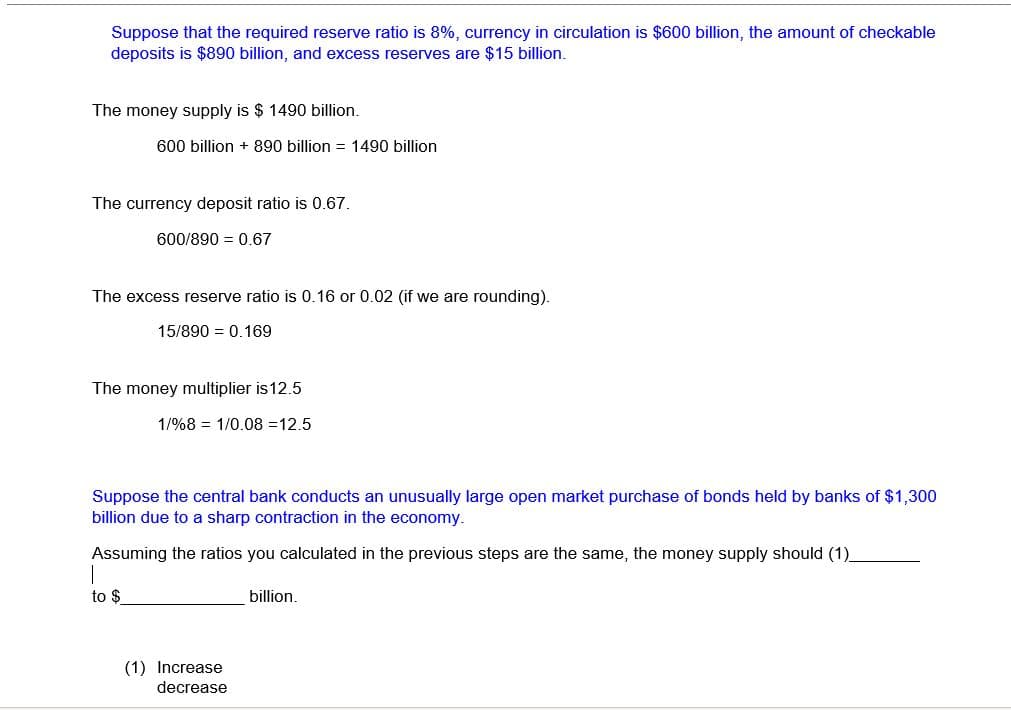

Suppose that the required reserve ratio is 8%, currency in circulation is $600 billion, the amount of checkable deposits is $890 billion, and excess reserves are $15 billion. The money supply is $ 1490 billion. 600 billion + 890 billion = 1490 billion The currency deposit ratio is 0.67. 600/890 = 0.67 The excess reserve ratio is 0.16 or 0.02 (if we are rounding). 15/890 = 0.169 The money multiplier is12.5 1/%8 = 1/0.08 =12.5 Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,300 billion due to a sharp contraction in the economy. Assuming the ratios you calculated in the previous steps are the same, the money supply should (1)_ to $ billion. (1) Increase decrease

Suppose that the required reserve ratio is 8%, currency in circulation is $600 billion, the amount of checkable deposits is $890 billion, and excess reserves are $15 billion. The money supply is $ 1490 billion. 600 billion + 890 billion = 1490 billion The currency deposit ratio is 0.67. 600/890 = 0.67 The excess reserve ratio is 0.16 or 0.02 (if we are rounding). 15/890 = 0.169 The money multiplier is12.5 1/%8 = 1/0.08 =12.5 Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,300 billion due to a sharp contraction in the economy. Assuming the ratios you calculated in the previous steps are the same, the money supply should (1)_ to $ billion. (1) Increase decrease

Chapter15: Money Creation

Section: Chapter Questions

Problem 15SQ

Related questions

Question

100%

Transcribed Image Text:Suppose that the required reserve ratio is 8%, currency in circulation is $600 billion, the amount of checkable

deposits is $890 billion, and excess reserves are $15 billion.

The money supply is $ 1490 billion.

600 billion + 890 billion = 1490 billion

The currency deposit ratio is 0.67.

600/890 = 0.67

The excess reserve ratio is 0.16 or 0.02 (if we are rounding).

15/890 = 0.169

The money multiplier is12.5

1/%8 = 1/0.08 =12.5

Suppose the central bank conducts an unusually large open market purchase of bonds held by banks of $1,300

billion due to a sharp contraction in the economy.

Assuming the ratios you calculated in the previous steps are the same, the money supply should (1).

to $

billion.

(1) Increase

decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning