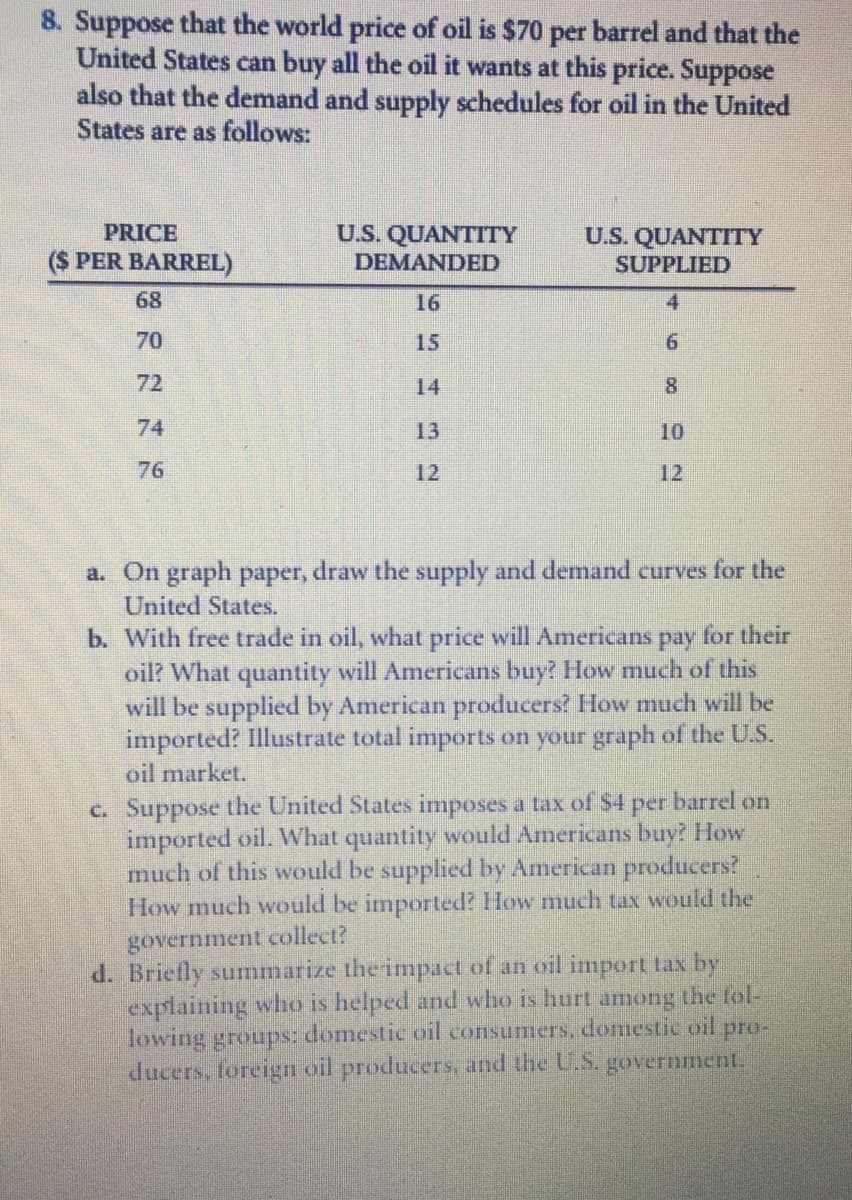

8. Suppose that the world price of oil is $70 per barrel and that the United States can buy all the oil it wants at this price. Suppose also that the demand and supply schedules for oil in the United States are as follows: PRICE U.S. QUANTITY DEMANDED U.S. QUANTITY PER BARREL) SUPPLIED 68 16 4 70 15 6. 72 14 74 13 10 76 12 12 a. On graph paper, draw the supply and demand curves for the United States. b. With free trade in oil, what price will Americans pay for their oil? What quantity will Americans buy? How much of this will be supplied by American producers? How much will be imported? Illustrate total imports on your graph of the U.S. oil market. c. Suppose the United States imposes a tax of $4 per barrel on imported oil. What quantity would Americans buy? How much of this would be supplied by American producers? How much would be imported? How much tax would the government collect? d. Briefly summarize therimpact of an oil import tax by explaining who is helped and who is hurt among the fol- lowing groups: domestic oil consumers, domestic oil ducers, foreign oil producers, and the U.S. government. pro-

8. Suppose that the world price of oil is $70 per barrel and that the United States can buy all the oil it wants at this price. Suppose also that the demand and supply schedules for oil in the United States are as follows: PRICE U.S. QUANTITY DEMANDED U.S. QUANTITY PER BARREL) SUPPLIED 68 16 4 70 15 6. 72 14 74 13 10 76 12 12 a. On graph paper, draw the supply and demand curves for the United States. b. With free trade in oil, what price will Americans pay for their oil? What quantity will Americans buy? How much of this will be supplied by American producers? How much will be imported? Illustrate total imports on your graph of the U.S. oil market. c. Suppose the United States imposes a tax of $4 per barrel on imported oil. What quantity would Americans buy? How much of this would be supplied by American producers? How much would be imported? How much tax would the government collect? d. Briefly summarize therimpact of an oil import tax by explaining who is helped and who is hurt among the fol- lowing groups: domestic oil consumers, domestic oil ducers, foreign oil producers, and the U.S. government. pro-

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter21: International Trade And Comparative Advantage

Section: Chapter Questions

Problem 2TY

Related questions

Question

100%

Transcribed Image Text:8. Suppose that the world price of oil is $70 per barrel and that the

United States can buy all the oil it wants at this price. Suppose

also that the demand and supply schedules for oil in the United

States are as follows:

PRICE

U.S. QUANTITTY

U.S. QUANTITY

(S PER BARREL)

DEMANDED

SUPPLIED

68

16

4

70

15

9.

72

14

74

13

10

76

12

12

a. On graph paper, draw the supply and demand curves for the

United States.

b. With free trade in oil, what price will Americans

oil? What quantity will Americans buy? How much of this

will be supplied by American producers? How much will be

imported? Illustrate total imports on your graph of the U.S.

oil market.

pay

for their

c. Suppose the United States imposes a tax of $4 per barrel on

imported oil. What quantity would Americans buy? How

much of this would be supplied by American producers?

How much would be imported? How much tax would the

government collect?

d. Briefly summarize therimpact of an oil import tax by

explaining who is helped and who is hurt among the fol-

lowing groups: domestic oil consumers, domestic oil pro-

ducers, foreign oil producers, and the U.S. government.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax