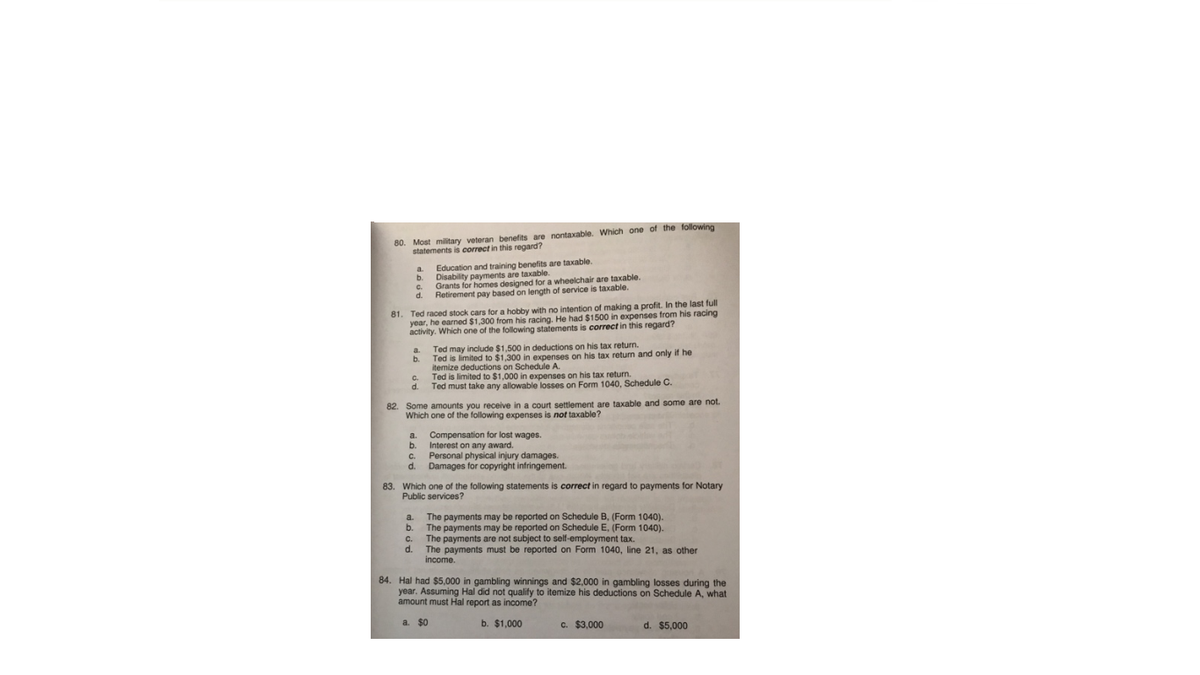

80. Most military veteran benefits are nontaxable. Which one of the following statements is correct in this regard? Education and training benefits are taxable. b. Disability payments are taxable. Grants for homes designed for a wheelchair are taxable. Retirement pay based on length of service is taxable. 81. Ted raced stock cars for a hobby with no intention of making a profit. In the last full year, he earned $1,300 from his racing. He had $1500 in expenses from his racing activity. Which one of the following statements is correct in this regard? Ted may include $1,500 in deductions on his tax return. Ted is limited to $1,300 in expenses on his tax return and only if he b. mize deductions on Schedule A. ite Ted is limited to $1,000 in expenses on his tax return. d. Ted must take any allowable losses on Form 1040, Schedule C. Some amounts you receive in a court settlement are taxable and some are not. Which one of the following expenses is not taxable? a. Compensation for lost wages. b. Interest on any award. C. Personal physical injury damages. d. Damages for copyright infringement. 83. Which one of the following statements is correct in regard to payments for Notary Public services? a. The payments may be reported on Schedule B, (Form 1040). b. The payments may be reported on Schedule E, (Form 1040). c. The payments are not subject to self-employment tax. d. The payments must be reported on Form 1040, line 21, as other income. 84. Hal had $5,000 in gambling winnings and $2,000 in gambling losses during the year. Assuming Hal did not qualify to itemize his deductions on Schedule A, what amount must Hal report as income? a. $0 b. $1,000 c. $3,000 d. $5,000

80. Most military veteran benefits are nontaxable. Which one of the following statements is correct in this regard? Education and training benefits are taxable. b. Disability payments are taxable. Grants for homes designed for a wheelchair are taxable. Retirement pay based on length of service is taxable. 81. Ted raced stock cars for a hobby with no intention of making a profit. In the last full year, he earned $1,300 from his racing. He had $1500 in expenses from his racing activity. Which one of the following statements is correct in this regard? Ted may include $1,500 in deductions on his tax return. Ted is limited to $1,300 in expenses on his tax return and only if he b. mize deductions on Schedule A. ite Ted is limited to $1,000 in expenses on his tax return. d. Ted must take any allowable losses on Form 1040, Schedule C. Some amounts you receive in a court settlement are taxable and some are not. Which one of the following expenses is not taxable? a. Compensation for lost wages. b. Interest on any award. C. Personal physical injury damages. d. Damages for copyright infringement. 83. Which one of the following statements is correct in regard to payments for Notary Public services? a. The payments may be reported on Schedule B, (Form 1040). b. The payments may be reported on Schedule E, (Form 1040). c. The payments are not subject to self-employment tax. d. The payments must be reported on Form 1040, line 21, as other income. 84. Hal had $5,000 in gambling winnings and $2,000 in gambling losses during the year. Assuming Hal did not qualify to itemize his deductions on Schedule A, what amount must Hal report as income? a. $0 b. $1,000 c. $3,000 d. $5,000

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter1: Ten Principles Of Economics

Section: Chapter Questions

Problem 6PA

Related questions

Question

Find the attached file.

Transcribed Image Text:80. Most military veteran benefits are nontaxable. Which one of the following

statements is correct in this

regard?

Education and training benefits are taxable.

b.

Disability payments are taxable.

Grants for homes designed for a wheelchair are taxable.

Retirement pay based on length of service is taxable.

81. Ted raced stock cars for a hobby with no intention of making a profit. In the last full

year, he earned $1,300 from his racing. He had $1500 in expenses from his racing

activity. Which one of the following statements is correct in this regard?

Ted may include $1,500 in deductions on his tax return.

Ted is limited to $1,300 in expenses on his tax return and only if he

b.

mize deductions on Schedule A.

ite

Ted is limited to $1,000 in expenses on his tax return.

d.

Ted must take any allowable losses on Form 1040, Schedule C.

Some amounts you receive in a court settlement are taxable and some are not.

Which one of the following expenses is not taxable?

a.

Compensation for lost wages.

b.

Interest on any award.

C.

Personal physical injury damages.

d. Damages for copyright infringement.

83. Which one of the following statements is correct in regard to payments for Notary

Public services?

a.

The payments may be reported on Schedule B, (Form 1040).

b.

The payments may be reported on Schedule E, (Form 1040).

c.

The payments are not subject to self-employment tax.

d.

The payments must be reported on Form 1040, line 21, as other

income.

84. Hal had $5,000 in gambling winnings and $2,000 in gambling losses during the

year. Assuming Hal did not qualify to itemize his deductions on Schedule A, what

amount must Hal report as income?

a. $0

b. $1,000

c. $3,000

d. $5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax