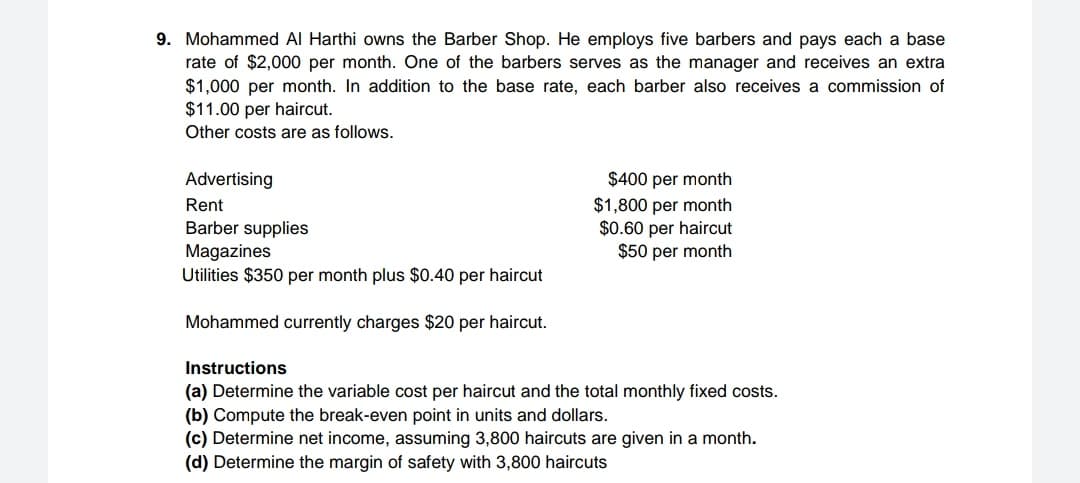

9. Mohammed AI Harthi owns the Barber Shop. He employs five barbers and pays each a base rate of $2,000 per month. One of the barbers serves as the manager and receives an extra $1,000 per month. In addition to the base rate, each barber also receives a commission of $11.00 per haircut. Other costs are as follows. Advertising $400 per month $1,800 per month $0.60 per haircut $50 per month Rent Barber supplies Magazines Utilities $350 per month plus $0.40 per haircut Mohammed currently charges $20 per haircut. Instructions (a) Determine the variable cost per haircut and the total monthly fixed costs. (b) Compute the break-even point in units and dollars. (c) Determine net income, assuming 3,800 haircuts are given in a month. (d) Determine the margin of safety with 3,800 haircuts

9. Mohammed AI Harthi owns the Barber Shop. He employs five barbers and pays each a base rate of $2,000 per month. One of the barbers serves as the manager and receives an extra $1,000 per month. In addition to the base rate, each barber also receives a commission of $11.00 per haircut. Other costs are as follows. Advertising $400 per month $1,800 per month $0.60 per haircut $50 per month Rent Barber supplies Magazines Utilities $350 per month plus $0.40 per haircut Mohammed currently charges $20 per haircut. Instructions (a) Determine the variable cost per haircut and the total monthly fixed costs. (b) Compute the break-even point in units and dollars. (c) Determine net income, assuming 3,800 haircuts are given in a month. (d) Determine the margin of safety with 3,800 haircuts

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter3: Accounting For Labor

Section: Chapter Questions

Problem 4E: Peggy Nolan earns 20 per hour for up to 300 units of production per day. If she produces more than...

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Answer

Transcribed Image Text:9. Mohammed Al Harthi owns the Barber Shop. He employs five barbers and pays each a base

rate of $2,000 per month. One of the barbers serves as the manager and receives an extra

$1,000 per month. In addition to the base rate, each barber also receives a commission of

$11.00 per haircut.

Other costs are as follows.

$400 per month

$1,800 per month

$0.60 per haircut

$50 per month

Advertising

Rent

Barber supplies

Magazines

Utilities $350 per month plus $0.40 per haircut

Mohammed currently charges $20 per haircut.

Instructions

(a) Determine the variable cost per haircut and the total monthly fixed costs.

(b) Compute the break-even point in units and dollars.

(c) Determine net income, assuming 3,800 haircuts are given in a month.

(d) Determine the margin of safety with 3,800 haircuts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College