(a) Apply the moving average (MA) model with a three-day lag (q = 3) and a five-day lag (q =5) to forecast Apple Inc.'s stock price in the following three trading days (i.e., its stock price on November 19, 20 and 21). (Hint: calculate the stock price on November 19 first, and then use the estimated stock price of November 19 to forecast the stock price on November 20.) (ROUND TO ONE DECIMAL)

(a) Apply the moving average (MA) model with a three-day lag (q = 3) and a five-day lag (q =5) to forecast Apple Inc.'s stock price in the following three trading days (i.e., its stock price on November 19, 20 and 21). (Hint: calculate the stock price on November 19 first, and then use the estimated stock price of November 19 to forecast the stock price on November 20.) (ROUND TO ONE DECIMAL)

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter7: Nonlinear Optimization Models

Section7.6: Models For Rating Sports Teams

Problem 28P

Related questions

Question

Both correlate to the problem in the 1st photo

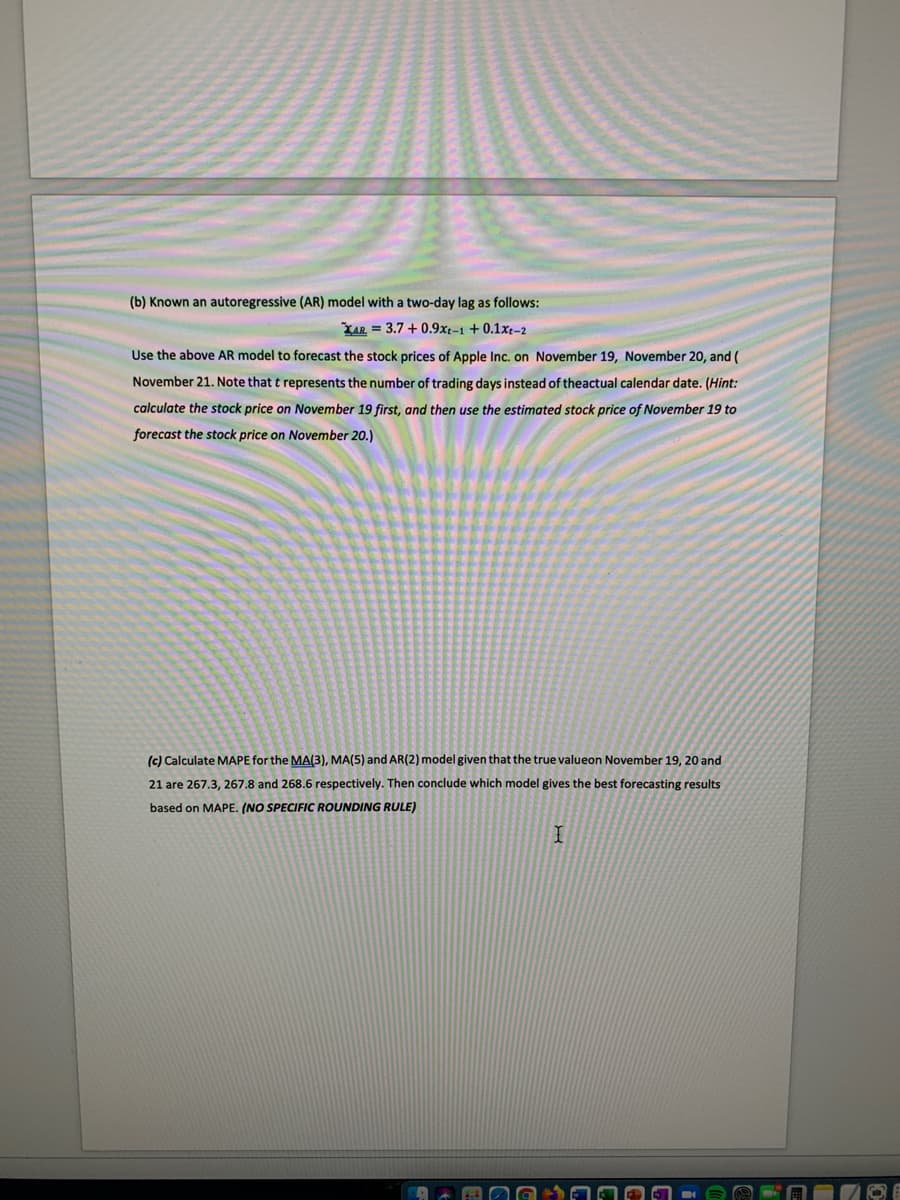

Transcribed Image Text:(b) Known an autoregressive (AR) model with a two-day lag as follows:

XAR = 3.7 + 0.9xt-1 +0.1xt-2

Use the above AR model to forecast the stock prices of Apple Inc. on November 19, November 20, and (

November 21. Note that t represents the number of trading days instead of theactual calendar date. (Hint:

calculate the stock price on November 19 first, and then use the estimated stock price of November 19 to

forecast the stock price on November 20.)

(c) Calculate MAPE for the MA(3), MA(5) and AR(2) model given that the true valueon November 19, 20 and

21 are 267.3, 267.8 and 268.6 respectively. Then conclude which model gives the best forecasting results

based on MAPE. (NO SPECIFIC ROUNDING RULE)

Transcribed Image Text:A Problem Set 3-edited – Saved to my Mac

Review

View

O Tell me

处T

AaBbCcD

AaBbCcDdE AABE

AaBbCcDdEe

AaBbCcDdEe

AaBbCcDdEe

AaBbCcDdEe

AaBbCcDdEe

List Paragraph

Heading 1

Heading 2

Ti

Normal

Body Text

No Spacing

Table Paragr..

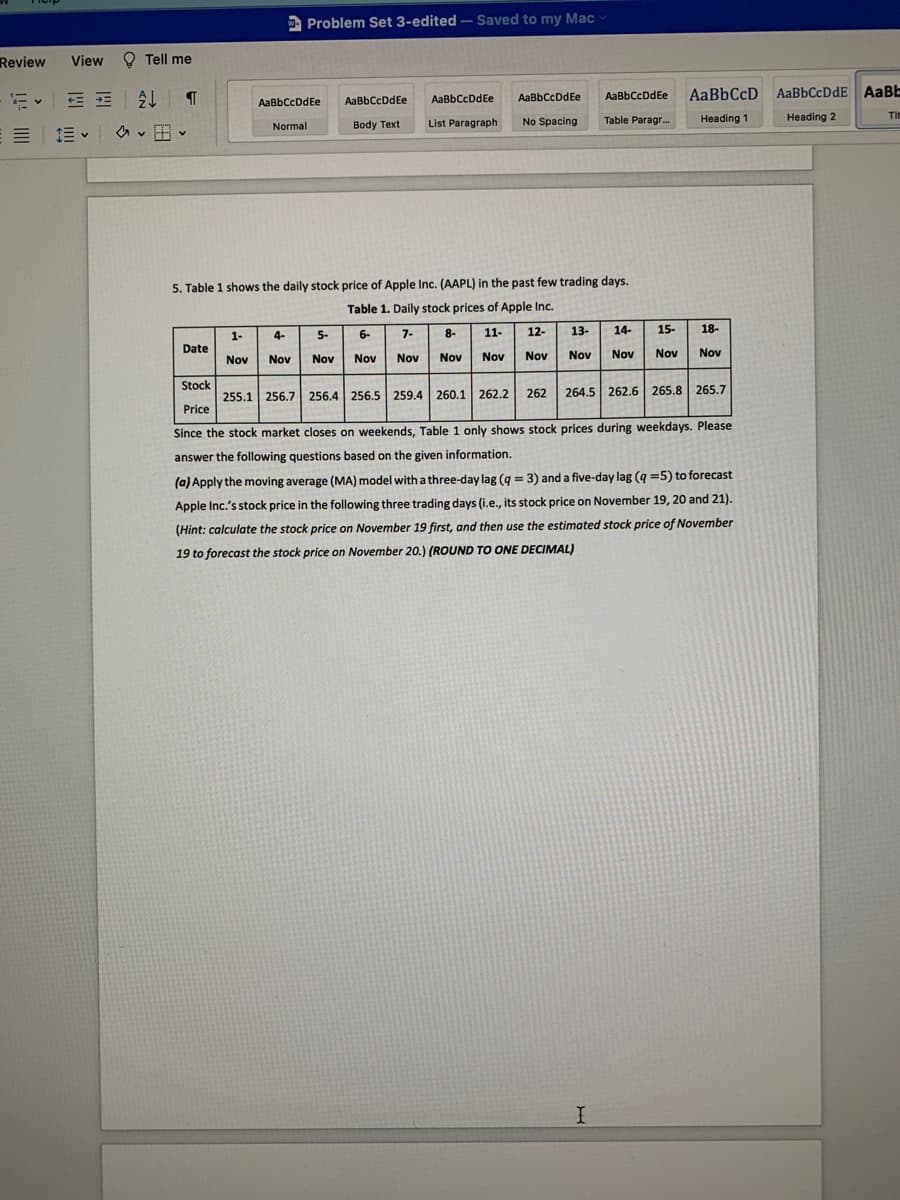

5. Table 1 shows the daily stock price of Apple Inc. (AAPL) in the past few trading days.

Table 1. Daily stock prices of Apple Ic.

1-

4-

5-

6-

7-

8-

11-

12-

13-

14-

15-

18-

Date

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Nov

Stock

255.1 256.7 256.4 256.5 259.4 260.1 262.2

262

264.5 262.6 265.8 265.7

Price

Since the stock market closes on weekends, Table 1 only shows stock prices during weekdays. Please

answer the following questions based on the given information.

(a) Apply the moving average (MA) model with a three-day lag (g = 3) and a five-day lag (q =5) to forecast

%3D

Apple Inc.'s stock price in the following three trading days (i.e., its stock price on November 19, 20 and 21).

(Hint: calculate the stock price on November 19 first, and then use the estimated stock price of November

19 to forecast the stock price on November 20.) (ROUND TO ONE DECIMAL)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,