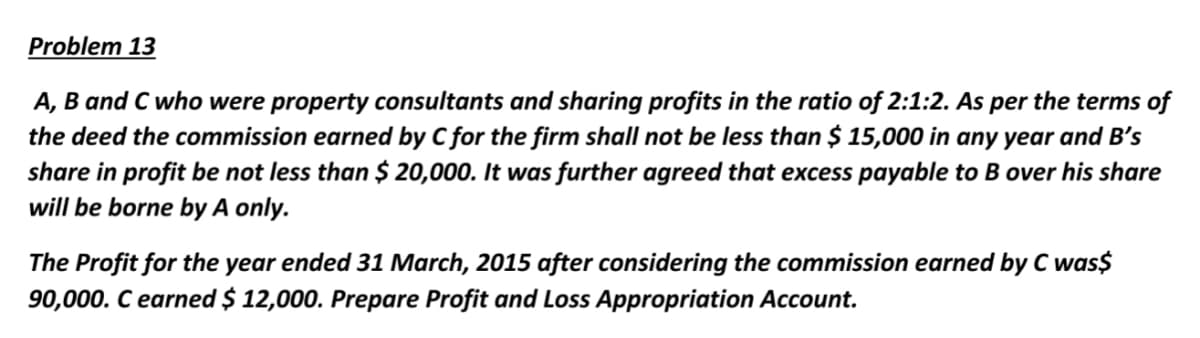

A, B and C who were property consultants and sharing profits in the ratio of 2:1:2. As per the terms of the deed the commission earned by C for the firm shall not be less than $ 15,000 in any year and B's share in profit be not less than $ 20,000. It was further agreed that excess payable to B over his share will be borne by A only. The Profit for the year ended 31 March, 2015 after considering the commission earned by C was$ 90,000. C earned $ 12,000. Prepare Profit and Loss Appropriation Account.

A, B and C who were property consultants and sharing profits in the ratio of 2:1:2. As per the terms of the deed the commission earned by C for the firm shall not be less than $ 15,000 in any year and B's share in profit be not less than $ 20,000. It was further agreed that excess payable to B over his share will be borne by A only. The Profit for the year ended 31 March, 2015 after considering the commission earned by C was$ 90,000. C earned $ 12,000. Prepare Profit and Loss Appropriation Account.

Chapter4: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 41P

Related questions

Question

Transcribed Image Text:Problem 13

A, B and C who were property consultants and sharing profits in the ratio of 2:1:2. As per the terms of

the deed the commission earned by C for the firm shall not be less than $ 15,000 in any year and B's

share in profit be not less than $ 20,000. It was further agreed that excess payable to B over his share

will be borne by A only.

The Profit for the year ended 31 March, 2015 after considering the commission earned by C was$

90,000. C earned $ 12,000. Prepare Profit and Loss Appropriation Account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,