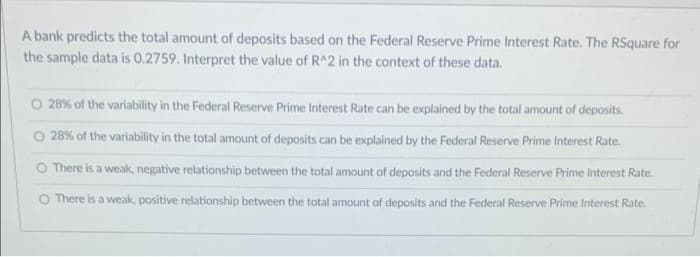

A bank predicts the total amount of deposits based on the Federal Reserve Prime Interest Rate. The RSquare for the sample data is O.2759. Interpret the value of R^2 in the context of these data. O 28% of the variability in the Federal Reserve Prime Interest Rate can be explained by the total amount of deposits. 28% of the variability in the total amount of deposits can be explained by the Federal Reserve Prime Interest Rate. O There is a weak, negative relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate. O There is a weak, positive relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate.

A bank predicts the total amount of deposits based on the Federal Reserve Prime Interest Rate. The RSquare for the sample data is O.2759. Interpret the value of R^2 in the context of these data. O 28% of the variability in the Federal Reserve Prime Interest Rate can be explained by the total amount of deposits. 28% of the variability in the total amount of deposits can be explained by the Federal Reserve Prime Interest Rate. O There is a weak, negative relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate. O There is a weak, positive relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 5E: A firm experienced the demand shown in the following table. *Unkown future value to be forecast Fill...

Related questions

Question

100%

Transcribed Image Text:A bank predicts the total amount of deposits based on the Federal Reserve Prime Interest Rate. The RSquare for

the sample data is O.2759. Interpret the value of R^2 in the context of these data.

O 28% of the variability in the Federal Reserve Prime Interest Rate can be explained by the total amount of deposits.

O 28% of the variability in the total amount of deposits can be explained by the Federal Reserve Prime Interest Rate.

O There is a weak, negative relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate.

O There is a weak, positive relationship between the total amount of deposits and the Federal Reserve Prime Interest Rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning