A business donated rent-free office space to the organization that would normally rent for $35,200 a year. A fund drive raised $186,000 in cash and $102,000 in pledges that will be paid within one year. A state government grant of $152,000 was received for program operating costs related to public health education. Salaries and fringe benefits paid during the year amounted to $208,760. At year-end, an additional $16,200 of salaries and fringe benefits were accrued. A donor pledged $102,000 for construction of a new

A business donated rent-free office space to the organization that would normally rent for $35,200 a year. A fund drive raised $186,000 in cash and $102,000 in pledges that will be paid within one year. A state government grant of $152,000 was received for program operating costs related to public health education. Salaries and fringe benefits paid during the year amounted to $208,760. At year-end, an additional $16,200 of salaries and fringe benefits were accrued. A donor pledged $102,000 for construction of a new

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

- A business donated rent-free office space to the organization that would normally rent for $35,200 a year.

- A fund drive raised $186,000 in cash and $102,000 in pledges that will be paid within one year. A state government grant of $152,000 was received for program operating costs related to public health education.

- Salaries and

fringe benefits paid during the year amounted to $208,760. At year-end, an additional $16,200 of salaries and fringe benefits were accrued. - A donor pledged $102,000 for construction of a new building, payable over five fiscal years, commencing in 2022. The discounted value of the pledge is expected to be $94,460.

- Office equipment was purchased for $12,200. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $9,800 was donated by a local office supply company. The furniture has an estimated useful life of 10 years. Furniture and equipment are considered net assets without donor restrictions by INVOLVE.

- Telephone expense for the year was $5,400, printing and postage expense was $12,200 for the year, utilities for the year were $8,500 and supplies expense was $4,500 for the year. At year-end, an immaterial amount of supplies remained on hand and the balance in accounts payable was $3,800.

- Volunteers contributed $15,200 of time to help with answering the phones, mailing materials, and various other clerical activities.

- It is estimated that 90 percent of the pledges made for the 2021 year will be collected.

Depreciation expense is recorded for the full year on the assets recorded in item 5. - All expenses were allocated to program services and support services in the following percentages: public health education, 35 percent; community service, 30 percent; management and general, 20 percent; and fund-raising, 15 percent.

- Net assets were released to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes.

- All nominal accounts were closed to the appropriate net asset accounts.

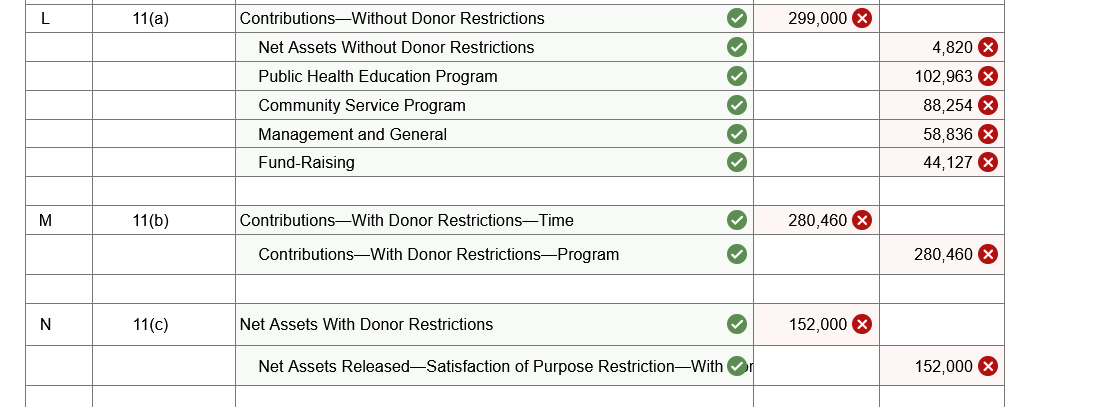

Transcribed Image Text:L

11(a)

Contributions-Without Donor Restrictions

299,000 X

Net Assets Without Donor Restrictions

4,820 X

102,963 X

88,254 X

Public Health Education Program

Community Service Program

Management and General

58,836 X

Fund-Raising

44,127 X

M

11(b)

Contributions-With Donor Restrictions-Time

280,460 X

Contributions-With Donor Restrictions-Program

280,460 X

N

11(c)

Net Assets With Donor Restrictions

152,000 8

Net Assets Released-Satisfaction of Purpose Restriction-With

152,000 X

O0 00 0 o

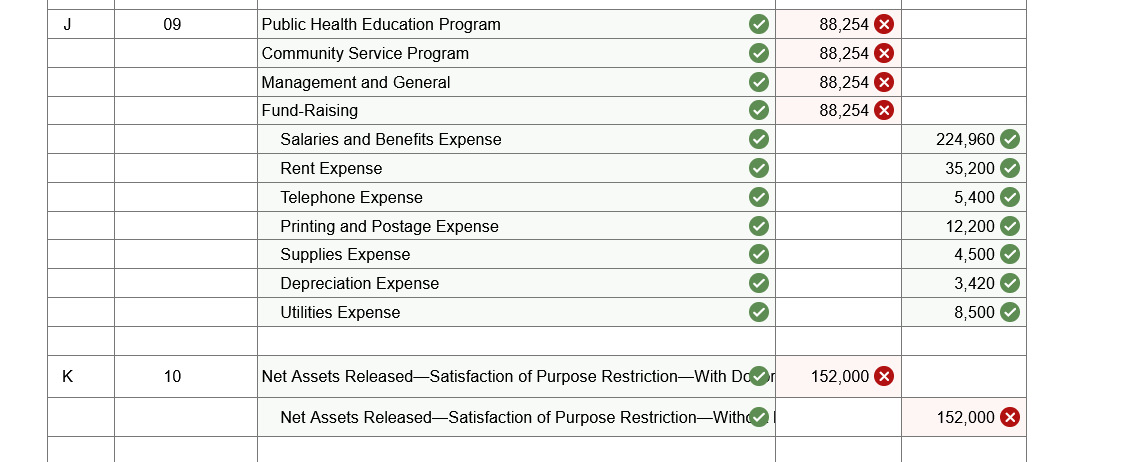

Transcribed Image Text:J

09

Public Health Education Program

88,254 X

Community Service Program

88,254 X

88,254 X

88,254 X

Management and General

Fund-Raising

Salaries and Benefits Expense

224,960 O

Rent Expense

35,200

Telephone Expense

5,400 O

12,200 O

4,500 O

Printing and Postage Expense

Supplies Expense

Depreciation Expense

3,420 O

Utilities Expense

8,500

K

10

Net Assets Released-Satisfaction of Purpose Restriction-With Dd

152,000 X

Net Assets Released-Satisfaction of Purpose Restriction-With

152,000 X

O0000 0000OO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you