a) Classily each cost element as either fixed, variable, or mixed b) Calculate: ) the variable production cost per unit and the total fixed production overhead. i) The total variable cost per unit and the total fixed costs Hint: Use the high-low method to separate mixed costs into their fixed and variable components. c) Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and dearly showing contribution and net income.

a) Classily each cost element as either fixed, variable, or mixed b) Calculate: ) the variable production cost per unit and the total fixed production overhead. i) The total variable cost per unit and the total fixed costs Hint: Use the high-low method to separate mixed costs into their fixed and variable components. c) Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and dearly showing contribution and net income.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 6PA: Gent Designs requires three units of part A for every unit of Al that it produces. Currently, part A...

Related questions

Question

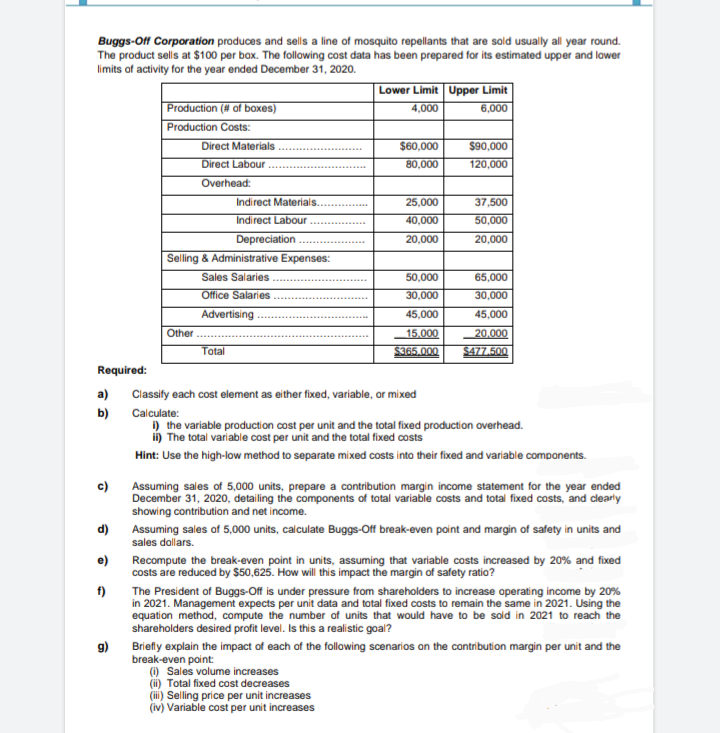

Transcribed Image Text:Buggs-Off Corporation produces and sells a line of mosquito repellants that are sold usually all year round.

The product sells at $100 per box. The following cost data has been prepared for its estimated upper and lower

limits of activity for the year ended December 31, 2020.

Lower Limit Upper Limit

6,000

Production (# af boxes)

Production Costs:

4,000

Direct Materials

$60,000

$90,000

Direct Labour

80,000

120,000

Overhead:

Indirect Materials..

25,000

37,500

Indirect Labour

40,000

50,000

Depreciation

20,000

20,000

Selling & Administrative Expenses:

Sales Salaries

50,000

65,000

Office Salaries

30,000

30,000

Advertising

45,000

45,000

Other

15.000

20,000

Total

$365.000

S477.500

Required:

a)

Classify each cost element as either fixed, variable, or mixed

b)

Calculate:

) the variable production cost per unit and the total fixed production overhead.

ii) The total variable cost per unit and the total fixed costs

Hint: Use the high-low method to separate mixed costs into their fixed and variable components.

c)

Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended

December 31, 2020, detailing the components of tatal variable costs and total fixed costs, and clearly

showing contribution and net income.

d) Assuming sales of 5,000 units, calculate Buggs-Off break-even point and margin of safety in units and

sales dollars.

e)

Recompute the break-even point in units, assuming that variable costs increased by 20% and fixed

costs are reduced by $50,625. How will this impact the margin of safety ratio?

The President of Buggs-Off is under pressure from shareholders to increase operating income by 20%

in 2021. Management expects per unit data and total fixed costs to remain the same in 2021. Using the

equation method, compute the number of units that would have to be sold in 2021 to reach the

shareholders desired profit level. Is this a realistic goal?

g)

Briefly explain the impact of each of the following scenarios on the contribution margin per unit and the

break-even point:

(i) Sales volume increases

(ii) Total fixed cost decreases

(i) Selling price per unit increases

(iv) Variable cost per unit increases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning