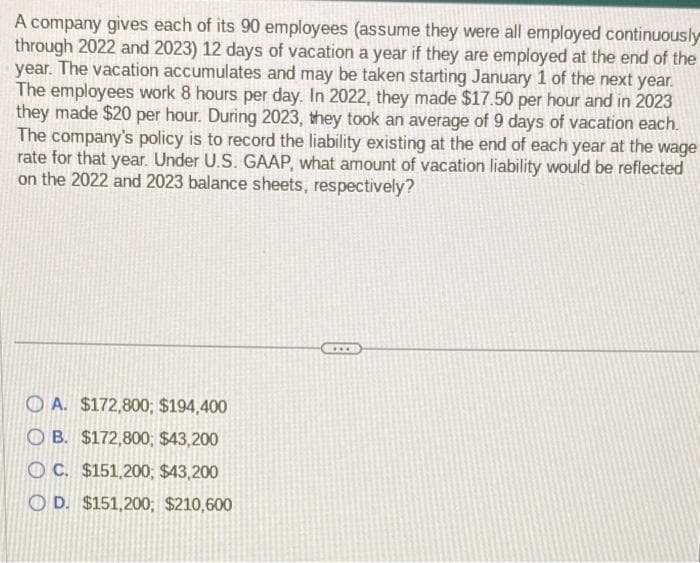

A company gives each of its 90 employees (assume they were all employed continuously through 2022 and 2023) 12 days of vacation a year if they are employed at the end of the year. The vacation accumulates and may be taken starting January 1 of the next year. The employees work 8 hours per day. In 2022, they made $17.50 per hour and in 2023 they made $20 per hour. During 2023, they took an average of 9 days of vacation each. The company's policy is to record the liability existing at the end of each year at the wage rate for that year. Under U.S. GAAP, what amount of vacation liability would be reflected on the 2022 and 2023 balance sheets, respectively? OA. $172,800; $194,400 OB. $172,800; $43,200 OC. $151,200, $43,200 OD. $151,200, $210,600

A company gives each of its 90 employees (assume they were all employed continuously through 2022 and 2023) 12 days of vacation a year if they are employed at the end of the year. The vacation accumulates and may be taken starting January 1 of the next year. The employees work 8 hours per day. In 2022, they made $17.50 per hour and in 2023 they made $20 per hour. During 2023, they took an average of 9 days of vacation each. The company's policy is to record the liability existing at the end of each year at the wage rate for that year. Under U.S. GAAP, what amount of vacation liability would be reflected on the 2022 and 2023 balance sheets, respectively? OA. $172,800; $194,400 OB. $172,800; $43,200 OC. $151,200, $43,200 OD. $151,200, $210,600

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 6MC

Related questions

Question

Transcribed Image Text:A company gives each of its 90 employees (assume they were all employed continuously

through 2022 and 2023) 12 days of vacation a year if they are employed at the end of the

year. The vacation accumulates and may be taken starting January 1 of the next year.

The employees work 8 hours per day. In 2022, they made $17.50 per hour and in 2023

they made $20 per hour. During 2023, they took an average of 9 days of vacation each.

The company's policy is to record the liability existing at the end of each year at the wage

rate for that year. Under U.S. GAAP, what amount of vacation liability would be reflected

on the 2022 and 2023 balance sheets, respectively?

A. $172,800; $194,400

OB. $172,800; $43,200

OC. $151,200, $43,200

OD. $151,200, $210,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT