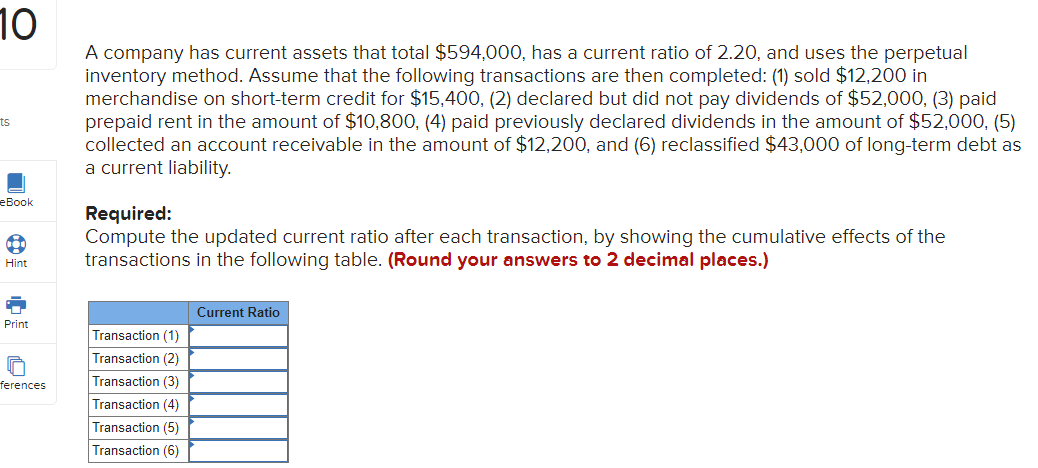

A company has current assets that total $594,000, has a current ratio of 2.20, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,200 in merchandise on short-term credit for $15,400, (2) declared but did not pay dividends of $52,000, (3) paid prepaid rent in the amount of $10,800, (4) paid previously declared dividends in the amount of $52,000, (5) collected an account receivable in the amount of $12,200, and (6) reclassified $43,000 of long-term debt as a current liability. Required: Compute the updated current ratio after each transaction, by showing the cumulative effects of the transactions in the following table. (Round your answers to 2 decimal places.) Current Ratio Transaction (1) Transaction (2) Transaction (3) Transaction (4) Transaction (5) Transaction (6)

A company has current assets that total $594,000, has a current ratio of 2.20, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,200 in merchandise on short-term credit for $15,400, (2) declared but did not pay dividends of $52,000, (3) paid prepaid rent in the amount of $10,800, (4) paid previously declared dividends in the amount of $52,000, (5) collected an account receivable in the amount of $12,200, and (6) reclassified $43,000 of long-term debt as a current liability. Required: Compute the updated current ratio after each transaction, by showing the cumulative effects of the transactions in the following table. (Round your answers to 2 decimal places.) Current Ratio Transaction (1) Transaction (2) Transaction (3) Transaction (4) Transaction (5) Transaction (6)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 25BEB

Related questions

Question

100%

Transcribed Image Text:10

A company has current assets that total $594,000, has a current ratio of 2.20, and uses the perpetual

inventory method. Assume that the following transactions are then completed: (1) sold $12,200 in

merchandise on short-term credit for $15,400, (2) declared but did not pay dividends of $52,000, (3) paid

prepaid rent in the amount of $10,800, (4) paid previously declared dividends in the amount of $52,000, (5)

collected an account receivable in the amount of $12,200, and (6) reclassified $43,000 of long-term debt as

a current liability.

ts

еВook

Required:

Compute the updated current ratio after each transaction, by showing the cumulative effects of the

transactions in the following table. (Round your answers to 2 decimal places.)

Hint

Current Ratio

Print

Transaction (1)

Transaction (2)

ferences

Transaction (3)

Transaction (4)

Transaction (5)

Transaction (6)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning