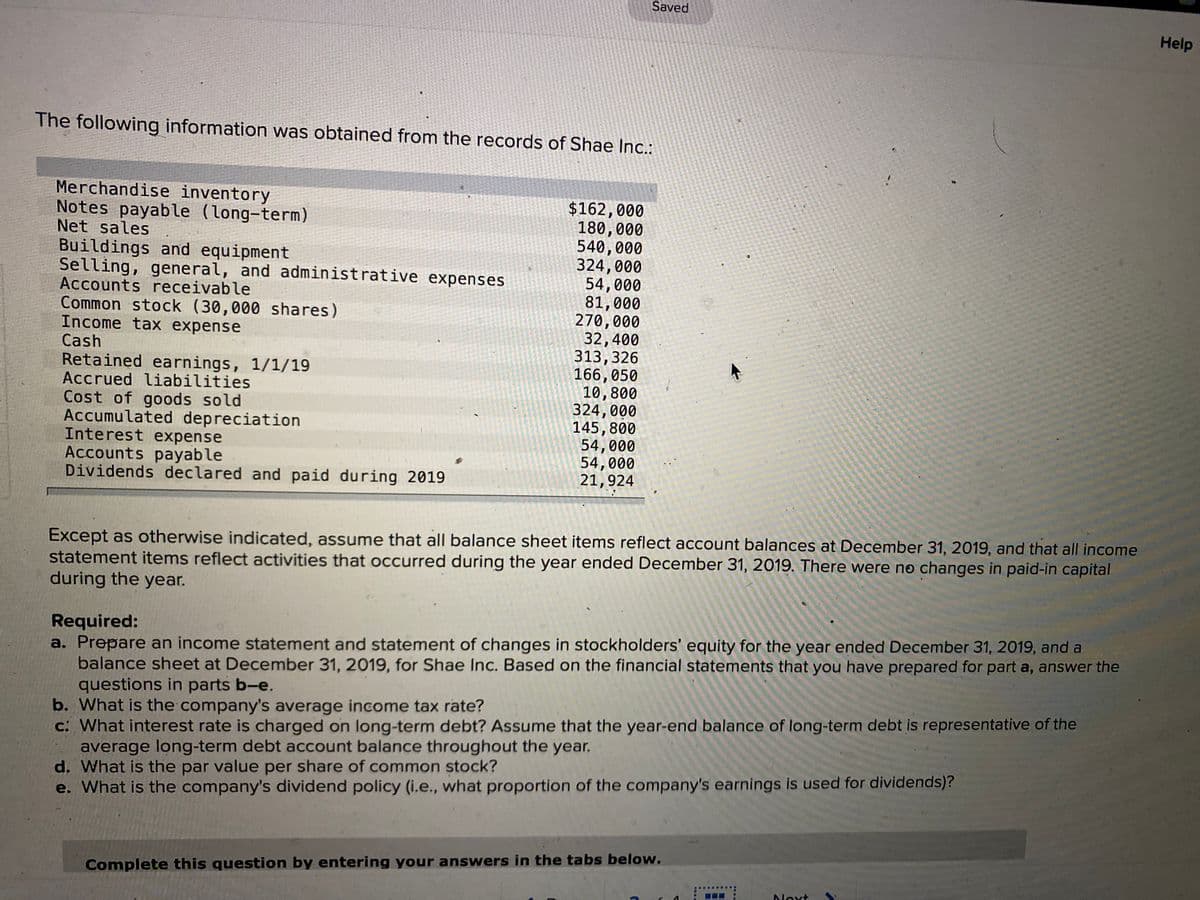

The following information was obtained from the records of Shae Inc.: Merchandise inventory Notes payable (long-term) Net sales Buildings and equipment Selling, general, and administrative expenses Accounts receivable Common stock (30,000 shares) Income tax expense Cash Retained earnings, 1/1/19 Accrued liabilities Cost of goods sold Accumulated depreciation Interest expense Accounts payable Dividends declared and paid during 2019 $162,000 180,000 540,000 324,000 54,000 81,000 270,000 32,400 313,326 166, 050 10,800 324,000 145,800 54,000 54,000 21,924 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c: What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

The following information was obtained from the records of Shae Inc.: Merchandise inventory Notes payable (long-term) Net sales Buildings and equipment Selling, general, and administrative expenses Accounts receivable Common stock (30,000 shares) Income tax expense Cash Retained earnings, 1/1/19 Accrued liabilities Cost of goods sold Accumulated depreciation Interest expense Accounts payable Dividends declared and paid during 2019 $162,000 180,000 540,000 324,000 54,000 81,000 270,000 32,400 313,326 166, 050 10,800 324,000 145,800 54,000 54,000 21,924 Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital during the year. Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c: What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

Hello, I need help

Transcribed Image Text:Saved

Help

The following information was obtained from the records of Shae Inc.:

Merchandise inventory

Notes payable (long-term)

Net sales

$162,000

180,000

540,000

324,000

54,000

81,000

270,000

32,400

313,326

166,050

10,800

324,000

145,800

54,000

54,000

21,924

Buildings and equipment

Selling, general, and administrative expenses

Accounts receivable

Common stock (30,000 shares)

Income tax expense

Cash

Retained earnings, 1/1/19

Accrued liabilities

Cost of goods sold

Accumulated depreciation

Interest expense

Accounts payable

Dividends declared and paid during 2019

Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2019, and that all income

statement items reflect activities that occurred during the year ended December 31, 2019. There were no changes in paid-in capital

during the year.

Required:

a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a

balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the

questions in parts b-e.

b. What is the company's average income tax rate?

c: What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the

average long-term debt account balance throughout the year.

d. What is the par value per share of common stock?

e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Complete this question by entering your answers in the tabs below.

Next

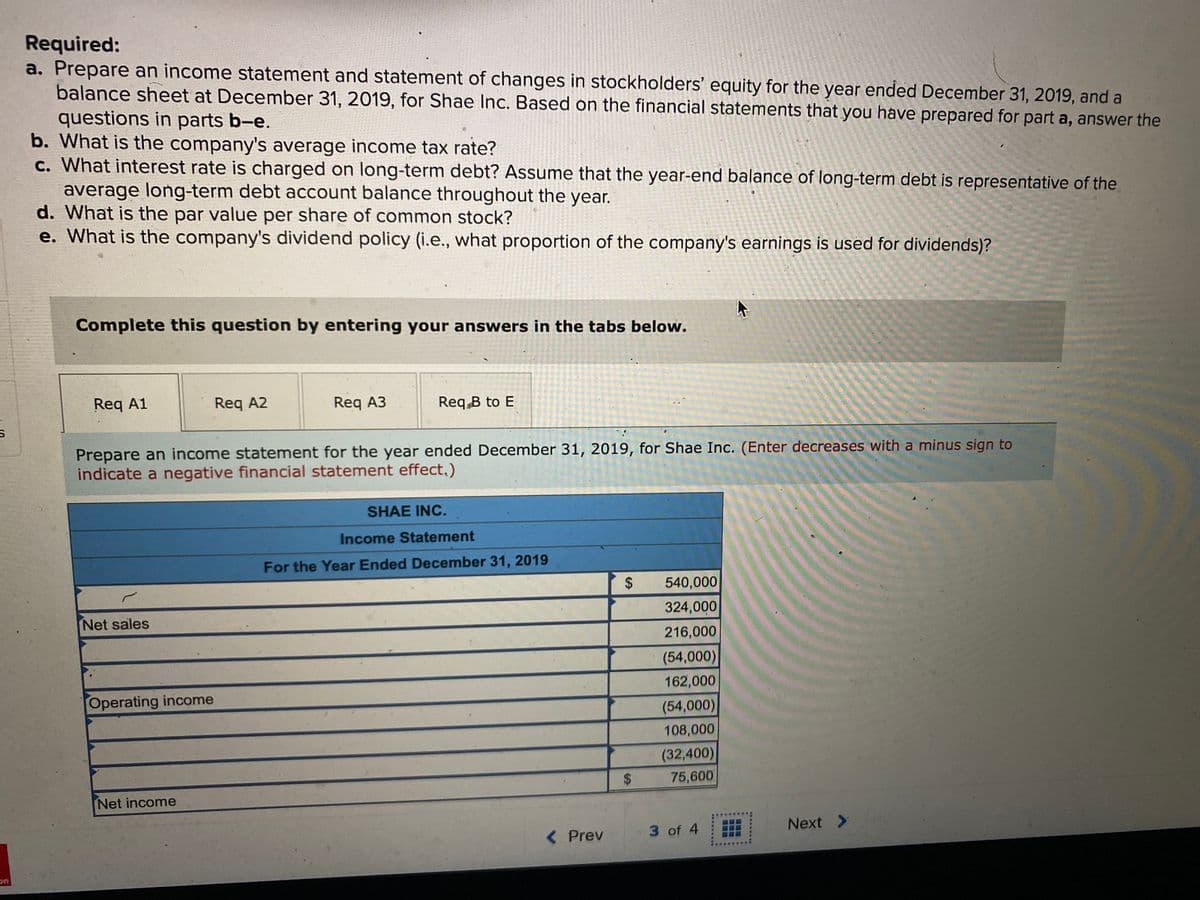

Transcribed Image Text:Required:

a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2019, and a

balance sheet at December 31, 2019, for Shae Inc. Based on the financial statements that you have prepared for part a, answer the

questions in parts b-e.

b. What is the company's average income tax rate?

c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the

average long-term debt account balance throughout the year.

d. What is the par value per share of common stock?

e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Req A3

Req B to E

Prepare an income statement for the year ended December 31, 2019, for Shae Inc. (Enter decreases with a minus sign to

indicate a negative financial statement effect,)

SHAE INC.

Income Statement

For the Year Ended December 31, 2019

540,000

Net sales

324,000

216,000

(54,000)

162,000

Operating income

(54,000)

108,000

(32,400)

75,600

$

Net income

3 of 4

Next >

< Prev

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,