(a) Compute the arithmetic mean of the annual rate of return for each stock. Which stock is preferable by this measure? (b) Compute the geometric mean of the annual rate of return for each stock. Which stock is preferable by this measure? (c) Compute the standard deviation of the annual rate of return for each stock. Which stock is preferable by this measure?

(a) Compute the arithmetic mean of the annual rate of return for each stock. Which stock is preferable by this measure? (b) Compute the geometric mean of the annual rate of return for each stock. Which stock is preferable by this measure? (c) Compute the standard deviation of the annual rate of return for each stock. Which stock is preferable by this measure?

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Note: Please answer this question only by typing your answers in the typing space available for this question

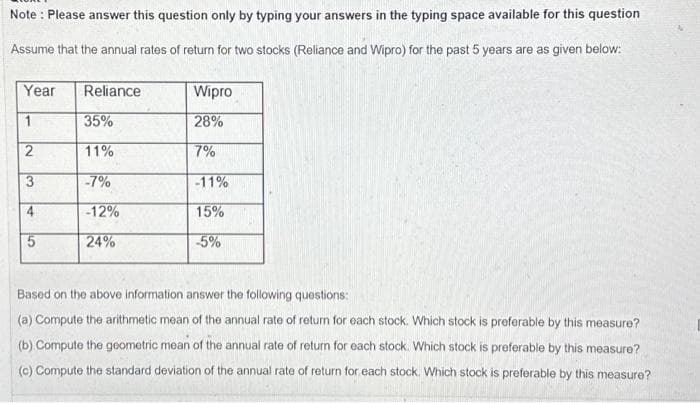

Assume that the annual rates of return for two stocks (Reliance and Wipro) for the past 5 years are as given below:

Year

2

3

4

5

Reliance

35%

11%

-7%

-12%

24%

Wipro

28%

7%

-11%

15%

-5%

Based on the above information answer the following questions:

(a) Compute the arithmetic mean of the annual rate of return for each stock. Which stock is preferable by this measure?

(b) Compute the geometric mean of the annual rate of return for each stock. Which stock is preferable by this measure?

(c) Compute the standard deviation of the annual rate of return for each stock. Which stock is preferable by this measure?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning