(a) Compute the best response functions of each company. Then compute the Nash equilibrium in quantities. The Nash equilibrium in quantities is also called the Cournot equilibrium. Note that in this case the payoffs are given by the profit functions rather than by the levels of utility. (b) Plot the best response functions and the Nash equilibrium. (c) Show that the Nash equilibrium is stable.

(a) Compute the best response functions of each company. Then compute the Nash equilibrium in quantities. The Nash equilibrium in quantities is also called the Cournot equilibrium. Note that in this case the payoffs are given by the profit functions rather than by the levels of utility. (b) Plot the best response functions and the Nash equilibrium. (c) Show that the Nash equilibrium is stable.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

part J K L M

Transcribed Image Text:Exercise

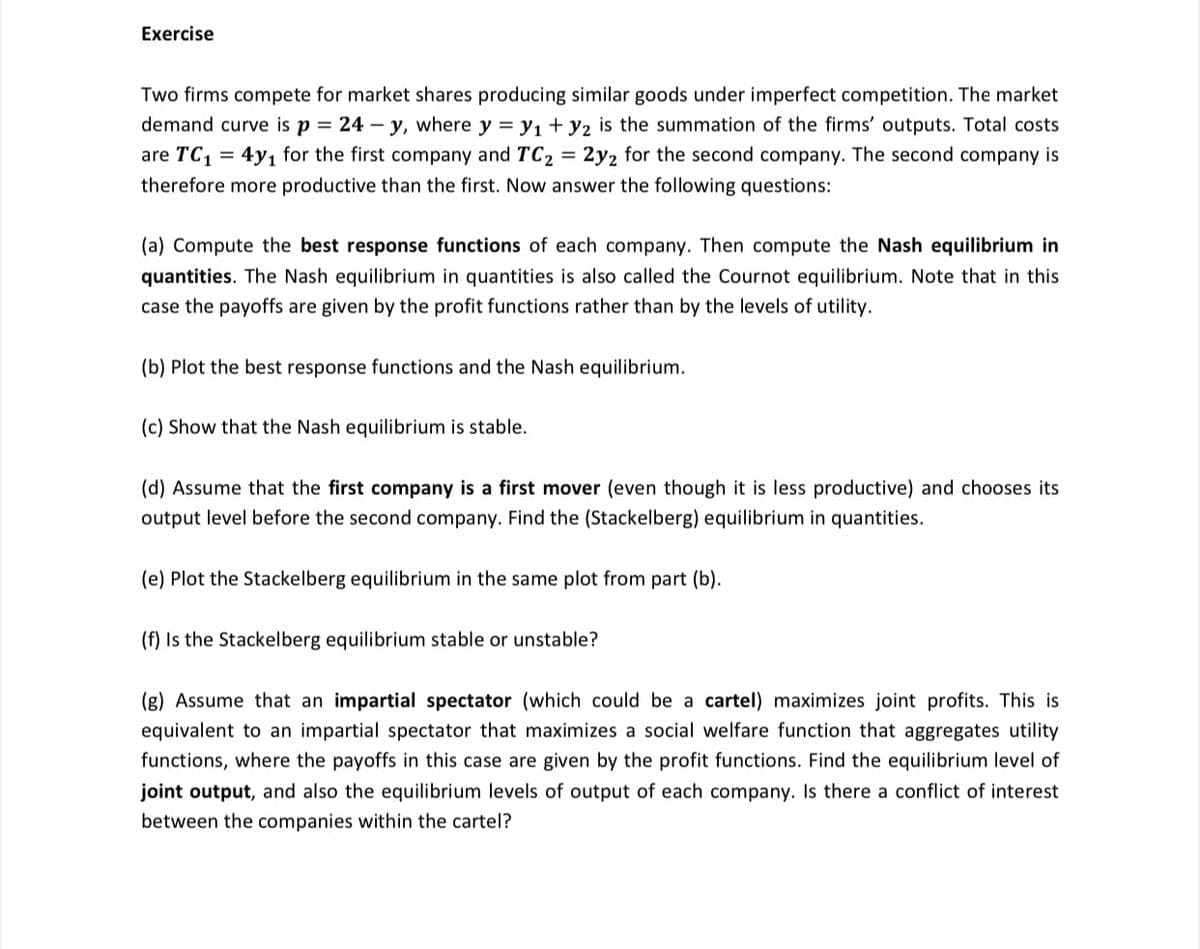

Two firms compete for market shares producing similar goods under imperfect competition. The market

demand curve is p = 24 – y, where y = y, + y2 is the summation of the firms' outputs. Total costs

are TC, = 4y1 for the first company and TC2 = 2y2 for the second company. The second company is

therefore more productive than the first. Now answer the following questions:

(a) Compute the best response functions of each company. Then compute the Nash equilibrium in

quantities. The Nash equilibrium in quantities is also called the Cournot equilibrium. Note that in this

case the payoffs are given by the profit functions rather than by the levels of utility.

(b) Plot the best response functions and the Nash equilibrium.

(c) Show that the Nash equilibrium is stable.

(d) Assume that the first company is a first mover (even though it is less productive) and chooses its

output level before the second company. Find the (Stackelberg) equilibrium in quantities.

(e) Plot the Stackelberg equilibrium in the same plot from part (b).

(f) Is the Stackelberg equilibrium stable or unstable?

(g) Assume that an impartial spectator (which could be a cartel) maximizes joint profits. This is

equivalent to an impartial spectator that maximizes a social welfare function that aggregates utility

functions, where the payoffs in this case are given by the profit functions. Find the equilibrium level of

joint output, and also the equilibrium levels of output of each company. Is there a conflict of interest

between the companies within the cartel?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning