A consulting company is buying a new computer system for their headquarters for $175,00 asset has a life of 5 years, and it will be put to service on April 1* 2022. Develop a full dep able for this asset according to MACRS (i.e., calculate the deductions allowed for 2022, 20 2025, 2026 and 2027). What is the book value of this asset if it is sold on Sept 1st 2026 and he tax implications if it was sold for $30,000. The company is in a 23% tax bracket.

A consulting company is buying a new computer system for their headquarters for $175,00 asset has a life of 5 years, and it will be put to service on April 1* 2022. Develop a full dep able for this asset according to MACRS (i.e., calculate the deductions allowed for 2022, 20 2025, 2026 and 2027). What is the book value of this asset if it is sold on Sept 1st 2026 and he tax implications if it was sold for $30,000. The company is in a 23% tax bracket.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 18E

Related questions

Question

Please answer fast

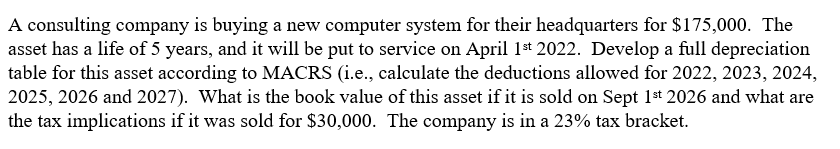

Transcribed Image Text:A consulting company is buying a new computer system for their headquarters for $175,000. The

asset has a life of 5 years, and it will be put to service on April 1st 2022. Develop a full depreciation

table for this asset according to MACRS (i.e., calculate the deductions allowed for 2022, 2023, 2024,

2025, 2026 and 2027). What is the book value of this asset if it is sold on Sept 1st 2026 and what are

the tax implications if it was sold for $30,000. The company is in a 23% tax bracket.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning