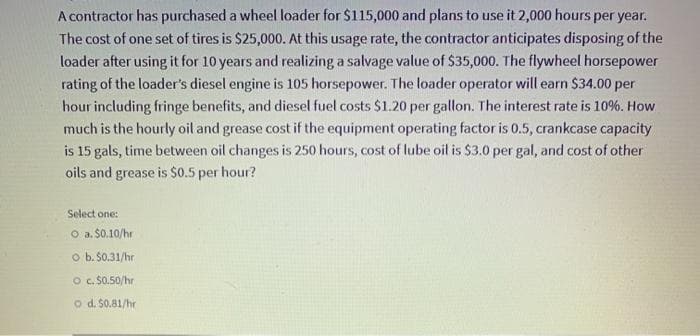

A contractor has purchased a wheel loader for $115,000 and plans to use it 2,000 hours per year. The cost of one set of tires is $25,000. At this usage rate, the contractor anticipates disposing of the loader after using it for 10 years and realizing a salvage value of $35,000. The flywheel horsepower rating of the loader's diesel engine is 105 horsepower. The loader operator will earn $34.00 per hour including fringe benefits, and diesel fuel costs $1.20 per gallon. The interest rate is 10%. How much is the hourly oil and grease cost if the equipment operating factor is 0.5, crankcase capacity is 15 gals, time between oil changes is 250 hours, cost of lube oil is $3.0 per gal, and cost of other oils and grease is $0.5 per hour? Select one: O a. $0.10/hr o b. S0.31/hr O c. $0.50/hr o d. $0.81/hr

A contractor has purchased a wheel loader for $115,000 and plans to use it 2,000 hours per year. The cost of one set of tires is $25,000. At this usage rate, the contractor anticipates disposing of the loader after using it for 10 years and realizing a salvage value of $35,000. The flywheel horsepower rating of the loader's diesel engine is 105 horsepower. The loader operator will earn $34.00 per hour including fringe benefits, and diesel fuel costs $1.20 per gallon. The interest rate is 10%. How much is the hourly oil and grease cost if the equipment operating factor is 0.5, crankcase capacity is 15 gals, time between oil changes is 250 hours, cost of lube oil is $3.0 per gal, and cost of other oils and grease is $0.5 per hour? Select one: O a. $0.10/hr o b. S0.31/hr O c. $0.50/hr o d. $0.81/hr

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:A contractor has purchased a wheel loader for $115,000 and plans to use it 2,000 hours per year.

The cost of one set of tires is $25,000. At this usage rate, the contractor anticipates disposing of the

loader after using it for 10 years and realizing a salvage value of $35,000. The flywheel horsepower

rating of the loader's diesel engine is 105 horsepower. The loader operator will earn $34.00 per

hour including fringe benefits, and diesel fuel costs $1.20 per gallon. The interest rate is 10%. How

much is the hourly oil and grease cost if the equipment operating factor is 0.5, crankcase capacity

is 15 gals, time between oil changes is 250 hours, cost of lube oil is $3.0 per gal, and cost of other

oils and grease is $0.5 per hour?

Select one:

O a. $0.10/hr

o b. $0.31/hr

o c. S0.50/hr

o d. $0.81/hr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,