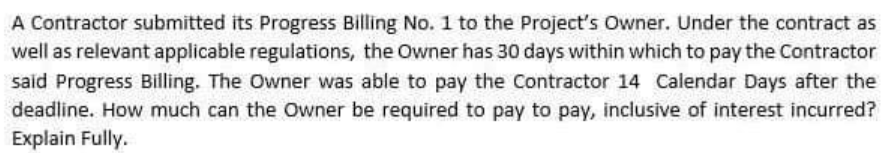

A Contractor submitted its Progress Billing No. 1 to the Project's Owner. Under the contract as well as relevant applicable regulations, the Owner has 30 days within which to pay the Contractor said Progress Billing. The Owner was able to pay the Contractor 14 Calendar Days after the deadline. How much can the Owner be required to pay to pay, inclusive of interest incurred? Explain Fully

A Contractor submitted its Progress Billing No. 1 to the Project's Owner. Under the contract as well as relevant applicable regulations, the Owner has 30 days within which to pay the Contractor said Progress Billing. The Owner was able to pay the Contractor 14 Calendar Days after the deadline. How much can the Owner be required to pay to pay, inclusive of interest incurred? Explain Fully

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 41P

Related questions

Question

Transcribed Image Text:A Contractor submitted its Progress Billing No. 1 to the Project's Owner. Under the contract as

well as relevant applicable regulations, the Owner has 30 days within which to pay the Contractor

said Progress Billing. The Owner was able to pay the Contractor 14 Calendar Days after the

deadline. How much can the Owner be required to pay to pay, inclusive of interest incurred?

Explain Fully.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning