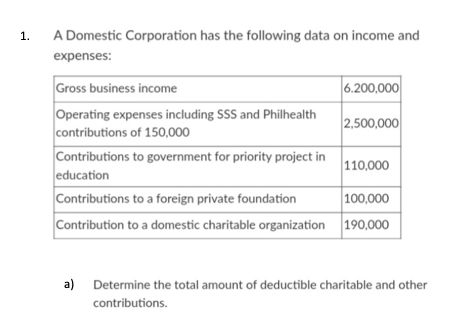

A Domestic Corporation has the following data on income and

Q: Heinz Company began operations on January 1, 2019, and uses the FIFO method in costing its raw…

A: Change in Inventory Valuation Method: A change in the technique of calculating inventory costs is…

Q: Some accountants believe that deferred taxes should not be recognized for certain temporary…

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: e business activities

A: The financial statement is the major in accounting.

Q: Aztec Inc. produces soft drinks. Mixing is the first department, and its output is measured in…

A:

Q: Data table December 31, 2023, account balances: Requirements Cash $ 28,000 Accounts Receivable…

A: Budgets are the quantitative summaries prepared to estimate in advance the receipts and payments to…

Q: The Bronco Corporation exchanged land for equipment. The land had a book value of $138,000 and a…

A: Exchange means to give up something for something else. Here in the question, Land is exchanged with…

Q: OUse the following to answer questions 18 - 22 Attention Men's Wear, Inc. Balance Sheet…

A: Treasury stocks are contra equity items which are in the nature of share repurchase and are…

Q: Problem 7. Consider the following data about Rock N' Roses Corp: Current ratio, 0.50; Quick ratio,…

A: Current ratio = Current Assets Current liabilities 0.5 = Current Assets…

Q: Compare and contrast the Hecksher-Ohlin theory and the increasing returns to scale theory? Clearly,…

A: there are different theory given in the economics related to the international trade according to…

Q: Let's Work It Out operates several retail stores that specialize in products for a healthy…

A: The Financial income of the fiscal year March 31 , 2019. Multi step Income…

Q: Create Journal entry, T-accounts, and financial statements (Income Sratement, Statement of Retained…

A: Journal entries are recorded as first step of accounting then we prepare ledgers Then trail…

Q: ed the holder to acquire one A ordinary share for $3. 31 Dec 2021: Offers wrer

A: Share capital is the capital which an owner contributes in the firm. This share capital can be…

Q: The partnership contract of NRR Partnership provided for the division of net income or losses in the…

A: A partnership is an agreement where two or more person agrees to do business. The terms of this…

Q: Q/3 The Municipality Directorate has purchased vehicles in the amount of (120) million Iraqi dinars…

A: Accounting for Depreciation Constant Ration Method of Depreciation

Q: Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a…

A: Following is the journal entry with correct amount

Q: In April Leafon Landscapes' direct labor was 60% of the conversion cost. If the manufacturing…

A: Conversion cost = Direct labor + Manufacturing overhead

Q: The following information is for Ivanhoe Company in September. 1. Cash balance per bank, September…

A: A reconciliations statement that compares the cash balance on a company's balance sheet to the…

Q: ements for tax exemption C. Type of for-profit business that also has a social mission D. Type of…

A: The definition of S corporation as,

Q: 4) The Toronto Estonian Credit union charges 7% compounded monthly on certain type of loan. The want…

A: Nominal Interest- The nominal interest rate is the stated interest rate that does not include…

Q: On January 1, 20x1 Plaka Co. acquired goods for sale in the ordinary course of business for…

A: Given information, Purchase price = P250,000 Refundable purchase taxes included in above = 5000…

Q: How do S Corporations report separately separately stated items?

A: The income losses, gains, deductions, and credit are passed by the corporation S to its shareholders…

Q: Discuss the features adapted by companies in a modern manufacturing environment with special focus…

A: The purpose of costing is to allocate the various cost of the product on the basis of either the…

Q: Determine the tax for Year 2 (only - not a total) if they decide to continue with manual mixing.

A: The tax on cash outflow would result in savings in tax and hence it would result in a decrease in…

Q: 23. Which of the following costs is relevant to a make-or-buy decision of a particular part of a…

A: Make cost is the cost in producing the product. Buy cost is the cost of purchasing or buying the…

Q: is a correct statement below? A. Equity is the residual interest in the liabilities of the entity…

A: Option A is incorrect The correct statement is Equity is the residual interest in the assets of the…

Q: P 4,600 2,500 5,000 1,400 5,400 10,000 2,000 1,500 1,400 2,600 7,300 3,700 Accrued interest income…

A: All assets, expenses, and losses should be debited and all income, gains, and liabilities should be…

Q: During the current year, S Ltd. has net taxable capital gains of $50,000, receives dividends from…

A: Additional refundable tax is computed as 1023% of the lesser of the following: Aggregate investment…

Q: Widmer Company had gross wages of $155,000 during the week ended June 17. The amount of wages…

A: Social Security tax payable = wages subject to social security tax ×6% = $139,500 × 6% = $8370

Q: Ltd produces 3000 units of a single product in the period under review . Direct labour per unit $17,…

A: Solution: Variable cost includes direct materials, direct labor and variable overhead. Prime cost is…

Q: Equivalent Units, Unit Cost, Valuation of Goods Transferred Out and Ending Work in Process The…

A: Cost accounting is widely used by cost accountants to determine the cost per unit of the product…

Q: A B You will prepare a static master budget, budgeted financial statements and a flexible…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first3. Please resubmit the question…

Q: 18. The appropriate WACC of a firm is 6.43%. With risk-free rate of 4%, market return of 8%…

A: GIVEN The appropriate WACC of a firm is 6.43% With risk-free rate of 4 % market return of 8%…

Q: Broke Corp. reports operating expenses in two categories (1) selling and (2) general administrative.…

A: Selling Expenses - Selling Expenses are those expense which are related to the selling activities of…

Q: What is the maximum monthly social security benefit a person can receive if retiring exactly 1 year…

A: The social security benefit is the benefits which are received by the employee once the said…

Q: By looking at these real life samples of Financial Statements prepared in accordance to PAS/IAS:,…

A: Biological assets are living assets like plants and animals owned by the business. For example,…

Q: Unit Cost and Cost Assignment, Nonuniform Inputs Loran Inc. had the following equivalent units…

A: 1. Determination of the unit cost for materials, for conversion, and in total for the fabrication…

Q: Use the following to answer questions 6 – 12 J&TR, Inc., has two classes of stock authorized:…

A: The shareholder's equity comprises of total shares issued, retained earnings and dividend…

Q: Moltres Manufacturing Company had the following account balances for the quarter ending March 31:…

A: The question is related to Cost Accounting and is of cost sheet. The details are given regarding the…

Q: Problem 2.30 Systems Concepts, Traditional versus Activity-Based Cost AccountingSystemsThe following…

A: Activity-based costing represents the costing method that assigned the cost to each activity based…

Q: ry corporation is a mid sized public company that had been in operation for many years. December 31,…

A: Closing entries are accounting entries made to close the books of accounts. They are used to close…

Q: Happy Inc. accounted for noncurrent assets using the revaluation surplus model. On October 1, 2021,…

A: The assets and liabilities are presented in the balance sheet of the company which shows the…

Q: crease in revenue is on the credit side hence a decrease in expense is also on credit side true…

A: Solution: Revenues have credit balance and expenses have debit balances. When Revenue is credited it…

Q: Scarlet Company received an invoice for $70,000.00 that had payment terms of 1/5 n/30. If it made a…

A: Lets understand the basics. Seller for attracting early payment, gives the discount term to buyer of…

Q: On January 1, 2021, Heaven Inc. reported the following shareholders' equity: Preference share…

A: The dividend is declared and paid to the shareholders from the retained earnings of the business.

Q: Question 28 X operates a standard marginal costing system. The following budgeted and standard cost…

A: The direct material price variance would be one of two variances being used to evaluate direct…

Q: a. Product that should be emphasized b. Maximum amount per hour

A: Limited Factor Technique Limiting factor analysis is a technique which will maximise contribution…

Q: CA large profitable corporation is considering a capital investment of $50,000. The equipment has a…

A: If there is income during the year after taking into account all expenses than there is need of…

Q: next month's sales. How many mattresses should be produced in the first quarter of 2019?

A: Production Budget The production budget calculates the number of units of products manufactured by a…

Q: Please see below. Do you agree with this opinion? Why or why not? Please include an explanation.…

A: The question is related to the Ratio Analysis.

Q: The total interest paid on $46,000, ten-year, 6 percent bonds that are issued at 98 is a. $28,520.…

A: Total interest paid = Interest paid + Discount on bonds where, Discount on bonds = Face value of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- All of the listed features or obligations differentiate a registered charity from a private corporation except one. Which one? Ability to issue donors official tax receipts Required to file Form T3010 Charity can incorporate like a private company Requirement to meet annual spending quotaMake the appropriate calculations in each of the following independent situations presented below. In its first year of operation, the MFG Corporation, a regular corporation contributes $35,000 cash to a qualified charitable organization during the current tax year. The corporation has net operating income of $145,000 before deducting the contributions, and dividends received from domestic corporations, of $25,000. What is the amount of MFG’s allowable deduction for charitable contribution? Gloria, in forming a new corporation transfers land to the corporation in exchange for 100% of the stock of the corporation. Gloria’s basis in land is $275,000 and the corporation assumes a liability on the property in the amount of $300,000. The stock received by Gloria has a fair market value of $550,000. Give the amount of gain or loss that must be recognized by Gloria on this transaction. Kingdom Corporation is a manufacturing corporation that has accumulated earnings of $975,000. It can…The following selected transactions occurred for a nongovernmental, not-for-profit organization. 1. Received a contribution of stock to establish an endowment fund. The income from the endowment is unrestricted. The donor had acquired the stock for $23 about 20 years earlier. Its estimated fair value when donated was $250. 2. Pledges receivable at year end were $100, all from pledges received during the year. The pledges are unrestricted and 5% of the pledges are estimated to be uncollectible. The pledges expect to be collected early next year. For questions 3-5, assume that the organization has adopted a policy that restrictions on donations made for capital purposes are met when the capital item is purchased. A cash gift of $200 was received restricted for the purchase of equipment. Equipment of $80 was purchased from the gift restricted for this purpose. Depreciation expense for the year on the equipment purchased is $10. Required: Prepare the journal entries for the above…

- A nongovernmental, not-for-profit organization received the following donations of corporate stock during the year: Donation 1 Donation 2 Donation 3 Number of shares 2,000 3,000 1, 000 Adjusted basis $8,000 $5,500 $3,000 Fair market value at time of donation 8,500 6,000 $4,000 Fair market value at year end 10,000 2,000 $2,500 What net value of investments will the organization report at the end of the year? A.) $14,500 B.) $14,000 C.) $13,500 D.) $12,000The new standard for private not-for-profit entities, ASU 2016-14, changes the subdivisions of net assets Select one: a.from without donor restrictions and with donor restrictions to temporary and permanent. b.from unrestricted, temporarily restricted, and permanently restricted to without donor restrictions and with donor restrictions. c.from current and noncurrent to restricted and unrestricted. d.from without donor restrictions and with donor restrictions to operating, investing, and financing.**Objective Type Question:** Which of the following is a key requirement for compliance with IRS regulations for tax - exempt status? a) Filing quarterly financial reports with the IRS. b) Limiting the organization's charitable activities to a single geographic region. c) Using tax - exempt funds for personal expenses of the organization's directors. d) Meeting the IRS's criteria for operating exclusively for charitable, educational, or other exempt purposes.

- The following information was taken from the accounts and records of the Helping HandsFoundation, a private, not-for-profit organization classified as a VHWO. All balances are as ofJune 30, 2014, unless otherwise noted.Unrestricted Support - Contributions $2,000,000Unrestricted Support - Membership Dues 640,000Unrestricted Revenues - Investment Income 80,000Temporarily restricted gain on sale of investments 25,000Expenses - Program Services 1,860,000Expenses - Supporting Services 350,000Expenses - Supporting Services 550,000Temporarily Restricted Support - Contributions 640,000Temporarily Restricted Revenues - Investment Income 60,000Permanently Restricted Support - Contributions 100,000Unrestricted Net Assets, July 1, 2013 450,000Temporarily Restricted Net Assets, July 1, 2013 2,100,000Permanently Restricted Net Assets, July 1, 2013 60,000 The unrestricted support from contributions was received in cash during the year. The expensesincluded $1,350,000 paid from temporarily-restricted…For a number of years, a private not-for-profit entity has been preparing financial statements that do not necessarily conform to U.S. generally accepted accounting principles. At the end of the most recent year (Year 2), those financial statements show total assets of $900,000, total liabilities of $100,000, net assets without donor restriction of $400,000, and net assets with donor restrictions of $400,000. This last category is composed of $300,000 in net assets with purpose restrictions and $100,000 in net assets that must be permanently held. At the end of Year 1, financial statements show total assets of $700,000, total liabilities of $60,000, net assets without donor restriction of $340,000, and net assets with donor restrictions of $300,000. This last category is composed of $220,000 in net assets with purpose restrictions and $80,000 in net assets that must be permanently held. Total expenses for Year 2 were $500,000 and reported under net assets without donor restrictions.…The following questions concern the accounting principles and procedures applicable to a private not-for-profit entity. Write answers to each question.a. What is the difference between revenue and public support?b. What is the significance of the statement of functional expenses?c. What accounting process does a private charity use in connection with donated materials? d. What is the difference in the two types of restricted net assets found in the financial records of a private not-for-profit organization?e. Under what conditions should the entity record donated services?f. What is the proper handling of costs associated with direct mail and other solicitations for money that also contain educational materials?g. A not-for-profit receives a painting. Under what conditions can this painting be judged as a work of art? If it meets the criteria for a work of art, how is the financial reporting of the entity affected?

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation. (depends if it need the tabel)Entity XYZ is a national government agency. Some of the major transactions of the agency for the year 202X were as follows: 1.The approved legislative appropriation for the year was 1 Billion. 10% of this appropriation was alloted by the Department of Budget and Management (DBM) to Entity XYZ.This allotment is broken down as follows: Capital Outlay 50% Maintenance and other operating expenses (MOOE) 40% Personnel Services (PS) 10% 2.Received Notice of Cash Allocation (NCA) from DBM, P20 million,net of tax 3.Obligations were incurred as follows: Capital Outlay 5million Obligation for (MOOE) 3million Personnel Services (PS) 2million 4. Delivery of office equipment and office supplies on account: office equipment 3million office supplies 200,000 5.Payable to officers and employees upon approval of payroll: Salaries and wages P1,000,000 Personnel economic relief allowance(PERA) 150,000 Gross Payroll 1,150,000 Less:Deductions Withholding Tax P35,000 Government service Insurance…Entity XYZ is a national government agency. Some of the major transactions of the agency for the year 202X were as follows: 1.The approved legislative appropriation for the year was 1 Billion. 10% of this appropriation was alloted by the Department of Budget and Management (DBM) to Entity XYZ.This allotment is broken down as follows: Capital Outlay 50% Maintenance and other operating expenses (MOOE) 40% Personnel Services (PS) 10% 2.Received Notice of Cash Allocation (NCA) from DBM, P20 million,net of tax 3.Obligations were incurred as follows: Capital Outlay 5million Obligation for (MOOE) 3million Personnel Services (PS) 2million 4. Delivery of office equipment and office supplies on account: office equipment 3million office supplies 200,000 5.Payable to officers and employees upon approval of payroll: Salaries and wages P1,000,000 Personnel economic relief allowance(PERA) 150,000 Gross Payroll 1,150,000 Less:Deductions Withholding Tax P35,000 Government service Insurance…