Data table December 31, 2023, account balances: Requirements Cash $ 28,000 Accounts Receivable 14,000 1. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts are 60% in the month of the sale and 40% in the month following the sale. Merchandise Inventory 17,000 Accounts Payable 12,000 2. Prepare the schedule of cash payments for purchases for January and February 2024. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid amount. Salaries and Commissions Payable 2,900 Budgeted amounts for 2024: January February 3. Sales, all on account $ 80,000 $ 81,600 Purchases, all on account 41,200 42,000 Commissions Expense 4,000 4,080 Salaries Expense 5,000 5,000 4. Prepare the cash budget for January and February 2024. Assume no financing took place. Rent Expense 3,200 3,200 Depreciation Expense 600 600 Insurance Expense 200 200 Income Tax Expense 1,800 1,800

Data table December 31, 2023, account balances: Requirements Cash $ 28,000 Accounts Receivable 14,000 1. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts are 60% in the month of the sale and 40% in the month following the sale. Merchandise Inventory 17,000 Accounts Payable 12,000 2. Prepare the schedule of cash payments for purchases for January and February 2024. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid amount. Salaries and Commissions Payable 2,900 Budgeted amounts for 2024: January February 3. Sales, all on account $ 80,000 $ 81,600 Purchases, all on account 41,200 42,000 Commissions Expense 4,000 4,080 Salaries Expense 5,000 5,000 4. Prepare the cash budget for January and February 2024. Assume no financing took place. Rent Expense 3,200 3,200 Depreciation Expense 600 600 Insurance Expense 200 200 Income Tax Expense 1,800 1,800

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 9SPB: FINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales...

Related questions

Question

I really need help with requirement 3

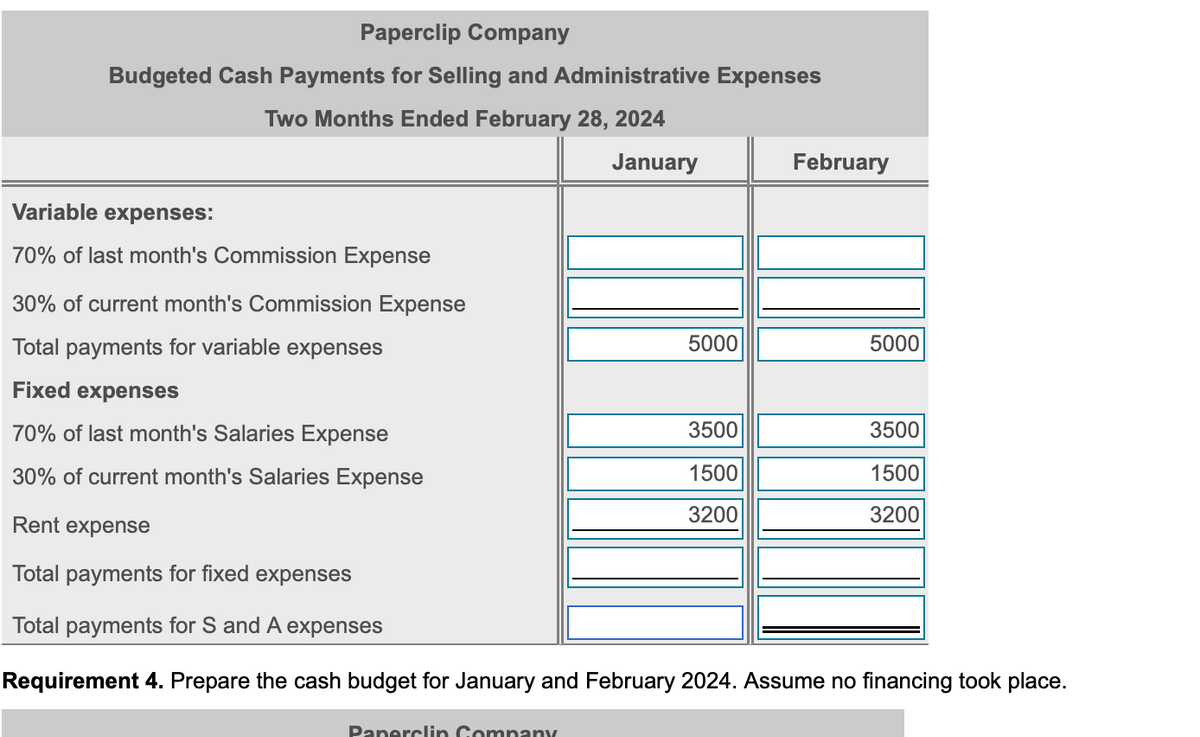

Transcribed Image Text:Paperclip Company

Budgeted Cash Payments for Selling and Administrative Expenses

Two Months Ended February 28, 2024

January

February

Variable expenses:

70% of last month's Commission Expense

30% of current month's Commission Expense

Total payments for variable expenses

5000

5000

Fixed expenses

70% of last month's Salaries Expense

3500

3500

30% of current month's Salaries Expense

1500

1500

3200

3200

Rent expense

Total payments for fixed expenses

Total payments for S and A expenses

Requirement 4. Prepare the cash budget for January and February 2024. Assume no financing took place.

Panerclin Company

Transcribed Image Text:Data table

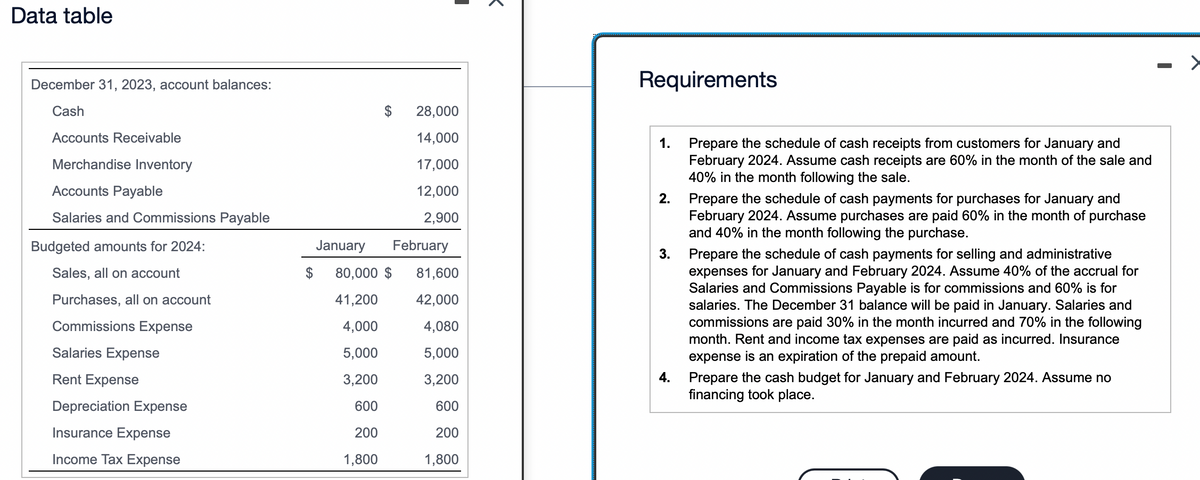

December 31, 2023, account balances:

Requirements

Cash

$

28,000

Accounts Receivable

14,000

1.

Prepare the schedule of cash receipts from customers for January and

February 2024. Assume cash receipts are 60% in the month of the sale and

40% in the month following the sale.

Merchandise Inventory

17,000

Accounts Payable

12,000

2.

Prepare the schedule of cash payments for purchases for January and

February 2024. Assume purchases are paid 60% in the month of purchase

and 40% in the month following the purchase.

Salaries and Commissions Payable

2,900

Budgeted amounts

January

February

3.

Prepare the schedule of cash payments for selling and administrative

expenses for January and February 2024. Assume 40% of the accrual for

Salaries and Commissions Payable is for commissions and 60% is for

salaries. The December 31 balance will be paid in January. Salaries and

commissions are paid 30% in the month incurred and 70% in the following

month. Rent and income tax expenses are paid as incurred. Insurance

expense is an expiration of the prepaid amount.

Sales, all on account

80,000 $

81,600

Purchases, all on account

41,200

42,000

Commissions Expense

4,000

4,080

Salaries Expense

5,000

5,000

4.

Prepare the cash budget for January and February 2024. Assume no

financing took place.

Rent Expense

3,200

3,200

Depreciation Expense

600

600

Insurance Expense

200

200

Income Tax Expense

1,800

1,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning