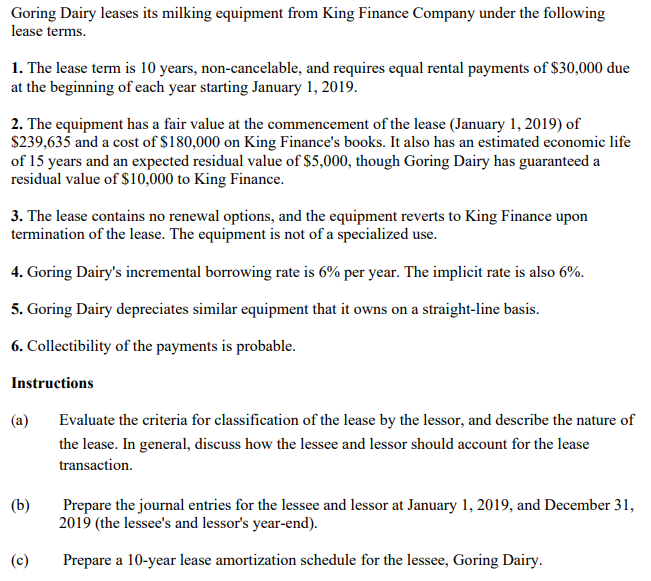

Goring Dairy leases its milking equipment from King Finance Company under the following lease terms. 1. The lease term is 10 years, non-cancelable, and requires equal rental payments of $30,000 due at the beginning of each year starting January 1, 2019. 2. The equipment has a fair value at the commencement of the lease (January 1, 2019) of $239,635 and a cost of $180,000 on King Finance's books. It also has an estimated economic life of 15 years and an expected residual value of $5,000, though Goring Dairy has guaranteed a residual value of $10,000 to King Finance. 3. The lease contains no renewal options, and the equipment reverts to King Finance upon termination of the lease. The equipment is not of a specialized use. 4. Goring Dairy's incremental borrowing rate is 6% per year. The implicit rate is also 6%. 5. Goring Dairy depreciates similar equipment that it owns on a straight-line basis.

Goring Dairy leases its milking equipment from King Finance Company under the following lease terms. 1. The lease term is 10 years, non-cancelable, and requires equal rental payments of $30,000 due at the beginning of each year starting January 1, 2019. 2. The equipment has a fair value at the commencement of the lease (January 1, 2019) of $239,635 and a cost of $180,000 on King Finance's books. It also has an estimated economic life of 15 years and an expected residual value of $5,000, though Goring Dairy has guaranteed a residual value of $10,000 to King Finance. 3. The lease contains no renewal options, and the equipment reverts to King Finance upon termination of the lease. The equipment is not of a specialized use. 4. Goring Dairy's incremental borrowing rate is 6% per year. The implicit rate is also 6%. 5. Goring Dairy depreciates similar equipment that it owns on a straight-line basis.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

Transcribed Image Text:Goring Dairy leases its milking equipment from King Finance Company under the following

lease terms.

1. The lease term is 10 years, non-cancelable, and requires equal rental payments of $30,000 due

at the beginning of each year starting January 1, 2019.

2. The equipment has a fair value at the commencement of the lease (January 1, 2019) of

$239,635 and a cost of $180,000 on King Finance's books. It also has an estimated economic life

of 15 years and an expected residual value of $5,000, though Goring Dairy has guaranteed a

residual value of $10,000 to King Finance.

3. The lease contains no renewal options, and the equipment reverts to King Finance upon

termination of the lease. The equipment is not of a specialized use.

4. Goring Dairy's incremental borrowing rate is 6% per year. The implicit rate is also 6%.

5. Goring Dairy depreciates similar equipment that it owns on a straight-line basis.

6. Collectibility of the payments is probable.

Instructions

(а)

Evaluate the criteria for classification of the lease by the lessor, and describe the nature of

the lease. In general, discuss how the lessee and lessor should account for the lease

transaction.

(b)

Prepare the journal entries for the lessee and lessor at January 1, 2019, and December 31,

2019 (the lessee's and lessor's year-end).

(c)

Prepare a 10-year lease amortization schedule for the lessee, Goring Dairy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning