A government entity, which is a lessee under a finance lease. recognizes an asset acquired under a finance lease, and the related lease liability, measured at a. the fair value of the leased property at inception date * the present value of the minimum lease payments at inception date

A government entity, which is a lessee under a finance lease. recognizes an asset acquired under a finance lease, and the related lease liability, measured at a. the fair value of the leased property at inception date * the present value of the minimum lease payments at inception date

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 8RE: Use the following information to decide whether this equipment lease qualifies as an operating,...

Related questions

Question

x means incorrect answer not included in the choices.

Transcribed Image Text:HOICE

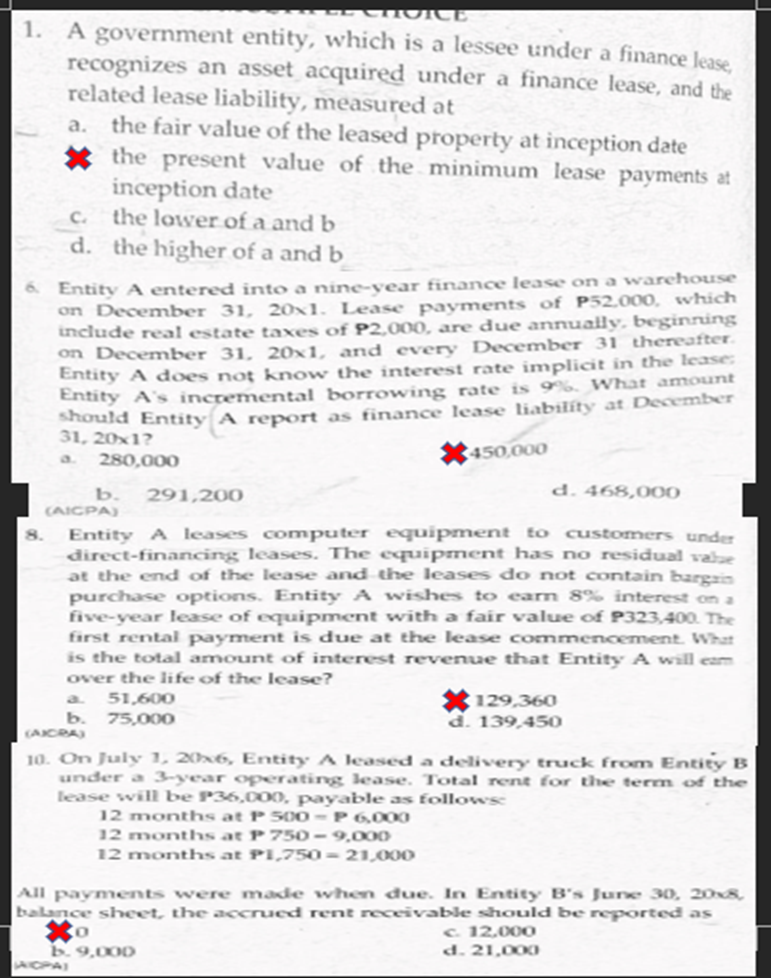

1. A government entity, which is a lessee under a finance lease

recognizes an asset acquired under a finance lease, and the

related lease liability, measured at

the fair value of the leased property at inception date

* the present value of the minimum lease payments at

inception date

c. the lower of a and b

d. the higher of a and b

a.

Entity A entered into a nine-vear finance lease on a warehouse

on December 31, 20x1. Lease payments of P52.000, which

include real estate taxes of P2,000, are due annually, beginning

on December 31, 20×1, and every December 31 thereafter.

Entity A does noţ know the interest rate implicit in the lease:

Entity A's incremental borrowing rate is 9%. What amount

should Entity A report as finance lease liabilíty at December

31, 20x1?

a.

X450,000

280,000

b.

291,200

d. 468,000

(AICPA)

Entity A leases computer equipment to customers under

direct-financing leases. The equipment has no residual vale

at the end of the lease and the leases do not contain bargzin

purchase options. Entity A wishes to earn 8% interest on a

five-year lease of equipment with a fair value of P323,400. The

first rental payment is due at the lease commencement. What

is the total amount of interest revenue that Etity A will eam

8.

over the life of the lease?

* 129,360

d. 139,450

a.

51,600

b.

(ACRA

75,000

10. On July 1, 20x6, Entity A leased a delivvery truck from Entity B

under a 3-year operating lease. Total rent for the term of the

lease will be P36,000, payable as followsc

12 months at P 500-P 6,000

12 months at P 750 - 9,000

12 months at PI,750= 21,00O

All payments were made when đue. In Entity B's June 30, 208,

balance sheet, the accrued rent receivable should be reported as

to

c. 12.000

d. 21,000

9,000

WIOPA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning