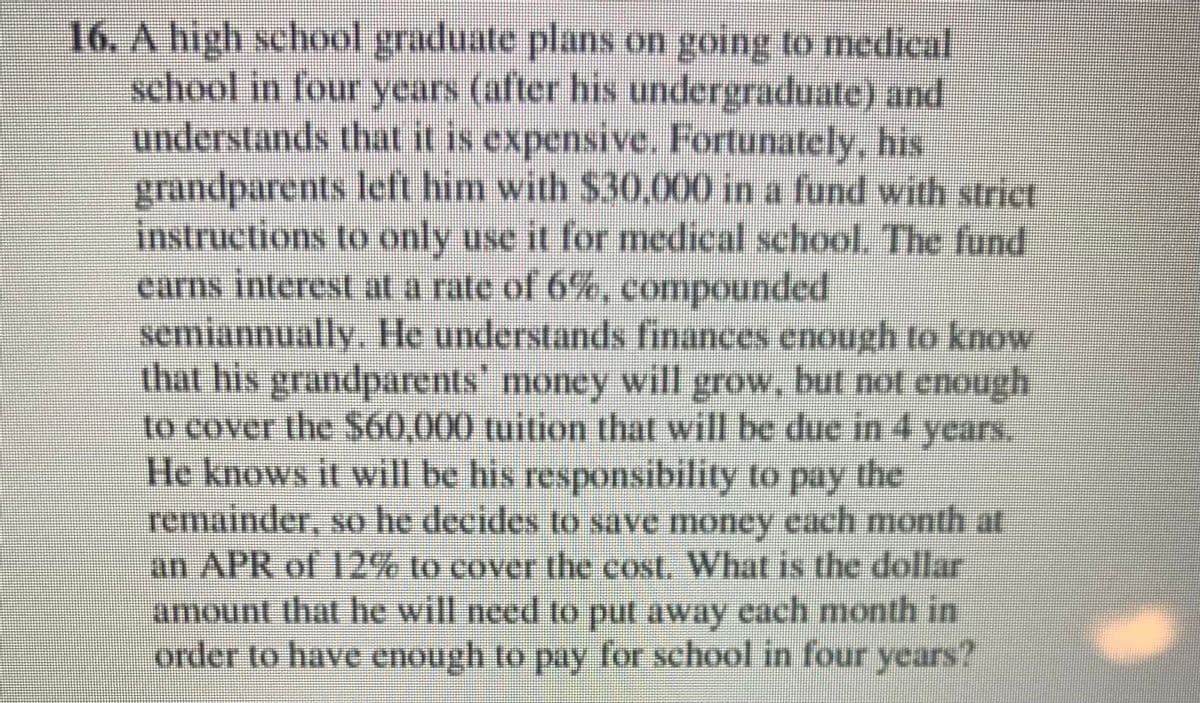

A high school graduate plans on going to medieal school in four years (after his undergraduate) and understands that it is expensive. Fortunately, his grandparents left him with $30,000 in a fund with strict instructions to only use it for medical school. The fund earns interest at a rate of 6%e, compounded semiannually. He understands finances enough to know that his grandparents' money will grow, but not enough to cover the $60,000 tuition that will be due in 4 years. He knows it will be his responsibility to pay the remainder, so he decides to save money each month at an APR of 12% to cover the cost. What is the dollar amount that he will need to put away each month in order to have enough to pay for school in four years?

A high school graduate plans on going to medieal school in four years (after his undergraduate) and understands that it is expensive. Fortunately, his grandparents left him with $30,000 in a fund with strict instructions to only use it for medical school. The fund earns interest at a rate of 6%e, compounded semiannually. He understands finances enough to know that his grandparents' money will grow, but not enough to cover the $60,000 tuition that will be due in 4 years. He knows it will be his responsibility to pay the remainder, so he decides to save money each month at an APR of 12% to cover the cost. What is the dollar amount that he will need to put away each month in order to have enough to pay for school in four years?

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 54P

Related questions

Question

Transcribed Image Text:16. A high school graduate plans on going to medical

school in four years (after his undergraduate) and

understands that it is expensive. Fortunately, his

grandparents left him with $30.000 in a fund wth strict

instructions to only use it for medical school. The fund

earns interest at a rate of 6%, compounded

semiannually, He understands finances enough to know

that his grandparents' money will grow, but not enough

to cover the $60,000 tuition that will be due in 4 years.

He knows it will be his responsibility to pay the

remainder, so he decides to save money each month at

an APR of 12% to cover the cost. What is the dollar

amount that he will need to put away each month in

order to have enough to pay for school in four years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning